- Global Markets Investor

- Posts

- US stocks had a mixed week. Weekly market recap, trading week 03/2026

US stocks had a mixed week. Weekly market recap, trading week 03/2026

Summary of the trading week using the most popular posts from the X platform

🔥GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

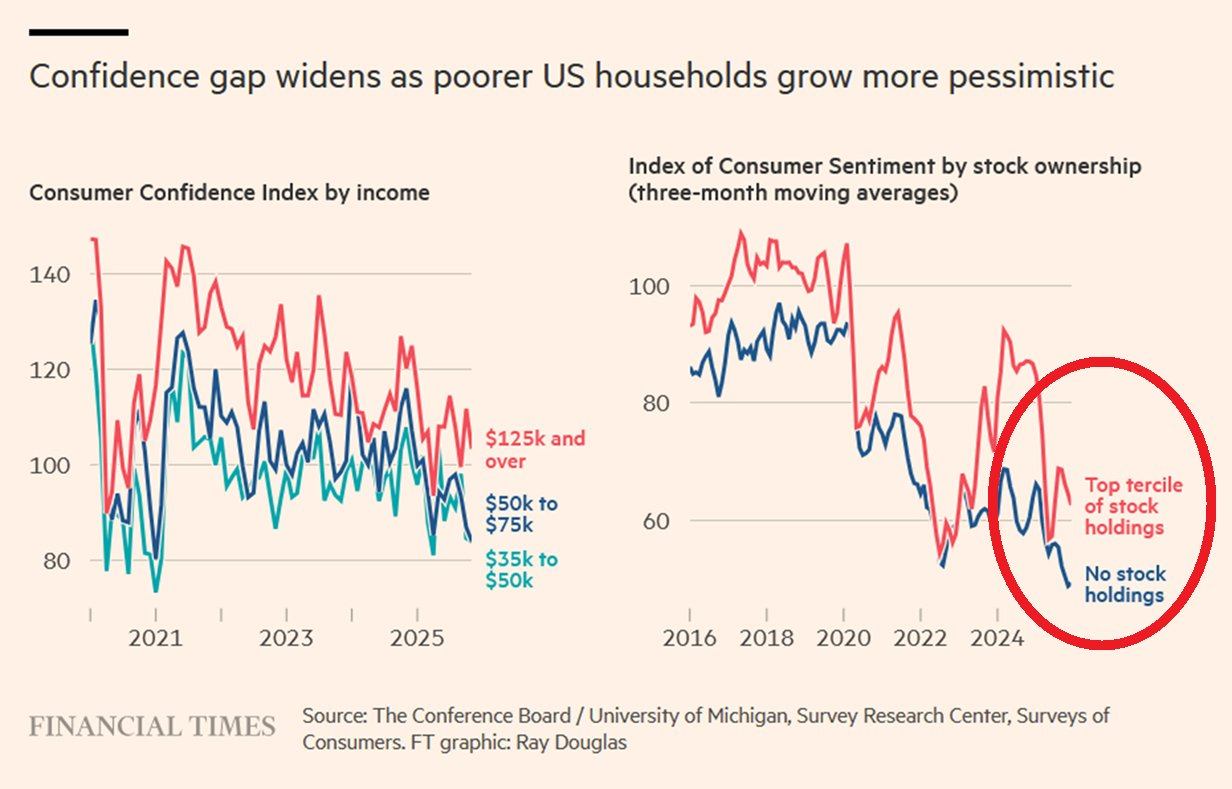

US stocks ended the week mixed as small caps surged on their longest winning streak since 2008 while tech lagged.

Silver posted its best start to a year in 3 decades while gold rallied for the 5th week in 6.

Lastly, short-term volatility remained subdued despite elevated single-stock vol and upside protection bids.

Meanwhile, on Saturday, US President Donald Trump announced 10% tariffs on several European nations starting February 1, escalating to 25% from June 1.

The tariffs target Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland.

Trump says the tariffs will remain until he secures "the Complete and Total purchase of Greenland.

In response, European Union lawmakers are preparing to halt approval of the EU–US trade deal.

Additionally, France’s President Macron is urging the EU to activate its “most potent trade weapon,” the anti-coercion instrument.

If deployed against the US, it would restrict US access to the EU market, potentially block US banks from EU procurement, and target major US tech firms. This tool has never been used before.

Lastly, the EU is also preparing up to €93 billion in tariffs and other restrictions on US companies.

Time to make market volatility great again.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 -0.4%

- Nasdaq -0.7%

- Dow Jones -0.3%

- Russell 2000 (small caps) +2.0%

- US 10-year Treasury yield +6 bps

- VIX +9%, front month VIX futures +1%

- US Dollar index +0.3%

- Gold +2.1%

- Silver +11.6%

- WTI Crude Oil +0.5%

- Bitcoin +5.4%

AI in HR? It’s happening now.

Deel's free 2026 trends report cuts through all the hype and lays out what HR teams can really expect in 2026. You’ll learn about the shifts happening now, the skill gaps you can't ignore, and resilience strategies that aren't just buzzwords. Plus you’ll get a practical toolkit that helps you implement it all without another costly and time-consuming transformation project.

For the trading week ending January 23, key events are:

- US Markets Closed, Martin Luther King Jr. Day on Monday

- US Pending Home Sales for December on Wednesday

- US Q3 GDP final reading on Thursday

- US Consumer Sentiment for January on Friday

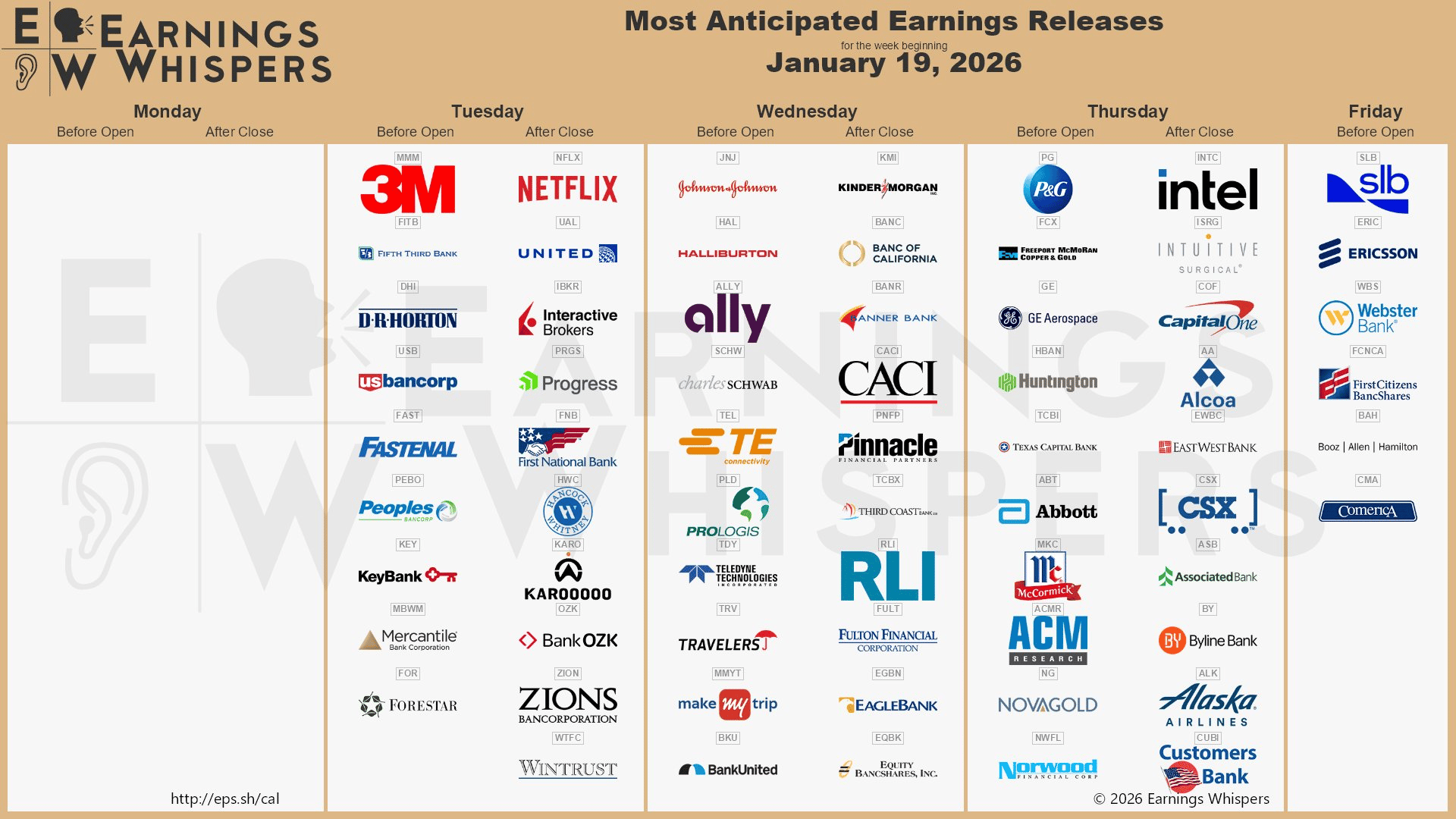

- ~7% of S&P 500 companies report earnings

Investors will be watching closely for headlines on the escalating tensions between the US and the EU.

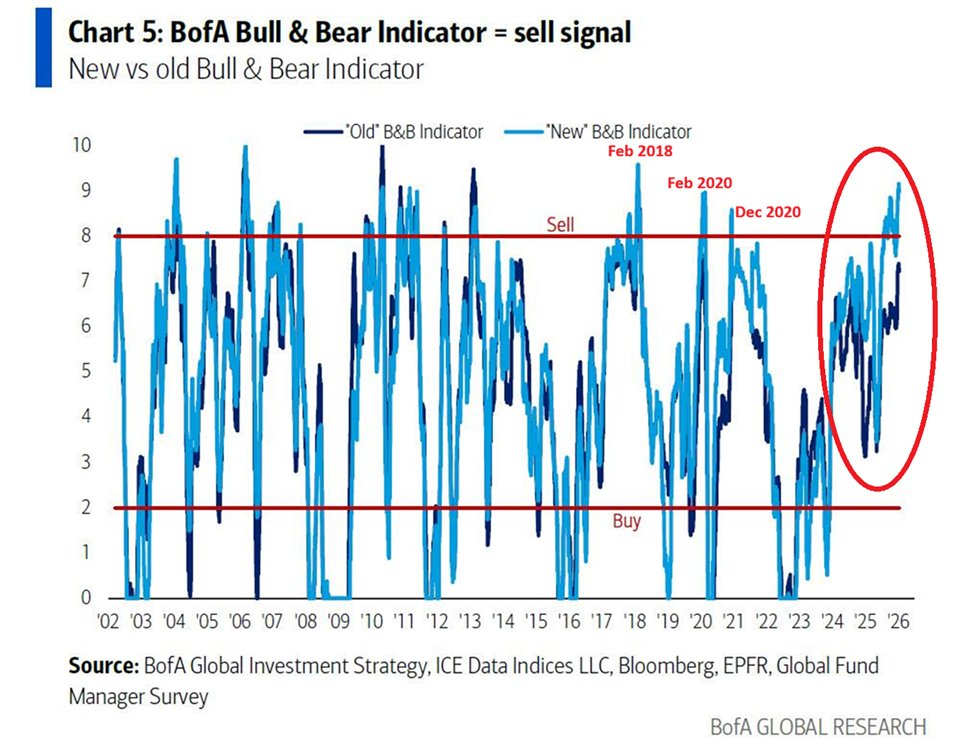

2) Retail investor sentiment is historically high. Individual investors have also never been speculating this much in the market.

3) Individual investors are also piling into silver-linked ETFs at a record pace. Is this the top signal for silver?

4) China has overtaken the world auto market. The country’s overall trade surplus has hit an all-time high.

5) Some additional posts that include interesting data.