- Global Markets Investor

- Posts

- ⚠️Japanese government bond yields are skyrocketing

⚠️Japanese government bond yields are skyrocketing

Will this worrying trend ever stop?

🔥25% OFF AN ANNUAL SUBSCRIPTION, BLACK FRIDAY AND THANKSGIVING PROMO

Click below to redeem, expires Friday 28 November before midnight.

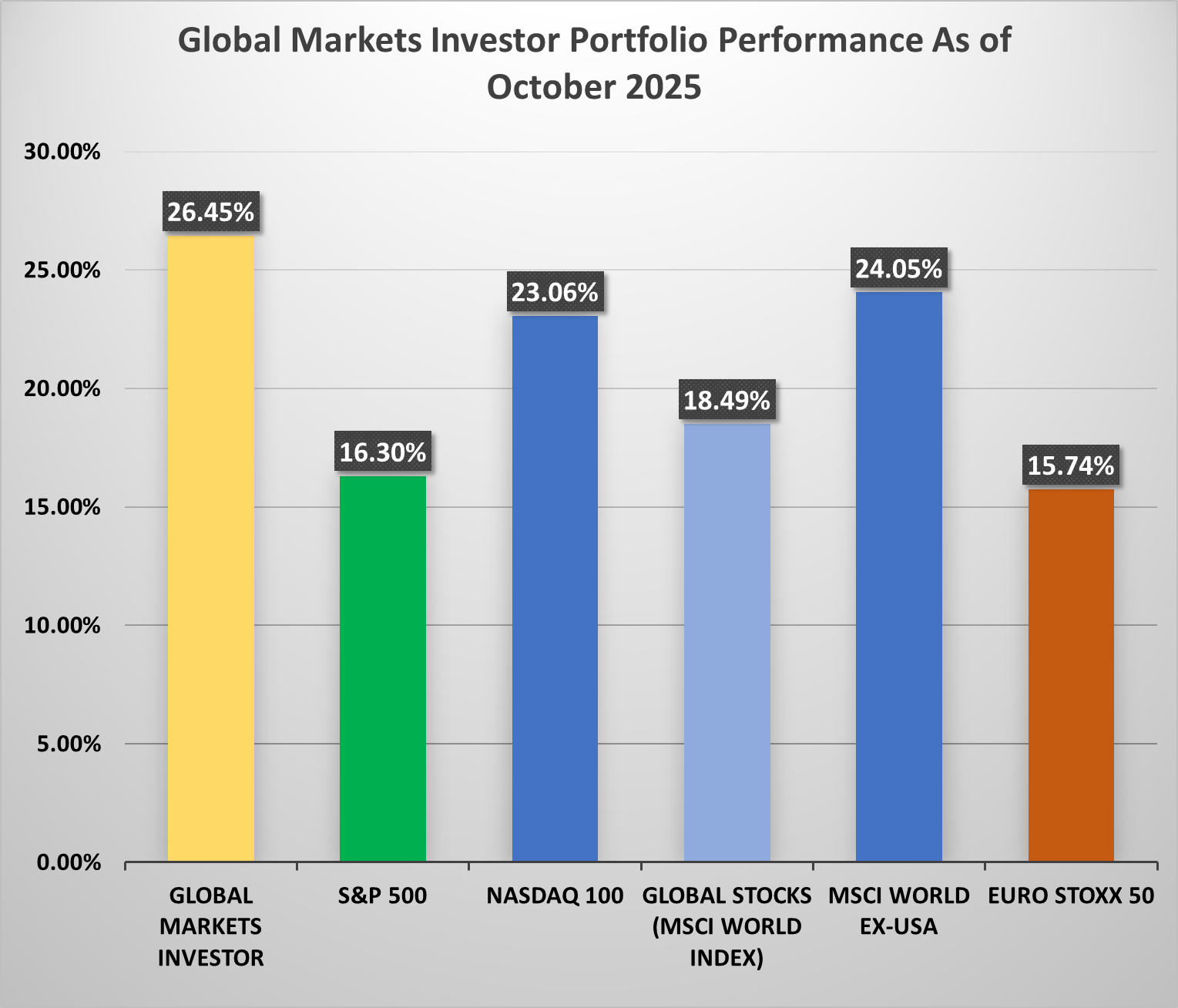

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 53% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

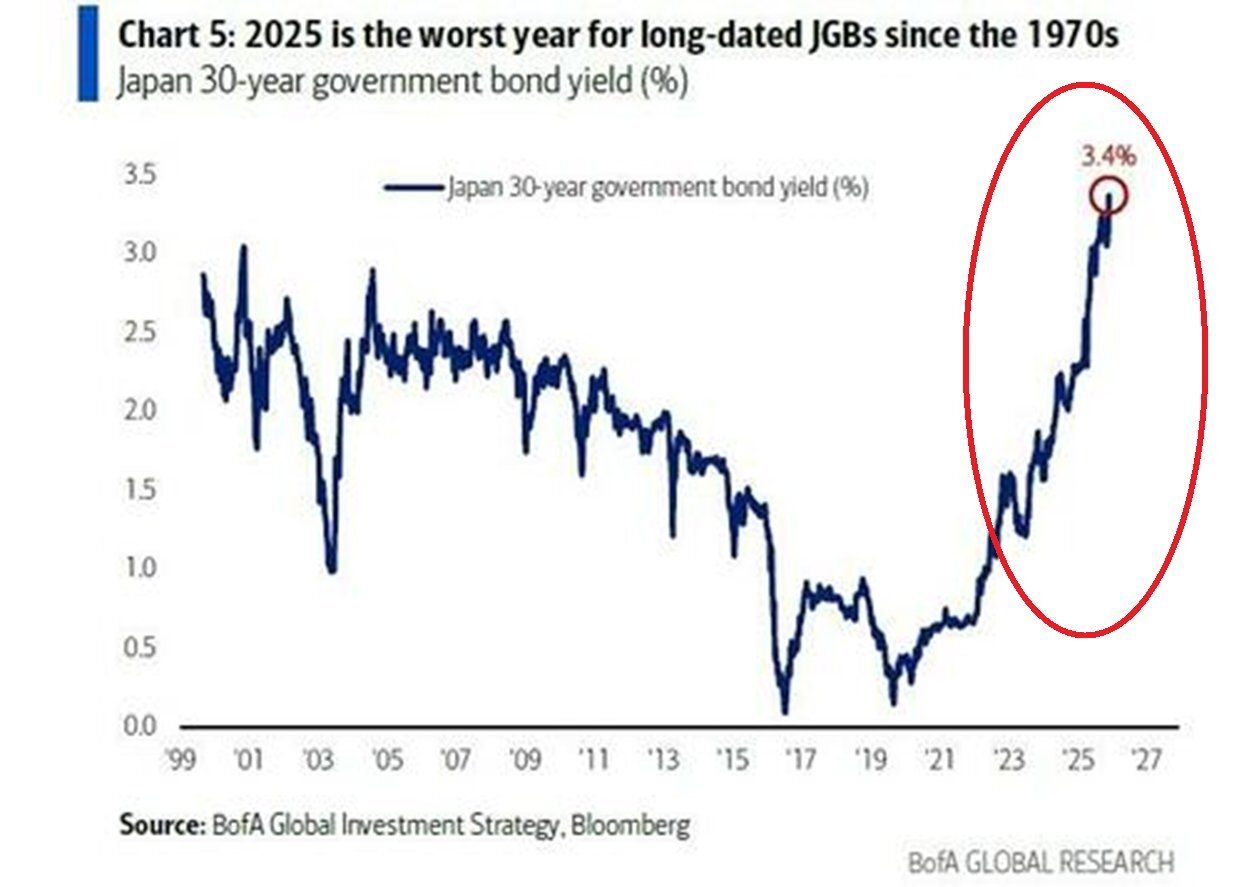

Japan's 30-year government bond yield hit 3.4%, the highest in at least 25 years, rising 100 basis points year-to-date. As you can see, this has been a massive move.

More than $10k in debt? We can help.

Debt happens. Getting out starts here.

Millions of Americans are tackling debt right now.

Whether it’s credit cards, loans, or medical bills, the right plan can help you take control again. Money.com's team researched trusted debt relief programs that actually work.

Answer a few quick questions to find your best path forward and see how much you could save. answer a few short questions, and get your free rate today.

According to Bank of America, this has been the worst year for long-dated Japanese Government Bonds since the 1970s.

Put simply, the world’s 3rd-largest bond market is trading like an emerging-market one.

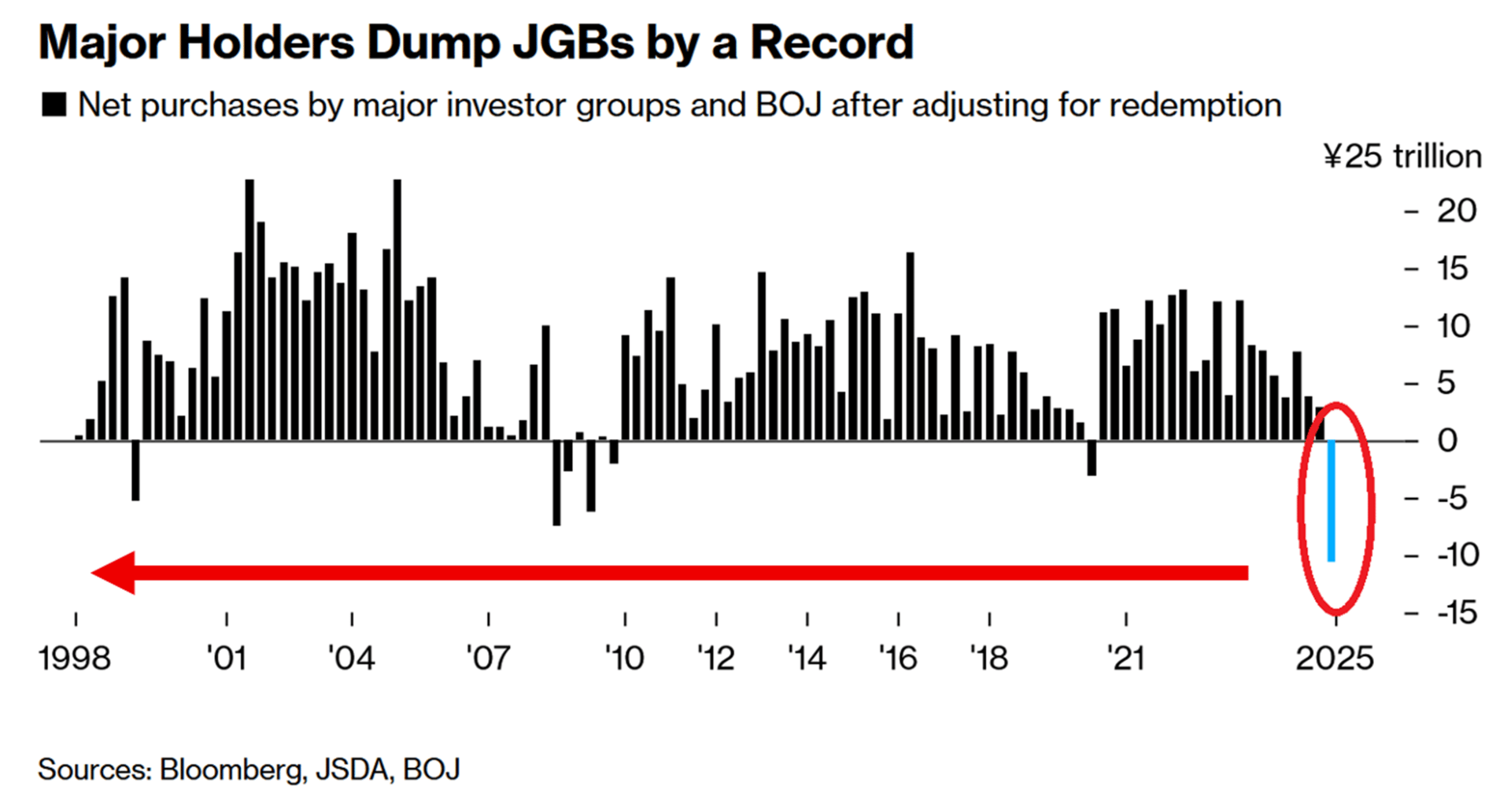

This comes as major investors have been selling long-term Japanese government bonds.

The Bank of Japan, domestic banks, insurers, and others net sold -¥10.7 trillion in Japanese Government Bonds (JGBs) in September, the most on record.

Demand for Japanese debt is falling, no wonder yields are rising.

If you have not read it yet, I recommend the analysis on global bond markets posted several weeks ago, covering this worrying global trend.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: