- Global Markets Investor

- Posts

- The Bank of Japan's balance sheet reduction (QT) is accelerating

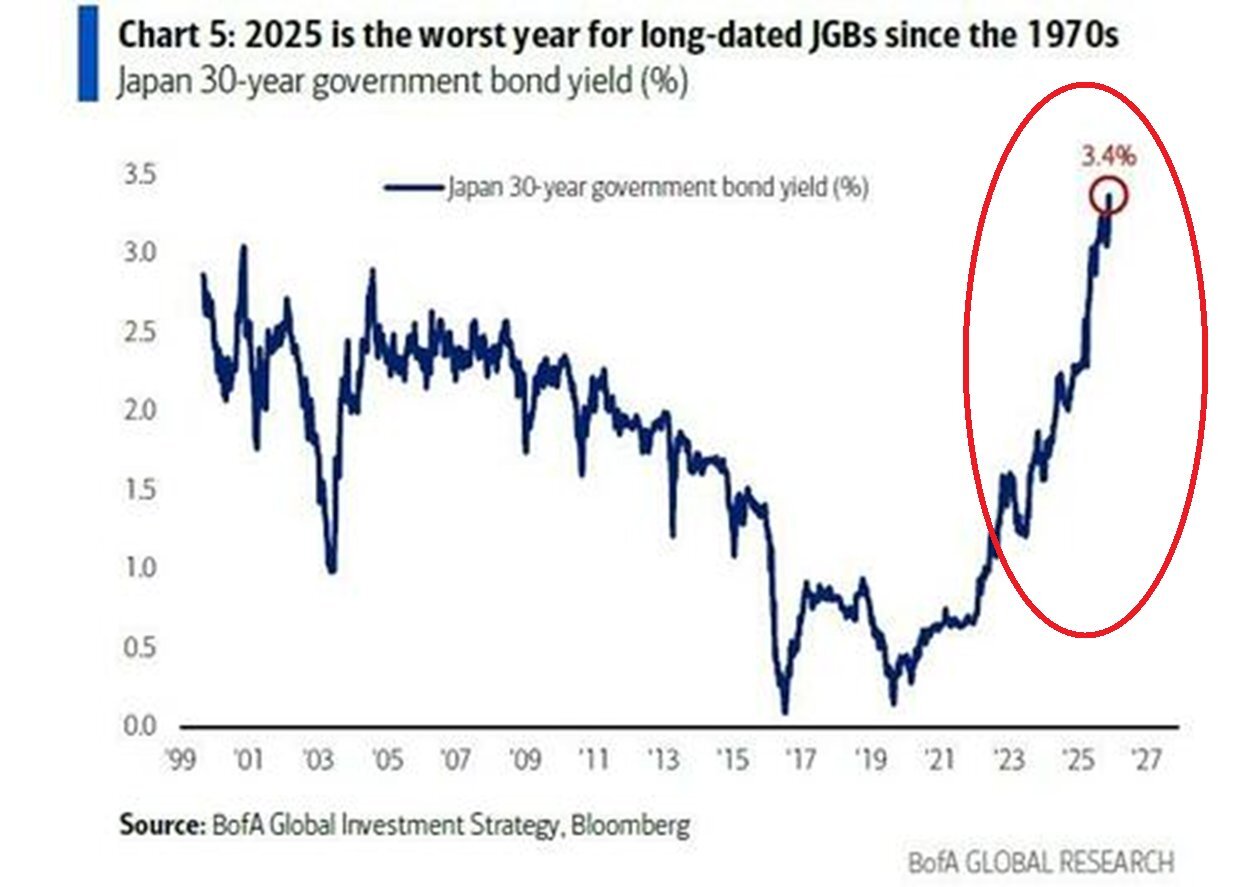

The Bank of Japan's balance sheet reduction (QT) is accelerating

Demand for the Japanese government bonds is falling

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Total assets fell ¥61.2 trillion in Q3 2025, to ¥695 trillion, the lowest since Q3 2022 and in line with Q3 2020 levels.

This reflects efforts to stabilize the rapidly weakening yen and reduce inflation pressures.

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

Despite this reduction, the Bank of Japan still holds 52% of all Japanese government bonds.

Government-controlled entities also hold a significant share, meaning private ownership of Japan’s debt remains limited.

Demand for Japanese debt is falling.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: