- Global Markets Investor

- Pages

- Investment Portfolio

On this page, you can find the latest updates to my long-term investment portfolio as well as the performance review.

My goal is to achieve long-term above-market average returns and protect capital during times of turbulence. At the same time, I try to minimize costs; therefore, the number of transactions and components included within the investment portfolio is not too large.

I mainly invest using ETFs via a brokerage account except for precious metals, which I own physically. I try to avoid investing in individual stocks due to a lack of time for a proper analysis of single companies, but I am not ruling out adding some in the future when appropriate.

Within the posts, I also provide ETF tickers listed in Europe. For example, UK-based/EU-based investors have currency factors to consider. Those ETFs could be either in USD or GBP, depending on whether one would like to have an exposure to USD. In 2024, overseas investors benefited from the currency appreciation (strong US dollar), but this reversed in 2025.

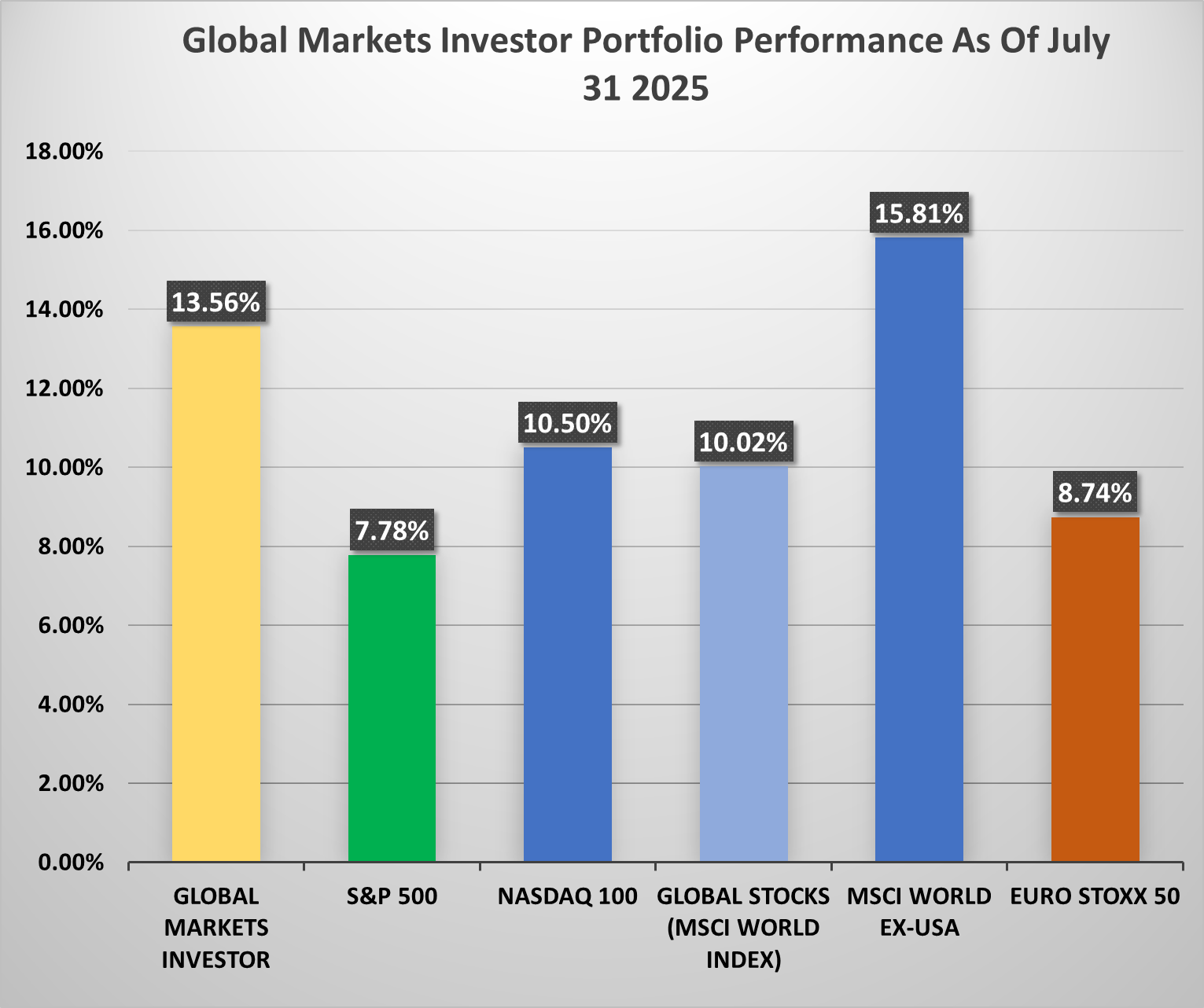

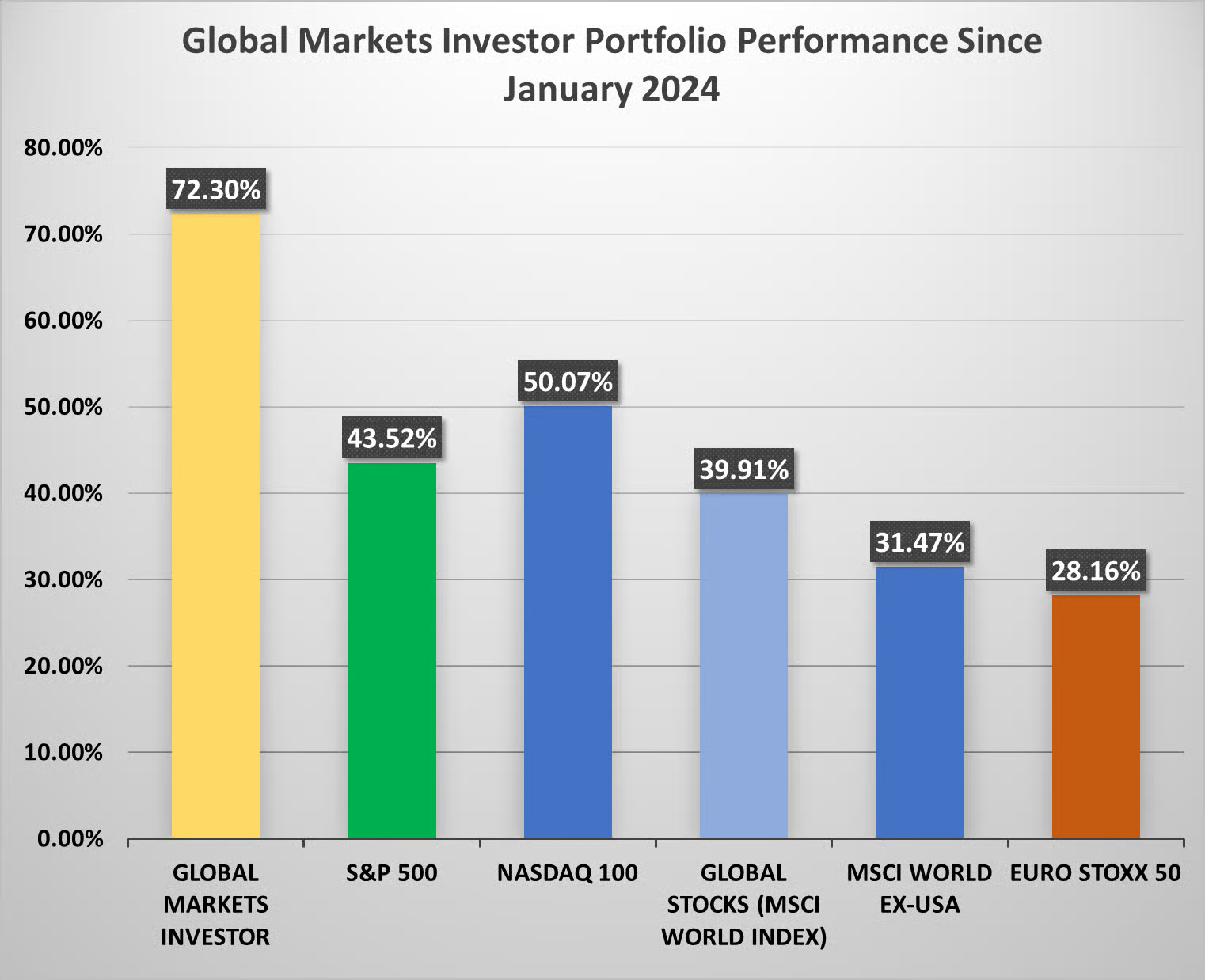

Overall, I would be happy to gain around 15% a year nominally on average, but there will be years like 2024 when my portfolio returned 23.6%, and those years help enhance long-term performance. I prefer protecting my capital over being too greedy. Thanks to this approach, my portfolio still managed positive returns during the March–April 2025 tariff turmoil, while major US indexes fell by nearly 20% on a year-to-date basis.

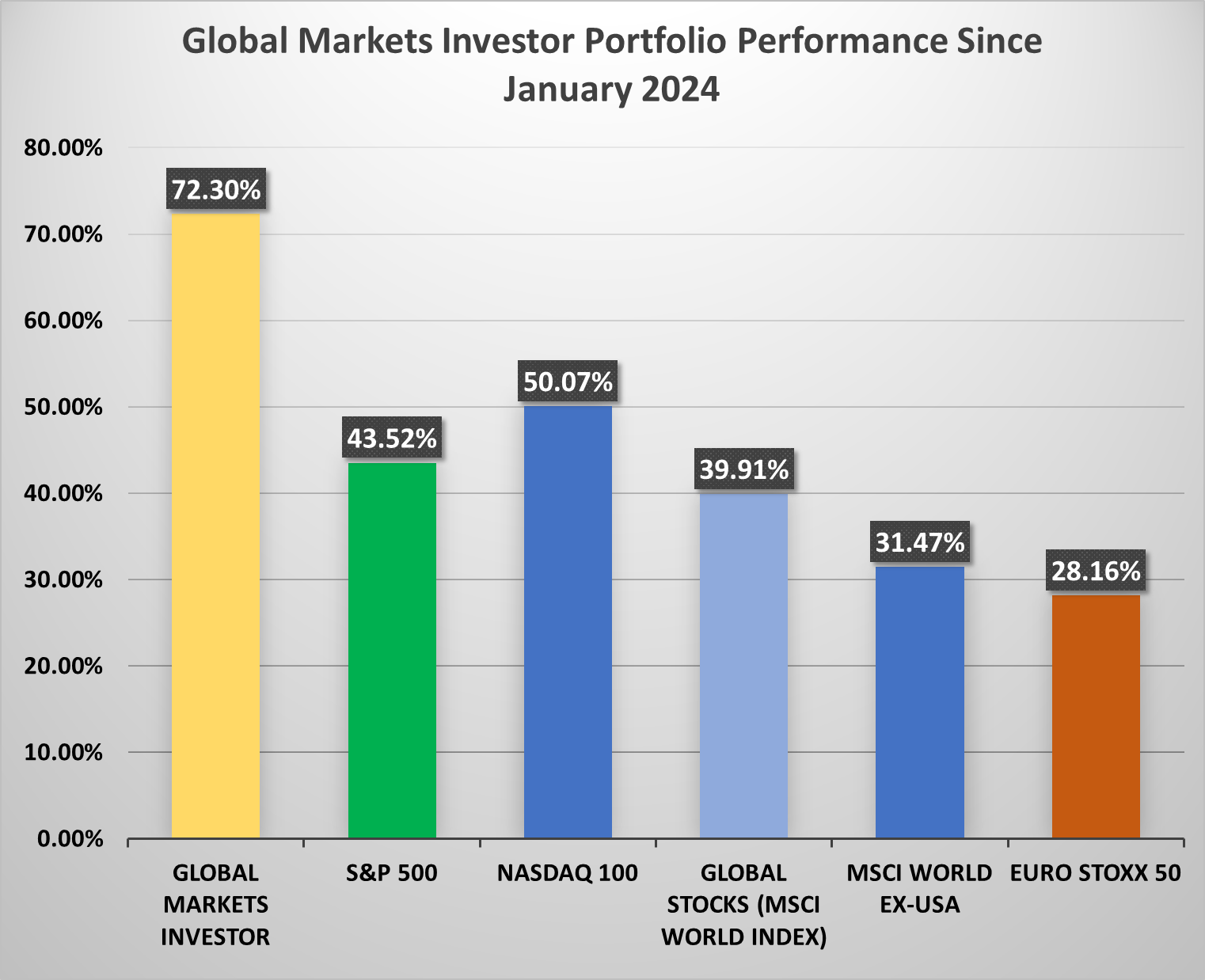

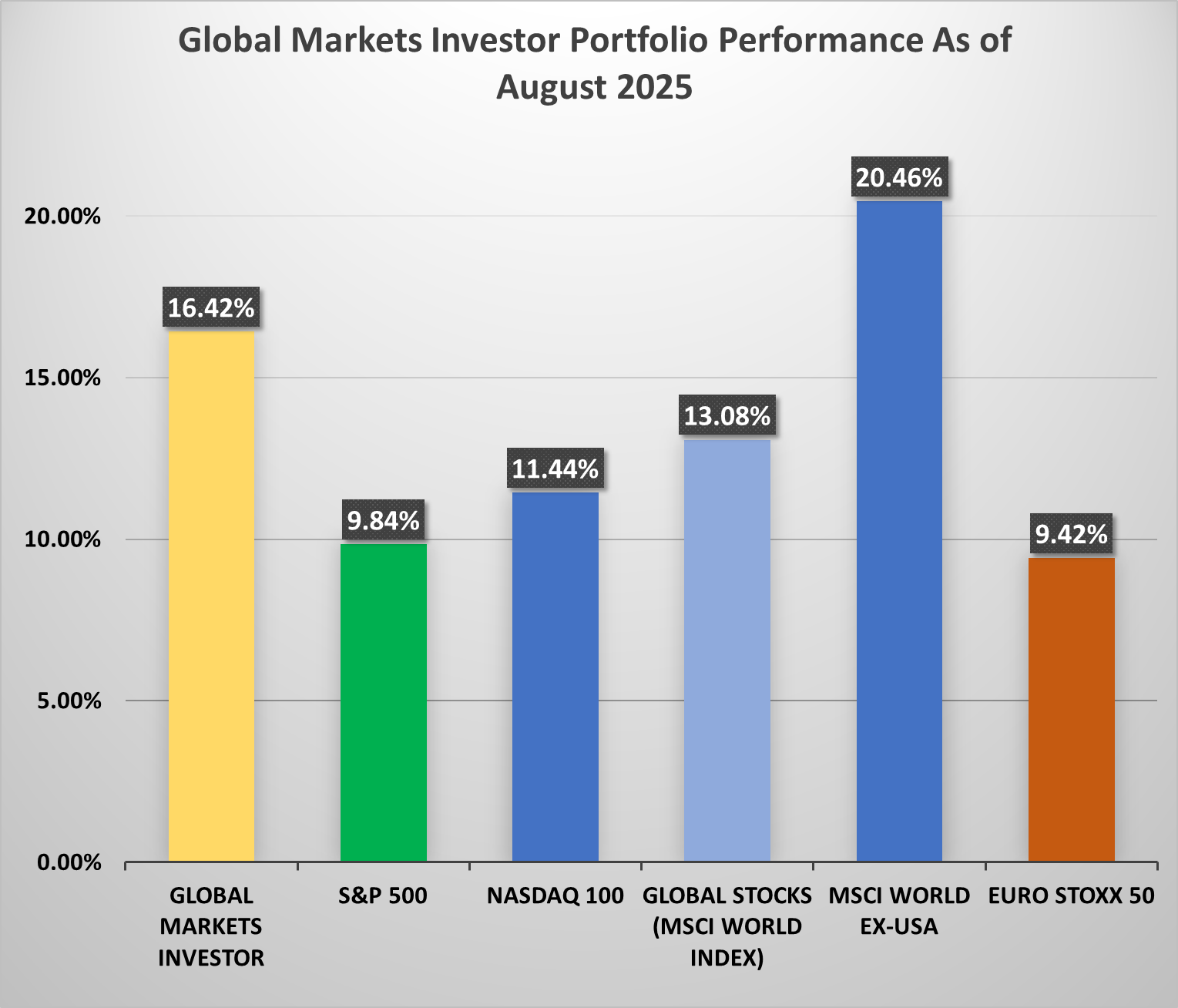

Since January 2024, my portfolio has returned +72.30%, beating the S&P 500 by 28.78 percentage points.

I am not a fund, so I can be more flexible than institutions. Finally, a person who follows my moves has the flexibility to decide if they want to buy/sell such assets and use similar weights to mine.

This service is good for someone who does not have time to do their own research and is a long-term investor.

Portfolio changes:

Portfolio review: