- Global Markets Investor

- Posts

- Concerns about more debt in Japan are rising

Concerns about more debt in Japan are rising

The Yen is weakening while government bonds are selling off

🔥GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

The Japanese yen tumbled to 159.13 per US Dollar, the weakest since July 2024.

This follows reports that Prime Minister Sanae Takaichi may call a snap election.

The yen was the worst-performing G10 currency in 2025 as US-Japan interest rate differentials remain historically wide.

The currency weakness also raises the risk of official intervention.

The Ministry of Finance last intervened in July 2024 and historically intervened at levels between 158 and 162.

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

At the same time, government bonds sell-off is intensifying as rising political risks reignited fears over Japan’s fiscal path.

The 30-year yield rose to a record 3.52%, while the 40-year yield hit a record 3.85%.

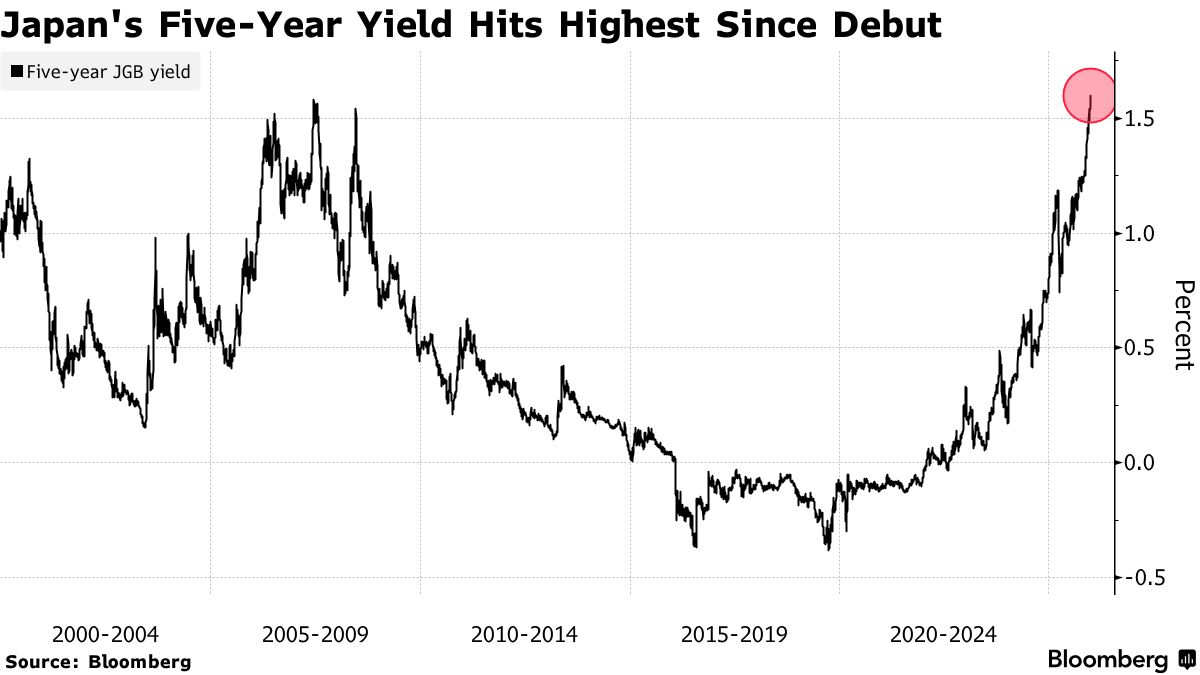

Furthermore, the 5-year government bond yield jumped to 1.62%, its highest since the debut in 2000.

According to Nikkei, Takaichi will announce the decision on Wednesday, looking to capitalize on elevated approval ratings and secure a stronger majority in the lower house.

If Takaichi wins big, markets expect Japan to spend more, and borrow more which puts downward pressure on Japanese government bonds and the yen.

The cost of debt in Japan is rising at a record pace.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: