- Global Markets Investor

- Posts

- ⚠️Retail investors are pouring money into funds they likely do not understand.

⚠️Retail investors are pouring money into funds they likely do not understand.

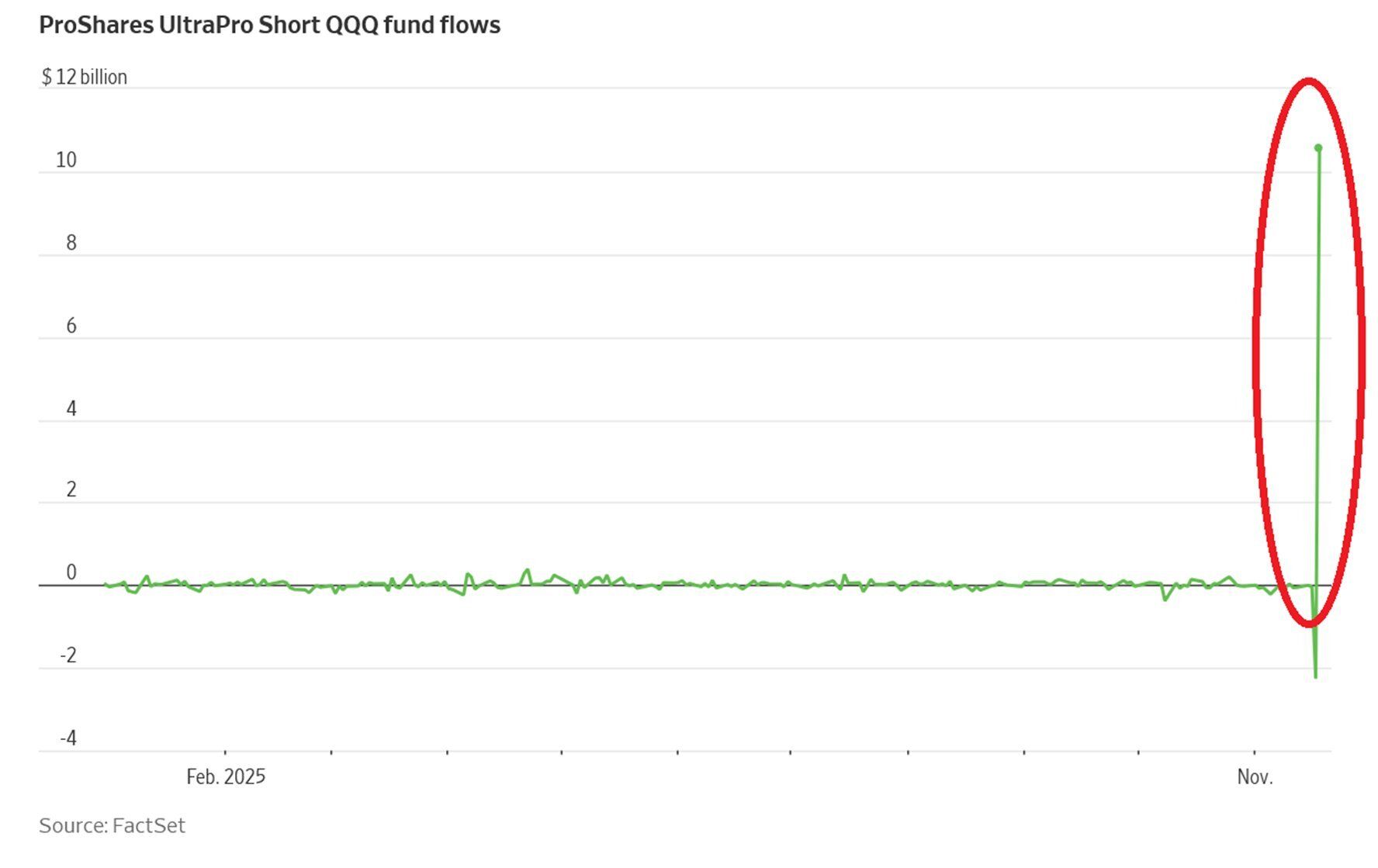

The 3x leverage short Nasdaq 100 ETF posted the largest inflow on record.

🔥25% OFF AN ANNUAL SUBSCRIPTION, BLACK FRIDAY AND THANKSGIVING PROMO

Click below to redeem, expires Friday 28 November before midnight.

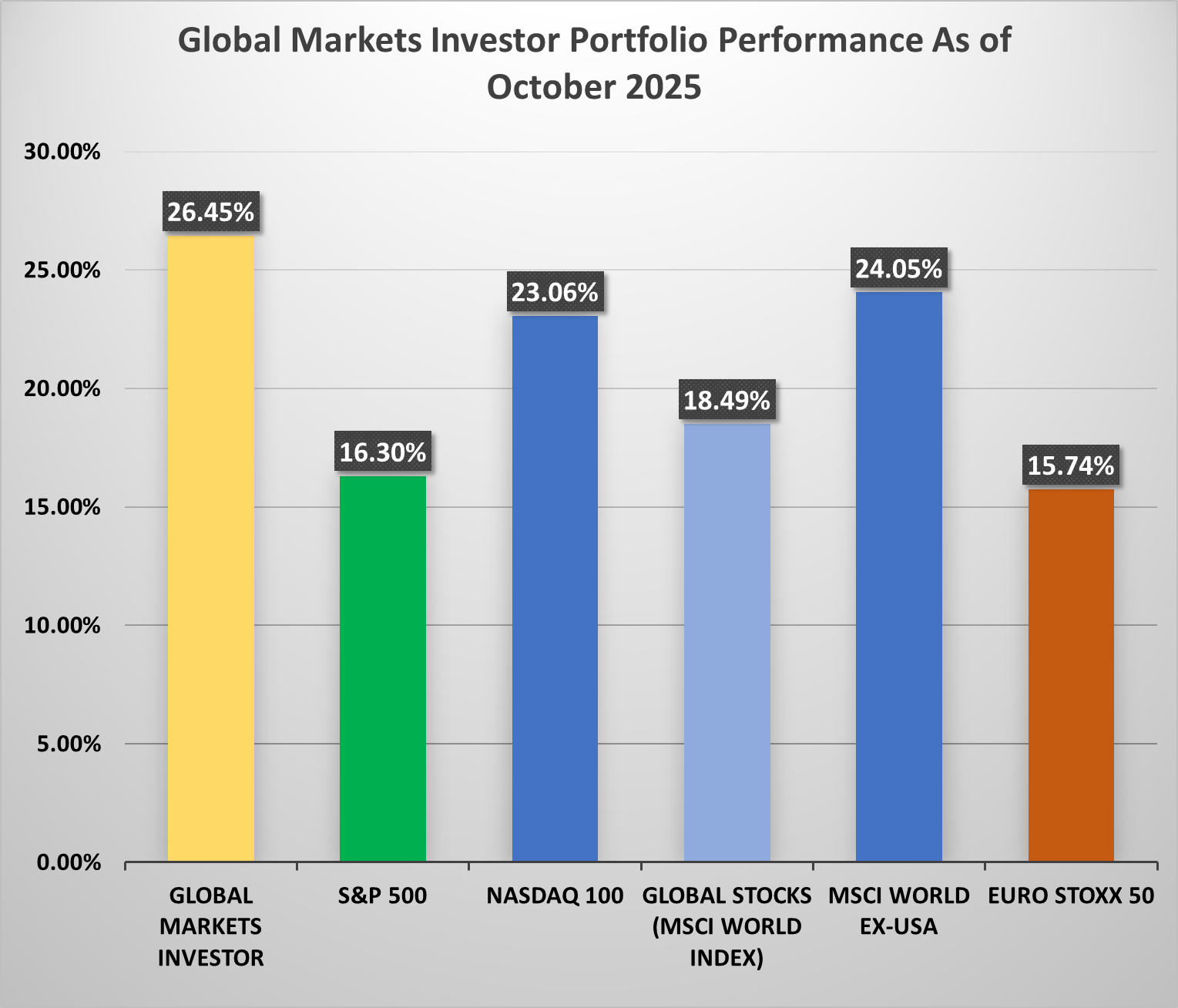

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 53% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

The 3x leveraged short Nasdaq 100 ETF, $SQQQ ( ▲ 0.92% ) , saw +$12 BILLION in net inflows on Thursday, the largest daily inflow on record in data going back to 2010, according to FactSet and Dow Jones Market Data.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

However, this figure may be inflated due to the 1-for-5 reverse stock split that occurred the same day. This comes as some data providers calculate flows using the formula:

Daily Dollar Inflow = (Shares Outstanding end of day − Shares Outstanding start of day) × Net Asset Value (NAV) at end of day.

A 1-for-5 reverse split causes shares outstanding to drop by 5x, and depending on how the adjustment is recorded intraday, it can mechanically distort the flow number.

Even if the split-adjusted distortion occurred, the true inflow would still be as much as ~$2.4 billion, still extremely large.

Therefore, this suggests retail investors bet heavily that tech stocks will decline, as these types of investment products are very popular among retail traders.

Many retail investors buy leveraged ETFs without understanding how they work because the payoff looks exciting: potentially big gains in a short time. However, these products have asymmetric returns, meaning they can fall much faster than they rise. This is because leveraged ETFs reset their exposure every day, a process called daily rebalancing.

During this reset, the fund must buy when prices rise and sell when prices fall to maintain its target leverage. Over time, this creates compounding effects, since the leverage must be rebuilt each day and the fund pays financing costs to maintain that leverage. These costs slowly eat into returns and can cause the ETF to underperform — sometimes far below the index it tracks. In volatile markets, this effect gets even worse because the fund is repeatedly forced to “buy high and sell low.”

Many leveraged ETFs also rely on futures and derivatives, which introduce extra costs such as roll costs, trading spreads, and interest expenses.

Simply put: leveraged ETFs can drop much faster than they rise, and the longer you hold them, the more these hidden mechanics work against investors.

For example, consider a 3x leveraged short Nasdaq ETF designed to deliver three times the opposite of the Nasdaq 100’s daily return. If the Nasdaq falls -1% in a day, the ETF aims to rise +3%. But if the Nasdaq rises +1%, the ETF aims to fall -3%.

To maintain this 3x daily leverage, the fund resets its exposure every day. This means it must add to its short positions when markets fall and buy them back when markets rise. This daily rebalancing creates compounding effects that can quickly erode the fund’s value in choppy markets.

Because the fund uses financial contracts to create this leverage, it also pays additional costs — such as interest, futures roll costs, and trading fees — which steadily reduce its value over time. These costs accumulate and can make the ETF drift lower even if the Nasdaq eventually returns to the same level.

This is why 3x leveraged short ETFs like SQQQ are generally meant only for very short-term trading, not long-term holding. Ideally, it is best not to use them.

More data about retail and professional investors positioning in the following market recap.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: