- Global Markets Investor

- Posts

- CHART OF THE WEEK: Will the market follow NVIDIA or Google stock?

CHART OF THE WEEK: Will the market follow NVIDIA or Google stock?

Is this the next big question for the US market?

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

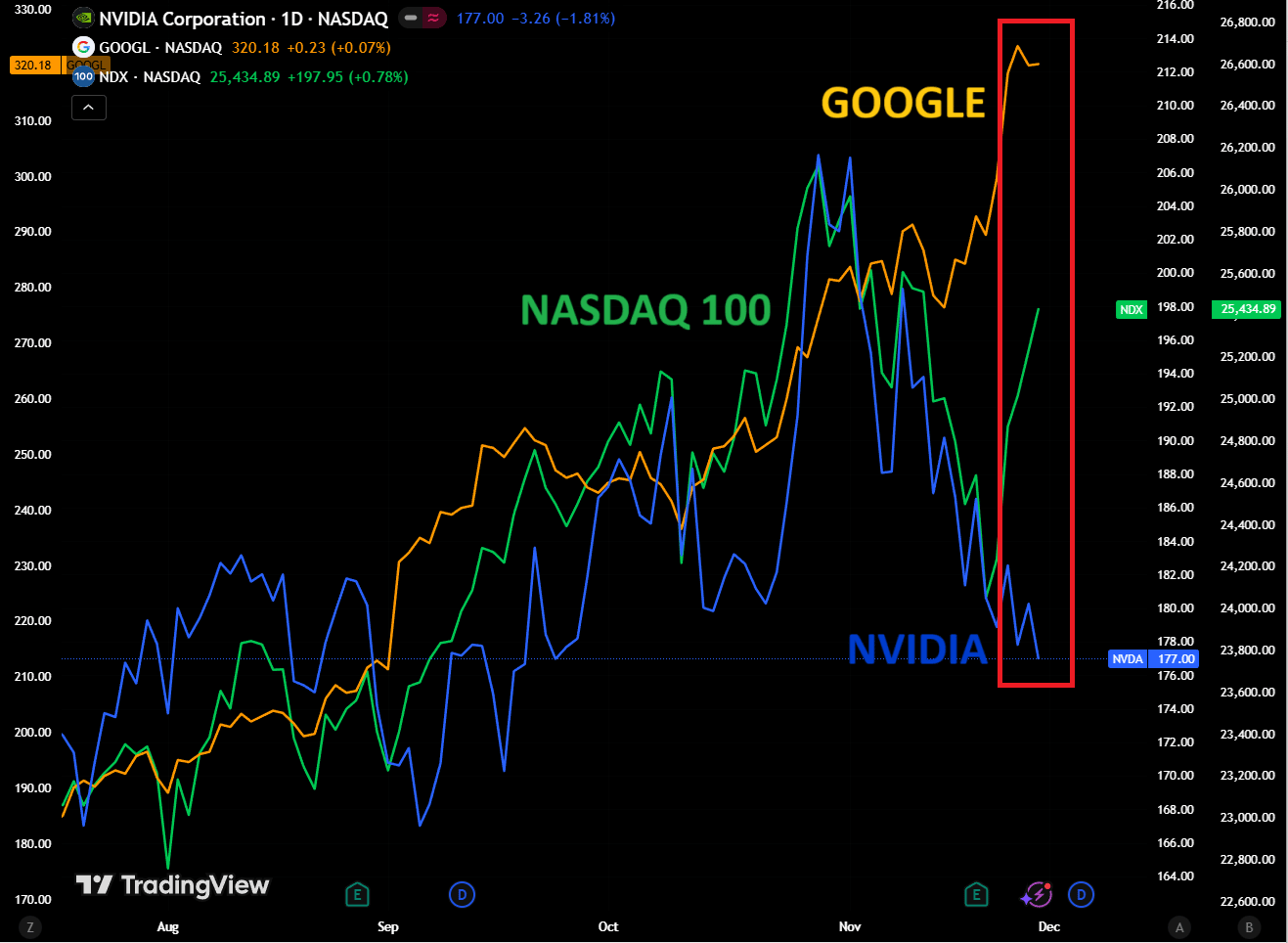

NVIDIA, $NVDA ( ▼ 1.76% ) , stock prices have DROPPED -11% over the last 13 days, to the lowest since September.

Alphabet, $GOOGL ( ▲ 0.65% ) , stock has surged +10% at the same time.

As a result, the Nasdaq 100, $NDX ( ▼ 0.8% ) , is down -0.7% in 13 days.

Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

This is a pretty remarkable shift given NVIDIA and Google have both driven the market over the last several years.

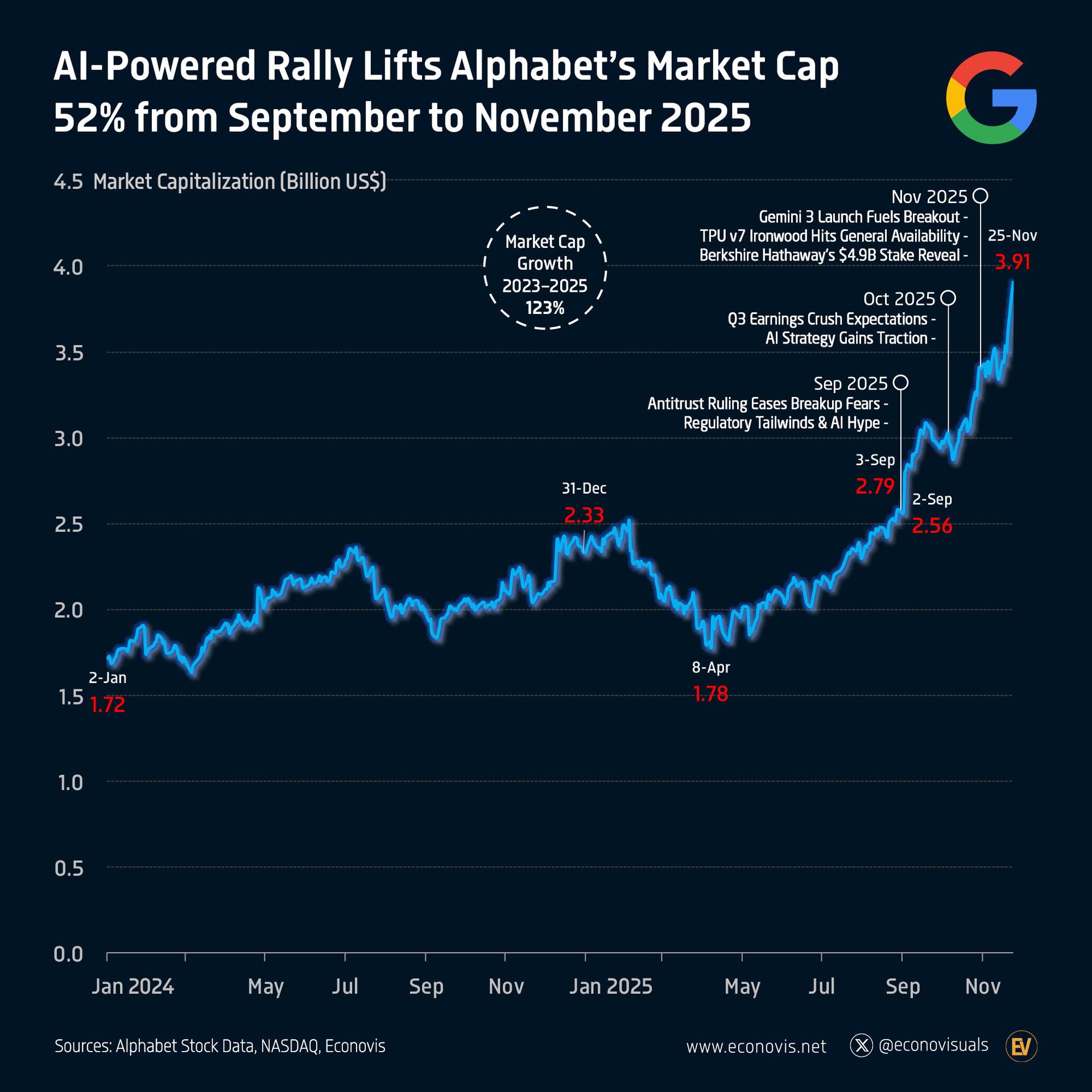

Google’s stock has rallied mainly because investors, including Berkshire Hathaway, see its AI plans delivering some promising results. The company is now training its own AI models on its own infrastructure using TPU chips. At the same time, the Gemini 3 model is delivering strong benchmark results.

TPU chips are specialized processors designed by Google to run and train AI models faster and more efficiently than general-purpose computer chips. This has convinced investors that Google can compete directly with both OpenAI and NVIDIA while keeping most of its system in-house.

As a result, the market share of Gemini has risen, while the market share of ChatGPT has declined.

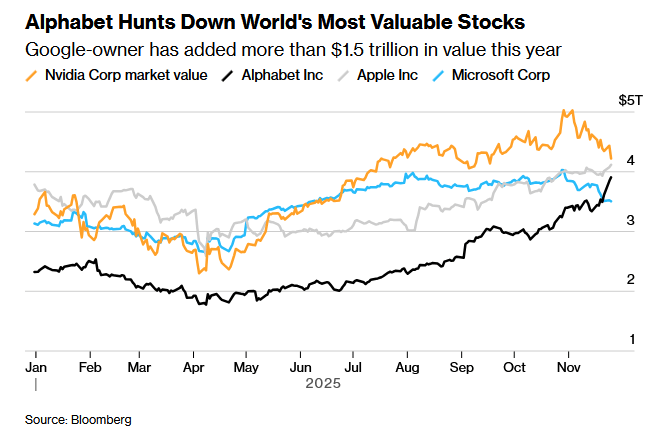

On the other hand, NVIDIA stock has fallen largely because Google's progress in AI chips is raising concerns that some future demand could shift away from NVIDIA's hardware (GPUs). Reports that Meta may start using Google TPUs have intensified this risk, since Meta is one of NVIDIA's largest customers and among the world's biggest AI infrastructure buyers.

At the same time, AI stocks overall have been under pressure as investors question how long heavy AI spending (capital expenditures) will continue before producing tangible, satisfactory returns. This has added extra selling pressure on NVIDIA, which depends heavily on companies continuing to build large amounts of new AI infrastructure.

Put simply, AI competition is intensifying and investor FOMO (Fear Of Missing Out) is stronger than ever.

Will the market follow Google or NVIDIA next? What do you think?

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: