- Global Markets Investor

- Posts

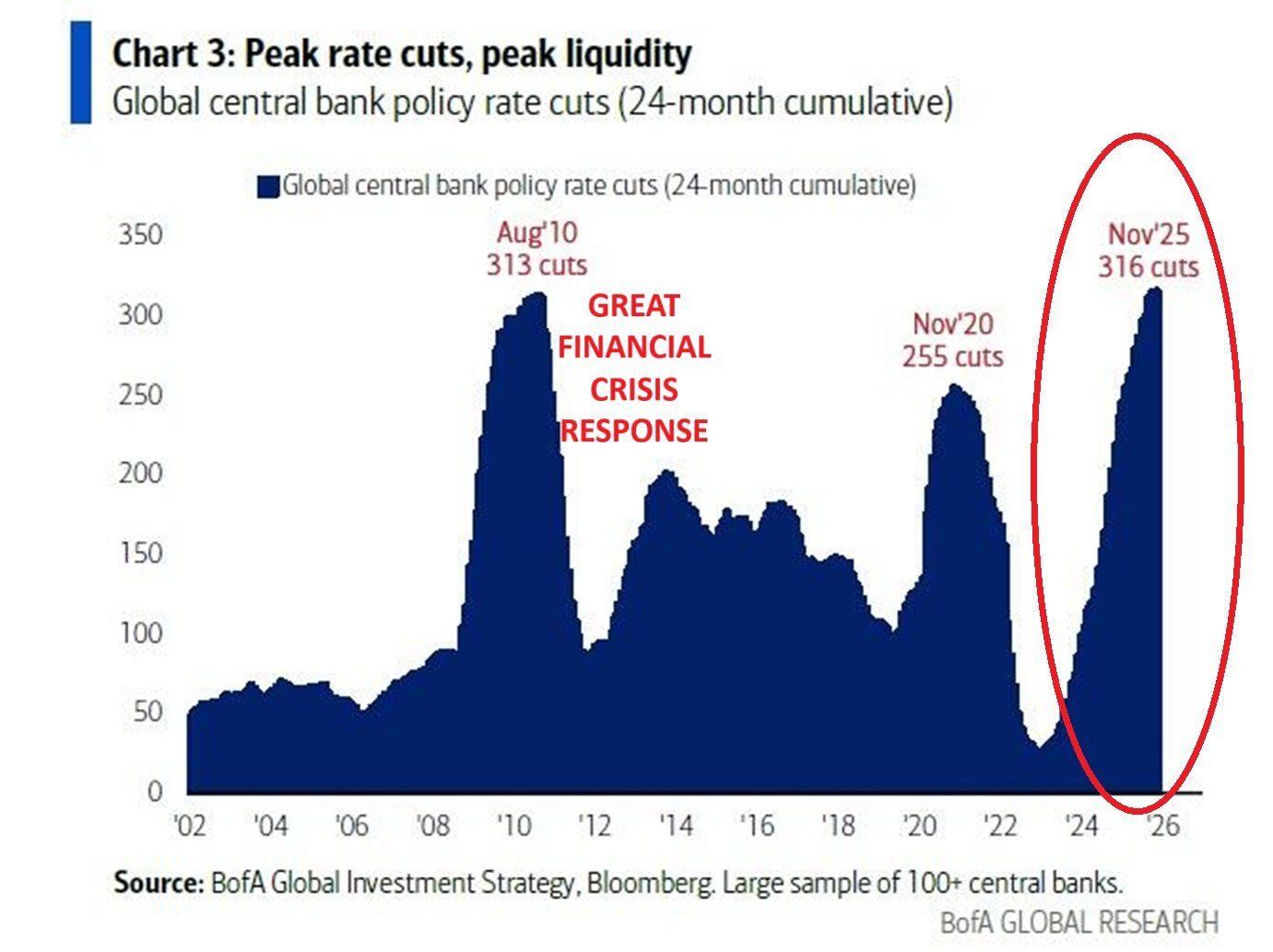

- ⚠️Global central banks are cutting rates at the fastest pace this century

⚠️Global central banks are cutting rates at the fastest pace this century

Where are the world’s largest central banks headed next?

🔥25% OFF AN ANNUAL SUBSCRIPTION, BLACK FRIDAY AND THANKSGIVING PROMO

Click below to redeem, expires Friday 28 November before midnight.

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 56% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Global central banks have cut rates 316 times over the last 2 years, officially surpassing the 313 cuts delivered during 2008-2010 in the historic policy response to the Great Financial Crisis.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

By comparison, during the 2020 Crisis, the 24-month cumulative cuts reached 255.

As you can see, interest-rate policy is changing at a historic rate, and the implications might be significant. When global central banks adjust rates, the impact ultimately reaches everyone. Mortgage costs, deposit rates, corporate financing, and consumer borrowing all move in response. So do asset prices, from equities and bonds to currencies and precious metals. However, in terms of the economy, the changes come with a lag.

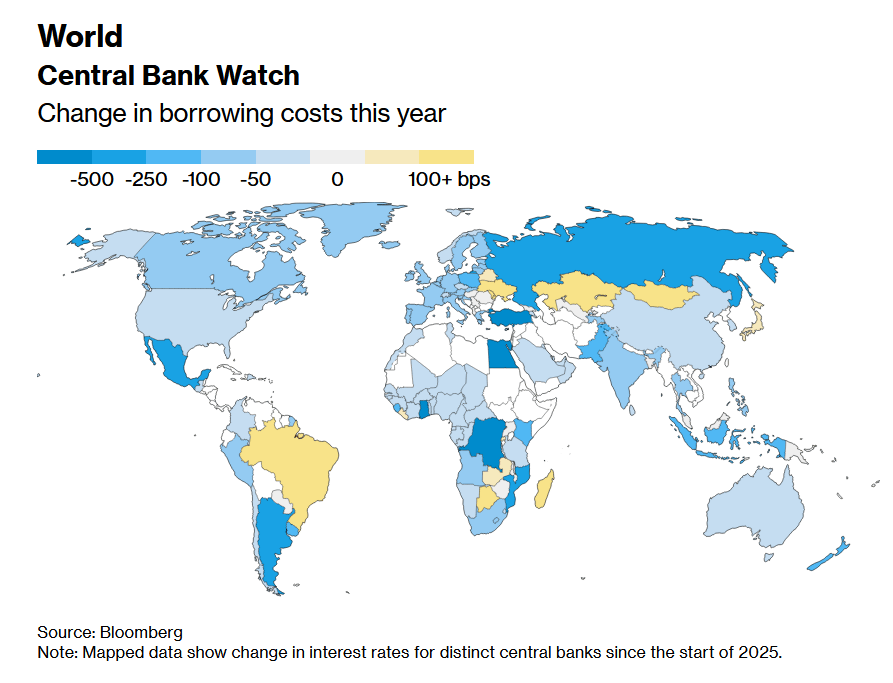

Given the scale of central-bank moves, now is the right moment to revisit the earlier analyses and examine the latest actions of the world’s major central banks, and what they are expected to do ahead.

This piece covers: the Federal Reserve, the European Central Bank, the Bank of Japan, the Bank of Canada, the Bank of England, the Reserve Bank of Australia, the Reserve Bank of New Zealand, the People’s Bank of China, the Reserve Bank of India, and the Swiss National Bank.

HOW LOOSE IS THE GLOBAL MONETARY POLICY TODAY?