- Global Markets Investor

- Posts

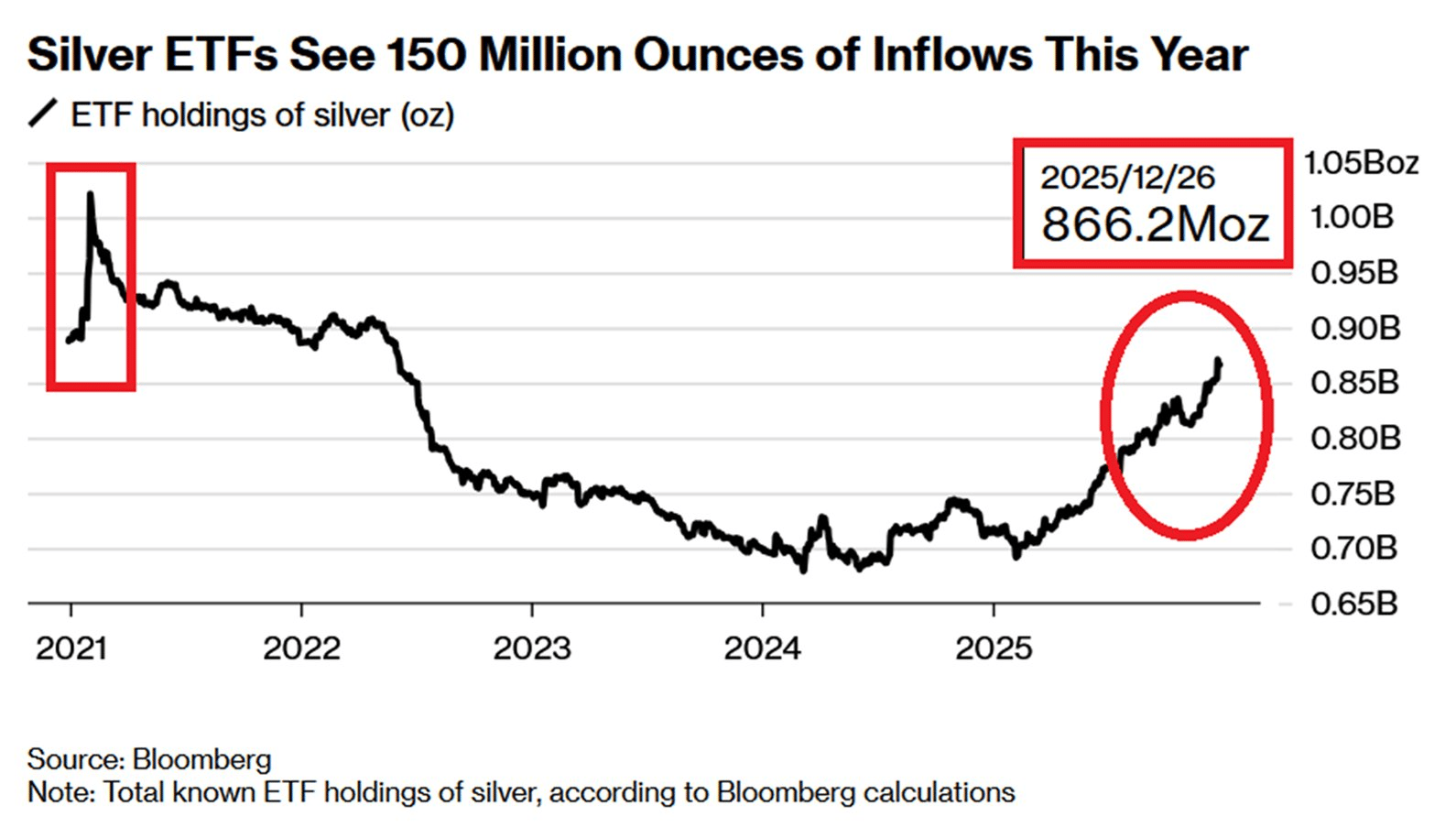

- 🔥Retail demand for silver ETFs is surging at a rapid pace

🔥Retail demand for silver ETFs is surging at a rapid pace

Will the silver market stabilize soon?

🔥🔥 GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI’s PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Total known holdings of silver-backed ETFs jumped to 866 MILLION ounces, the highest level in 3.5 years.

This marks a jump of ~170 million ounces since February.

Remember, ETF issuers must purchase physical silver and add it to the fund’s vaults when investors buy ETF shares.

By comparison, the 2021 all-time high hit ~1,030 million ounces.

Are retail investors piling in at the worst possible time, or is there still upside for silver?

More about the silver market in the Sunday’s market recap (below).

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: