- Global Markets Investor

- Posts

- US stocks rallied this week, driven by the technology sector. Weekly market recap, trading week 48/2025

US stocks rallied this week, driven by the technology sector. Weekly market recap, trading week 48/2025

Summary of the trading week using the most popular posts from the X platform

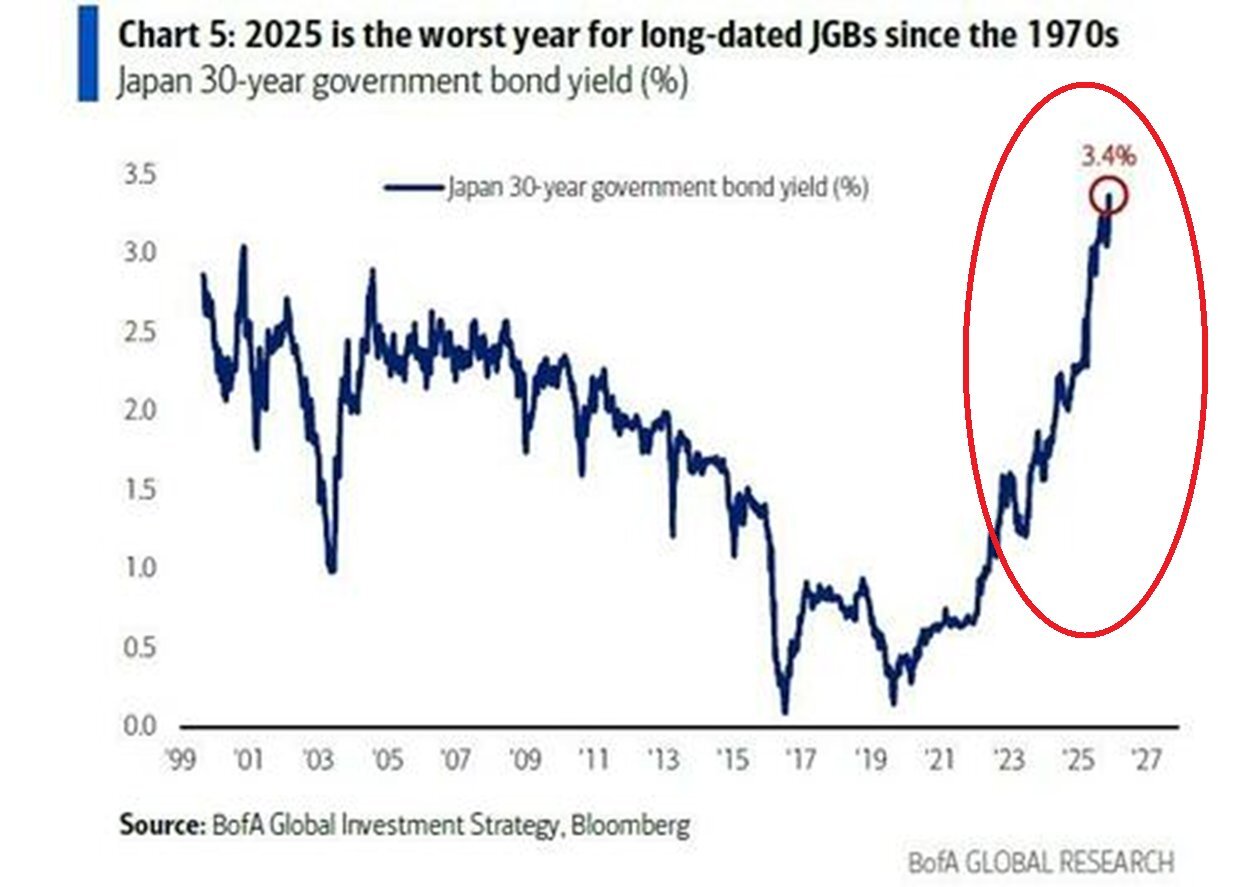

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

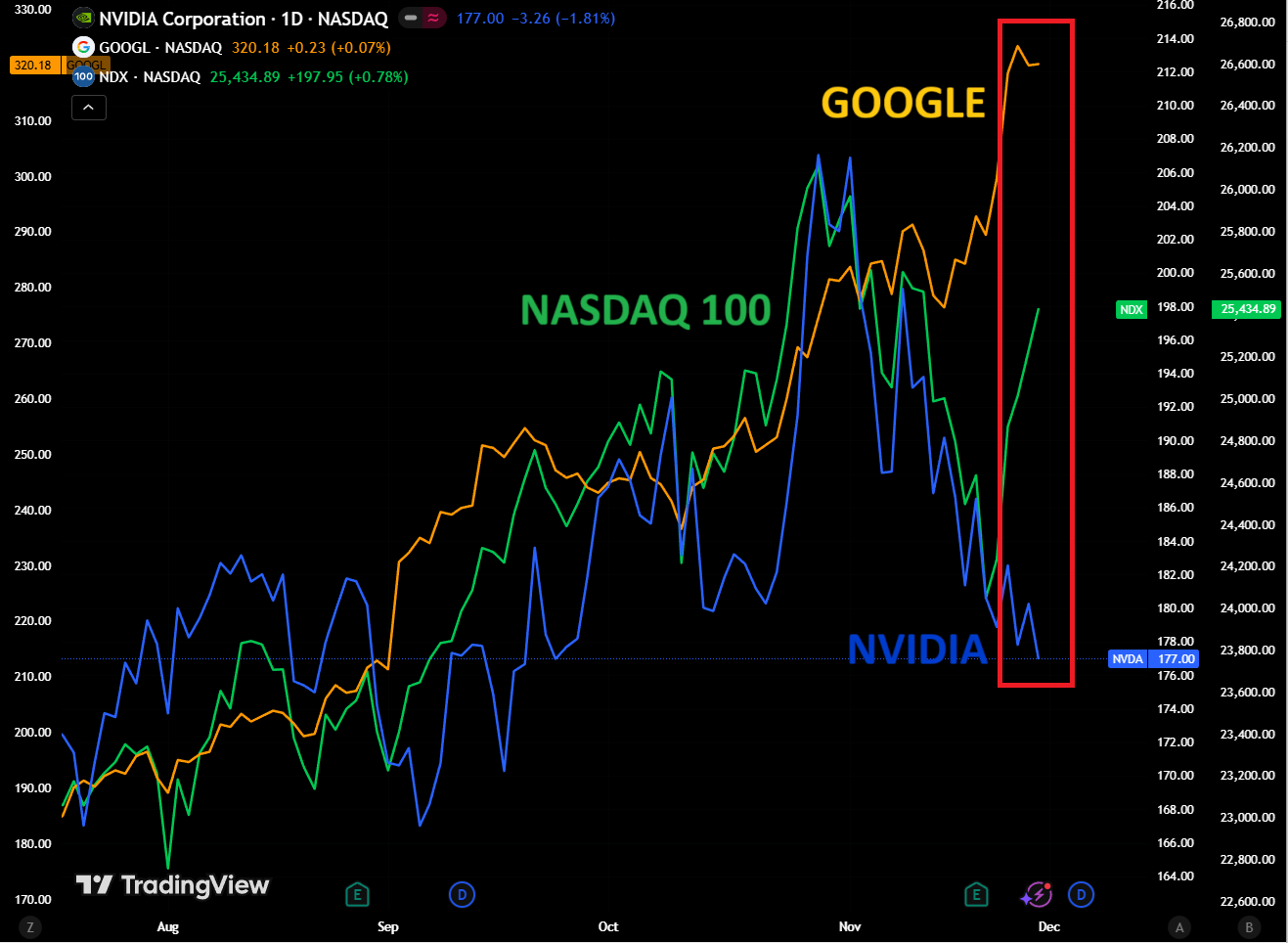

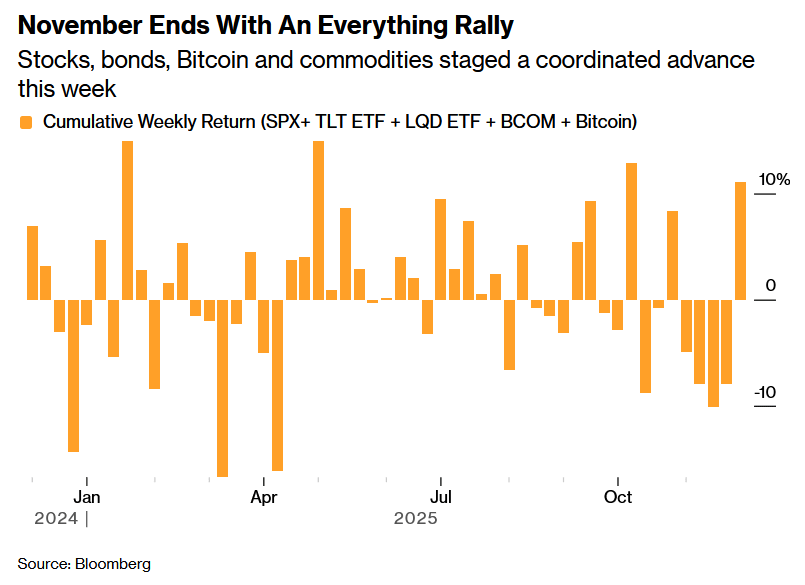

US stocks rallied hard this week, driven by the technology sector excluding NVIDIA.

Nevertheless, the S&P 500 and Nasdaq 100 ended down this month.

Silver and gold spiked, while Bitcoin recovered some of the previous week’s losses.

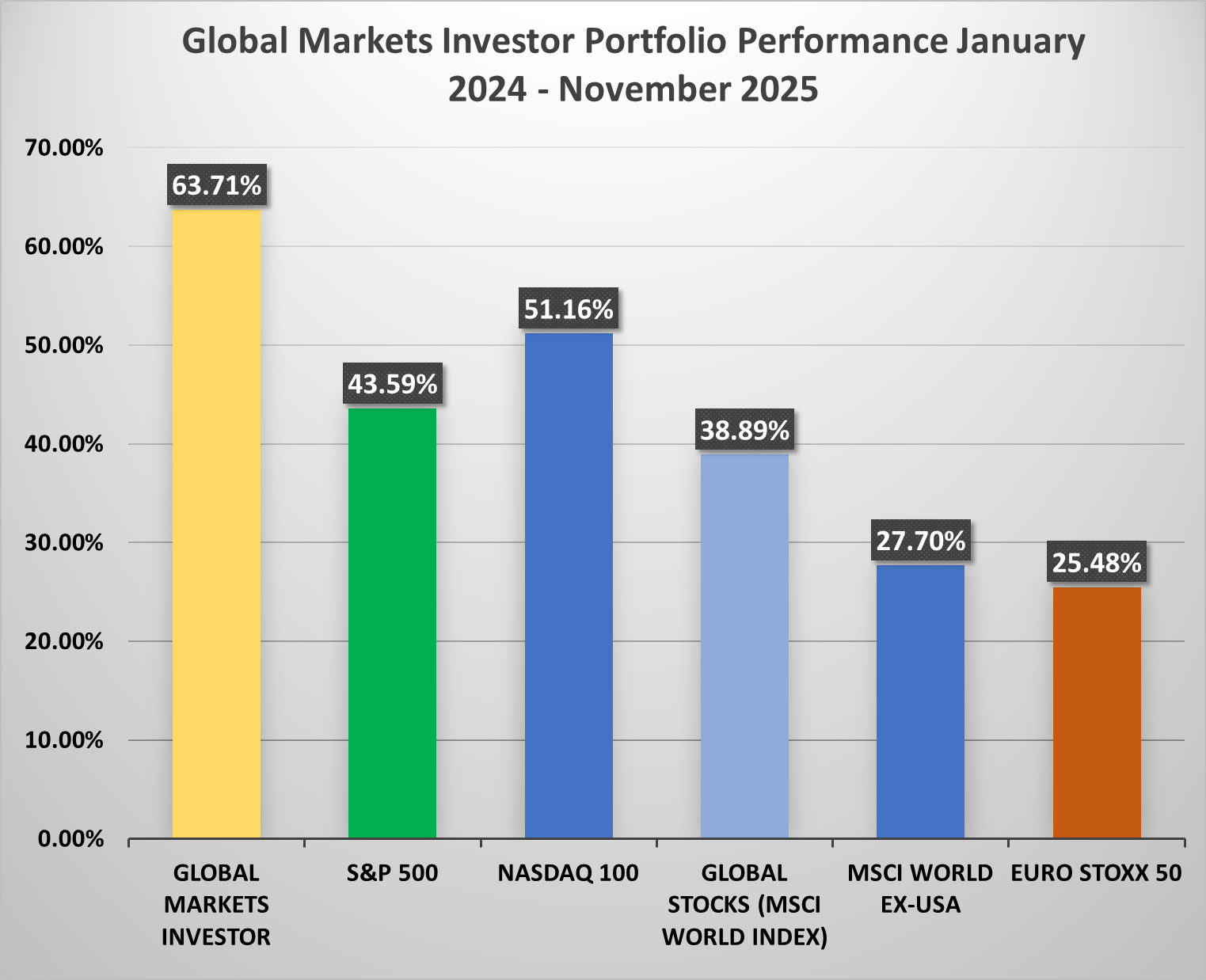

The chart below shows the weekly cumulative return of the S&P 500, the ETF $TLT ( ▲ 0.61% ) tracking 20+ year Treasuries, the investment-grade corporate bond ETF $LQD ( ▼ 0.04% ) , the commodity ETF $BCOM, and Bitcoin. It was the 4th-best week for these assets this year.

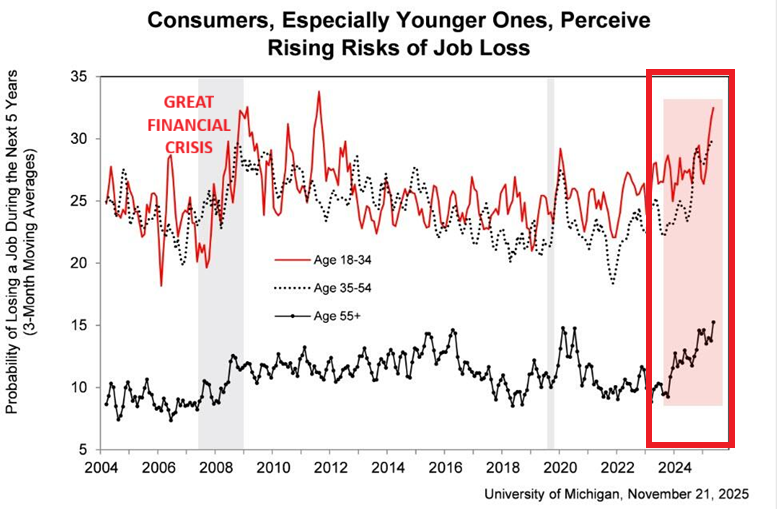

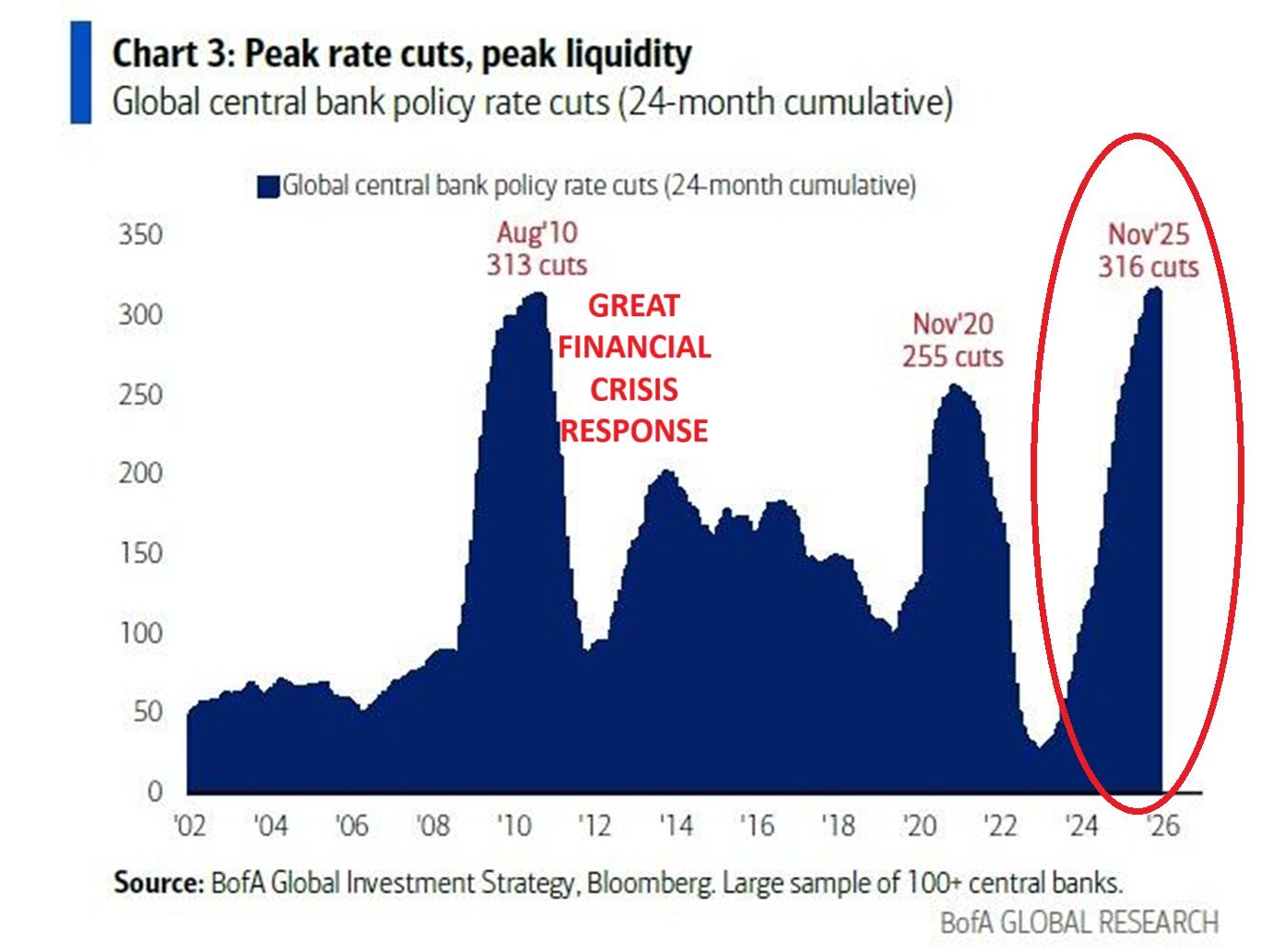

Markets rallied last week mostly on the back of a higher chance that the Fed will cut rates in December, after additional data confirmed labor-market weakness, as well as growing confidence in AI following Google's new model release.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 +3.2%

- Nasdaq +4.9%

- Dow Jones +3.2%

- Russell 2000 (small caps) +5.5%

- US 10-year Treasury yield -4 bps

- VIX -30%, front month VIX futures -19%

- US Dollar index -0.7%

- Gold +4.1%

- Silver +13%

- WTI Crude Oil +2.9%

- Bitcoin +7%

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

For the trading week ending December 5, key events are:

- US ISM Manufacturing PMI for November on Monday

- US ISM S&P Global Manufacturing PMI for November on Monday

- Fed Chair Powell Speech on Monday

- US ISM Services PMI for November on Wednesday

- US Industrial Production for September on Wednesday

- US ADP Private Employment for November on Wednesday

- US Challenger Job Cut Announcements for November on Thursday

- US Consumer Sentiment for December on Friday

- US PCE Inflation for September on Friday

Investors will be watching closely what Fed Chair Powell says, as well as the alternative job-market data coming from the US.

2) Retail investors’ buying streak has been remarkable. US large-cap mutual funds have had one of the worst years in a decade.

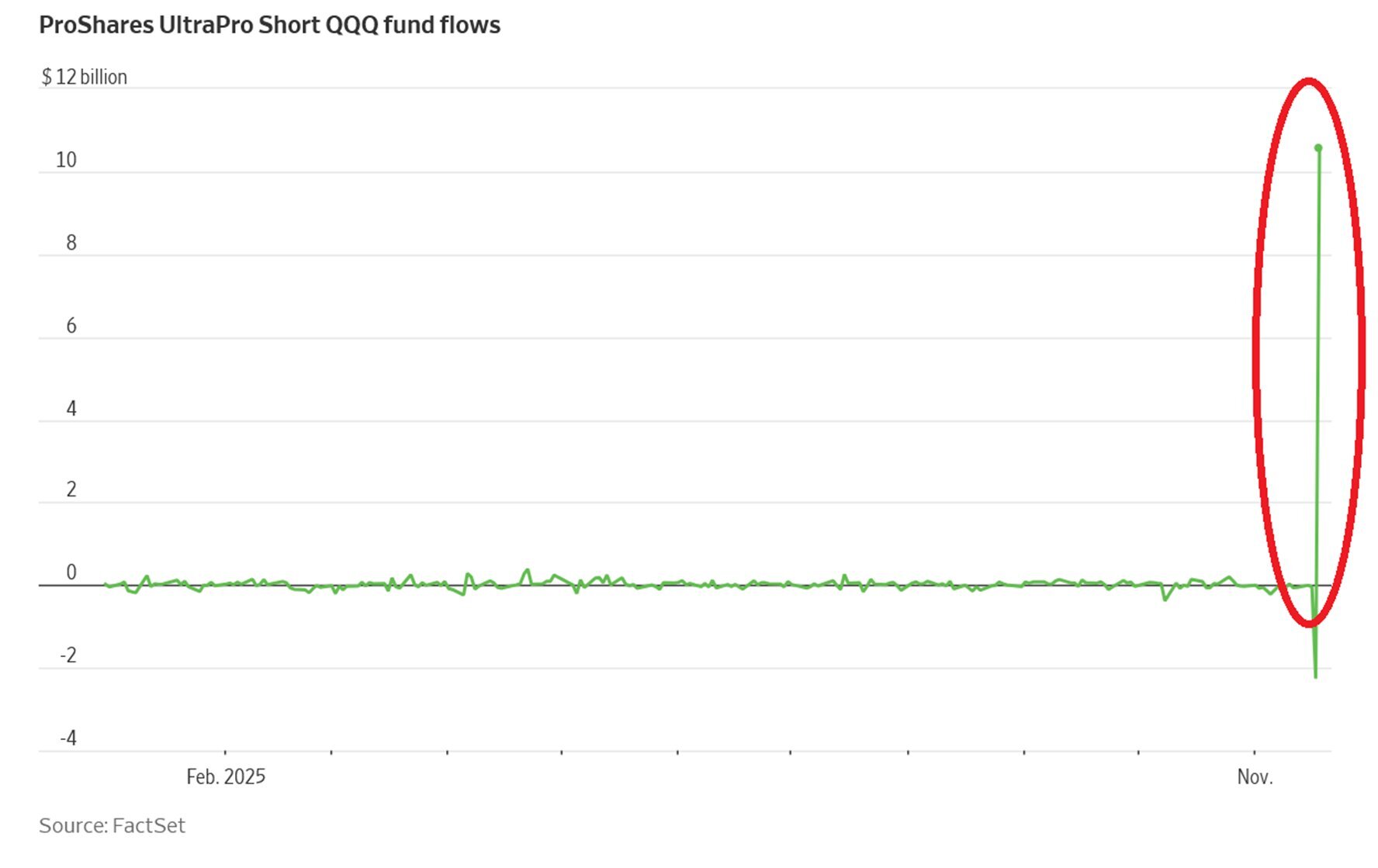

3) There has never been this much leverage in the US market.

4) US market liquidity stress is surging again.

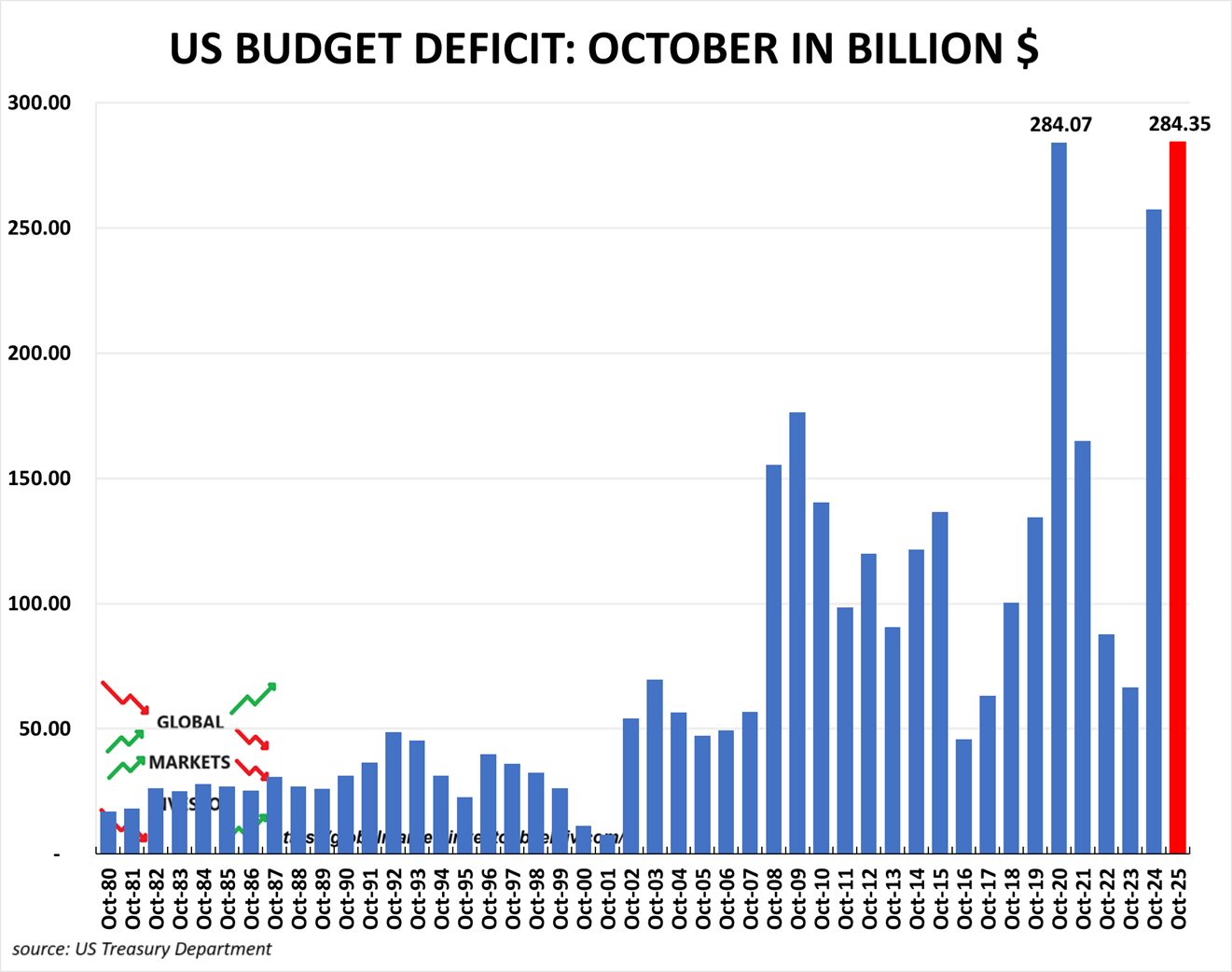

5) Major investors are dumping Japanese government bonds.

6) Some additional posts that include interesting data.