- Global Markets Investor

- Posts

- US stocks finished the week lower amid rising Treasury yields. Weekly market recap, trading week 01/2026

US stocks finished the week lower amid rising Treasury yields. Weekly market recap, trading week 01/2026

Summary of the trading week using the most popular posts from the X platform

🔥GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

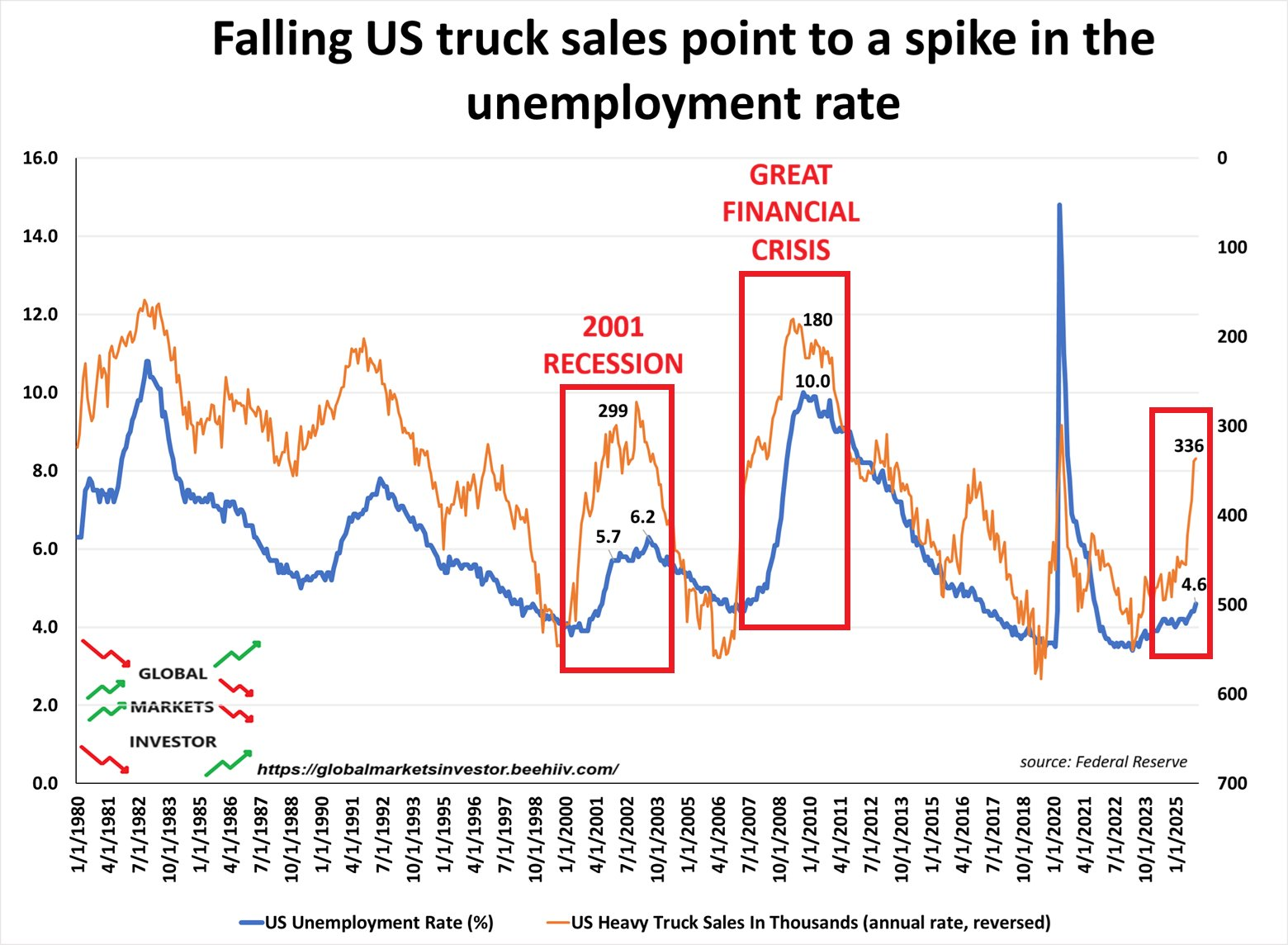

US stocks finished the week lower amid rising Treasury yields, though they posted a positive start to the year.

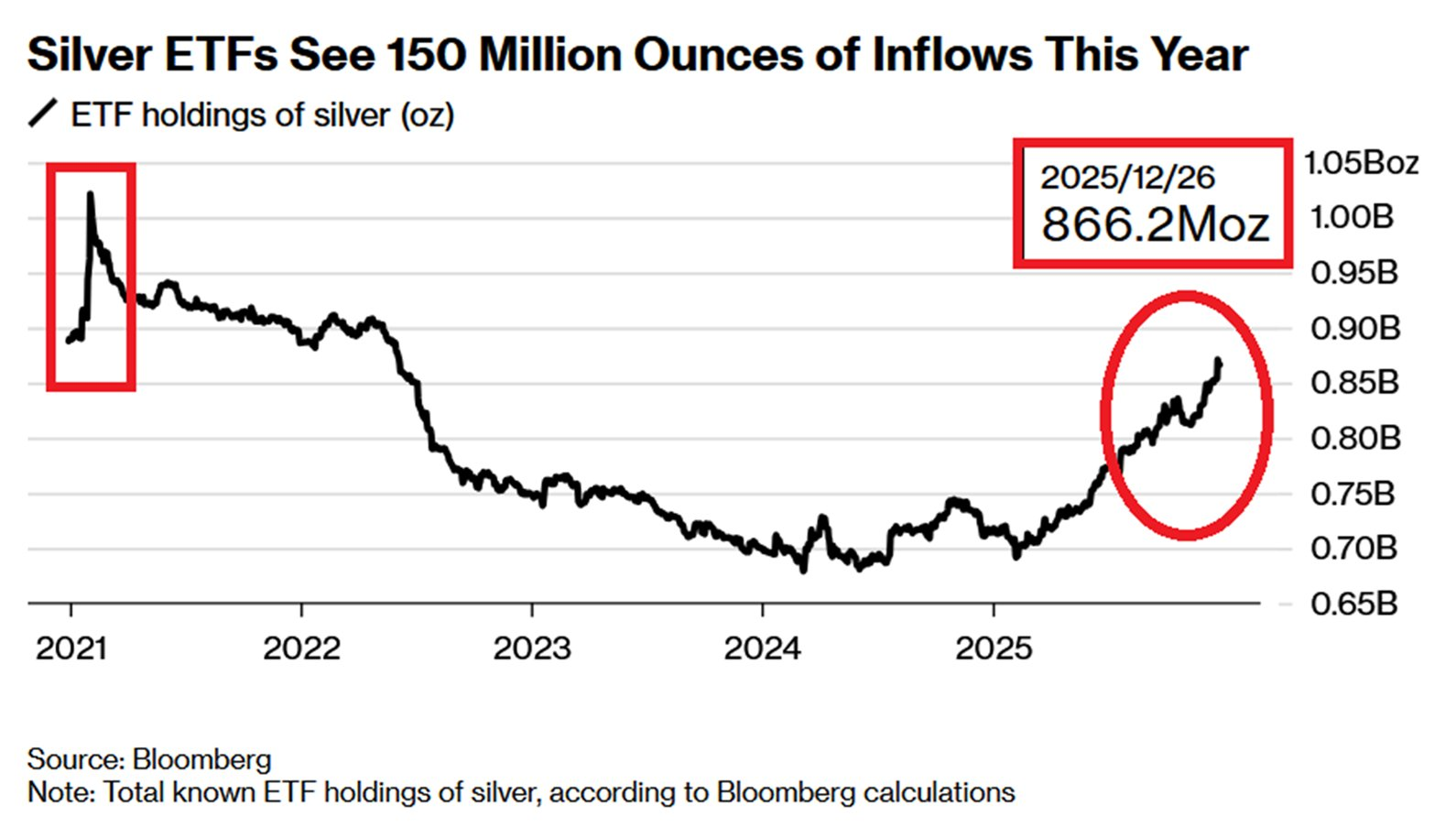

Silver and gold saw significant volatility and ended the week lower.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 -1.1%

- Nasdaq -1.5%

- Dow Jones -0.7%

- Russell 2000 (small caps) -1.1%

- US 10-year Treasury yield +6 bps

- VIX +8%, front month VIX futures -4%

- US Dollar index +0.5%

- Gold -4.7%

- Silver -6.7%

- WTI Crude Oil +1.0%

- Bitcoin +2.2%

Amazon Prime members: See what you could get, no strings attached

If you spend a good amount on Amazon, this card could easily be worth $100s in cash back every year. And — even better — you could get approved extremely fast. If approved, you’ll receive an insanely valuable welcome bonus deposited straight into your Amazon account, ready to use immediately.

You also don’t have to jump through any hoops to get this bonus. No extra work or special spending requirements. Get approved, and it’s yours.

This might be one of the most powerful cash back cards available, especially considering how much most people spend on Amazon each month. It gives you the chance to earn cash back on the purchases you’re already making, turning your routine shopping into something that actually pays you back.

If you shop at Amazon or Whole Foods, this card could help you earn meaningful cash back on every purchase you make. But this offer won’t last forever — and if you’re an Amazon Prime member, this card is as close to a no-brainer as it gets.

Amazon Prime members: See what you could get, no strings attached

For the trading week ending January 9, key events are:

- US ISM Manufacturing PMI for December on Monday

- US ISM Services PMI for December on Wednesday

- US ADP Employment for December on Wednesday

- US Job Openings for December on Wednesday

- US Challenger Job Cuts for December on Thursday

- US Non Farm Payrolls for December on Friday

- US Consumer Sentiment for January on Friday

Massive week in terms of the US job market data.

2) The US military operation on Venezuela is not about oil.

3) On 31 December 2025, Warren Buffett, a true investing legend and the greatest of all time, had his final day as Berkshire Hathaway CEO.

4) Crypto disconnected from US tech stock prices, does it signal a correction?

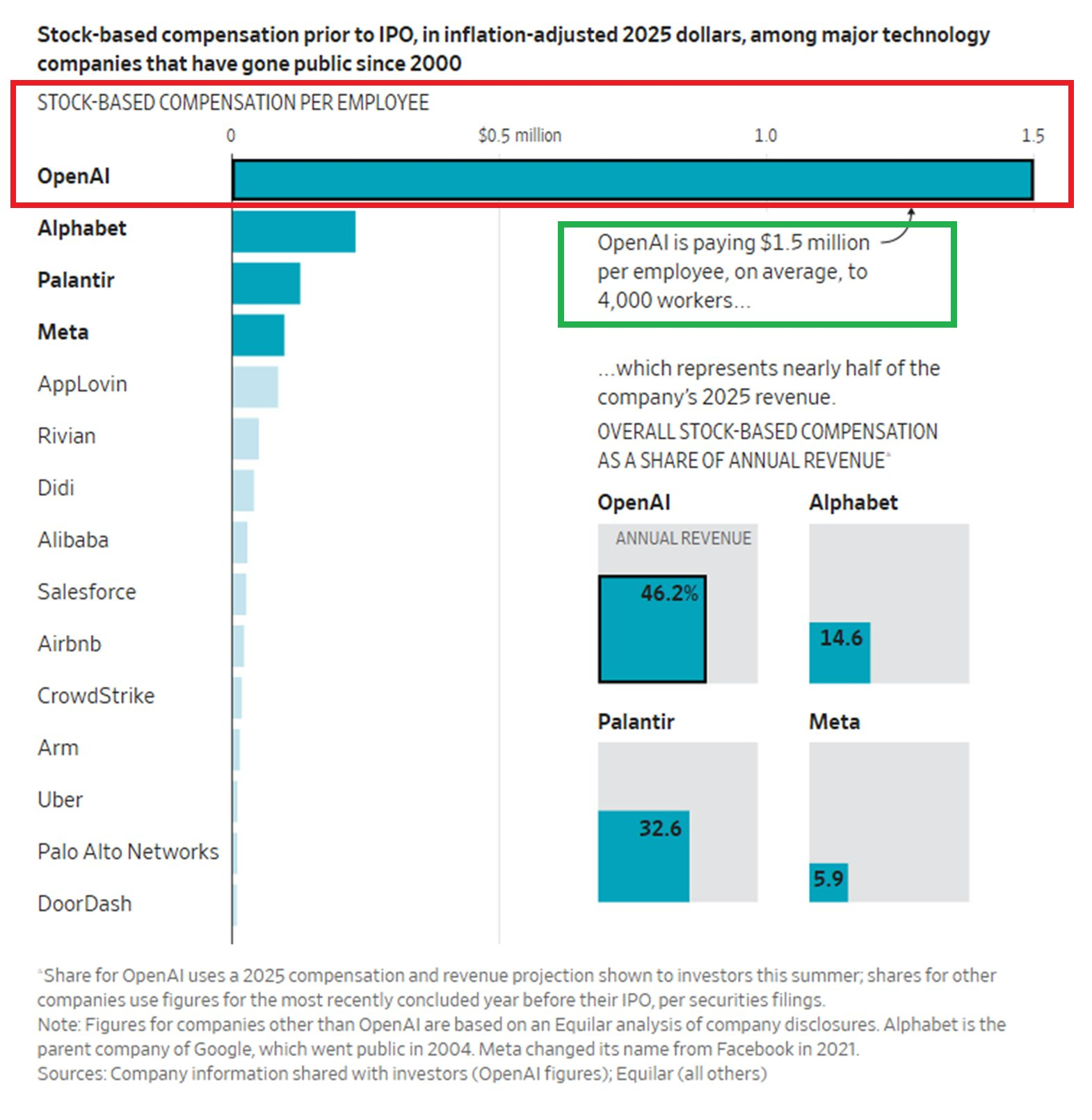

5) Some additional posts that include interesting data.