- Global Markets Investor

- Posts

- S&P 500 rose for the 3rd consecutive week. Weekly market recap, trading week 17/2025

S&P 500 rose for the 3rd consecutive week. Weekly market recap, trading week 17/2025

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are also surrounded by commentary and explanations of complicated topics.

US stocks rallied sharply as some investors hope that some trade deals will soon be announced, which will lower the current tariff level.

The Nasdaq saw the second-best week since November 2023, while gold finally experienced some pullback.

Meanwhile, China repeatedly admitted that there have been no negotiations between the US and China regarding tariffs.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 jumped 4.6%

- Nasdaq index spiked 6.7%

- Dow Jones rose 2.5%

- Russell 2000 (small caps) rallied 4.0%

- US 10-year Treasury yield fell 6 bps

- VIX fell 15%

- US Dollar index rose 0.2%

- WTI Crude Oil dropped 1.3%

- Silver increased 1.6%

- Gold fell 0.3%

- Bitcoin rallied 12%

What Top Execs Read Before the Market Opens

The Daily Upside was built by investment pros to give execs the intel they need—no fluff, just sharp insights on trends, deals, and strategy. Join 1M+ professionals and subscribe for free.

For the trading week ending May 2, key events are:

- US Consumer Confidence for April on Tuesday

- US Job Openings for for March on Tuesday

- US Q1 GDP data on Wednesday

- US PCE Inflation for March on Wednesday

- US ISM Manufacturing PMI for April on Thursday

- US Challenger Job Cuts for April on Thursday

- US nonfarm payrolls for April on Friday

- ~32% of S&P 500 companies reporting Q1 2025 earnings

Massive week in terms of the economic data and S&P 500 earnings, $SPX ( ▼ 0.43% ) , with the US labor market being in focus. Microsoft, $MSFT ( ▼ 2.24% ) , and $META ( ▼ 1.34% ) are scheduled to report on Wednesday after the close while Amazon, $AMZN ( ▲ 1.0% ) , and Apple, $AAPL ( ▼ 3.21% ) , on Thursday.

⚠️US stocks rallied sharply following hopes that some trade deals would soon be announced.

The Nasdaq saw the second-best week since November 2023, while gold finally experienced some pullback.

Meanwhile, China repeatedly admitted that there have been no negotiations between

— Global Markets Investor (@GlobalMktObserv)

8:10 PM • Apr 25, 2025

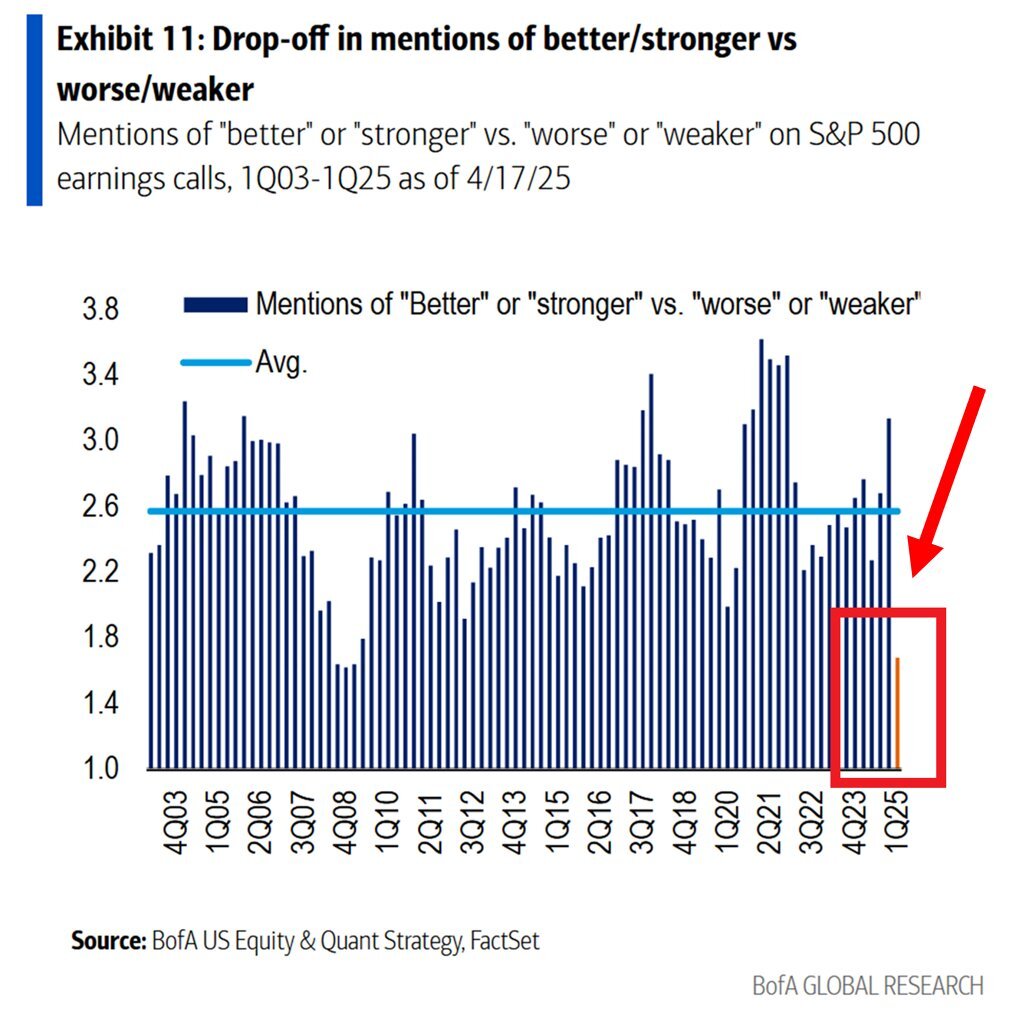

2) Such things do not happen at the market bottoms: