- Global Markets Investor

- Posts

- US stocks finished lower, snapping 3 consecutive weeks of gains. Weekly market recap, trading week 45/2025

US stocks finished lower, snapping 3 consecutive weeks of gains. Weekly market recap, trading week 45/2025

Summary of the trading week using the most popular posts from the X platform

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 56% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

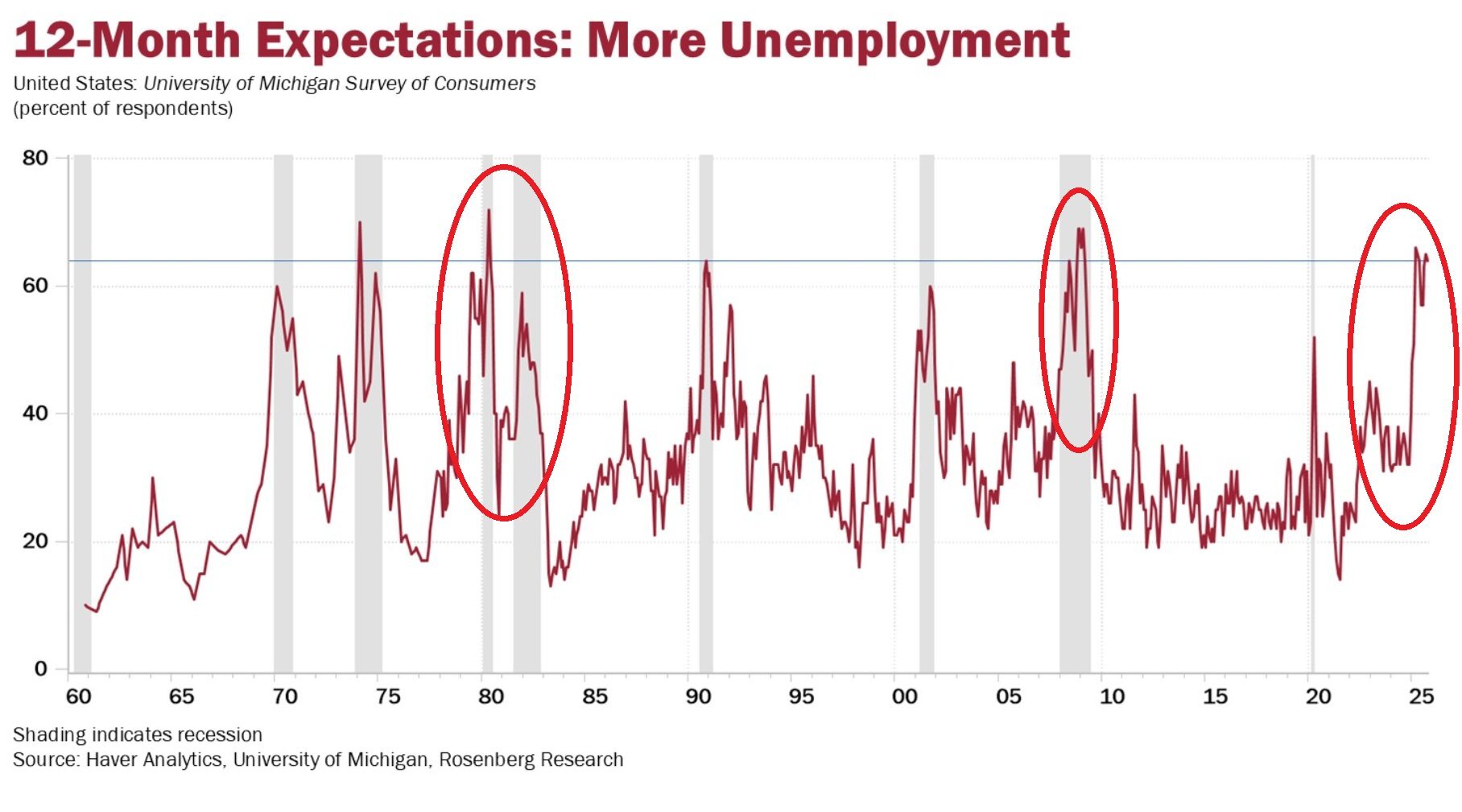

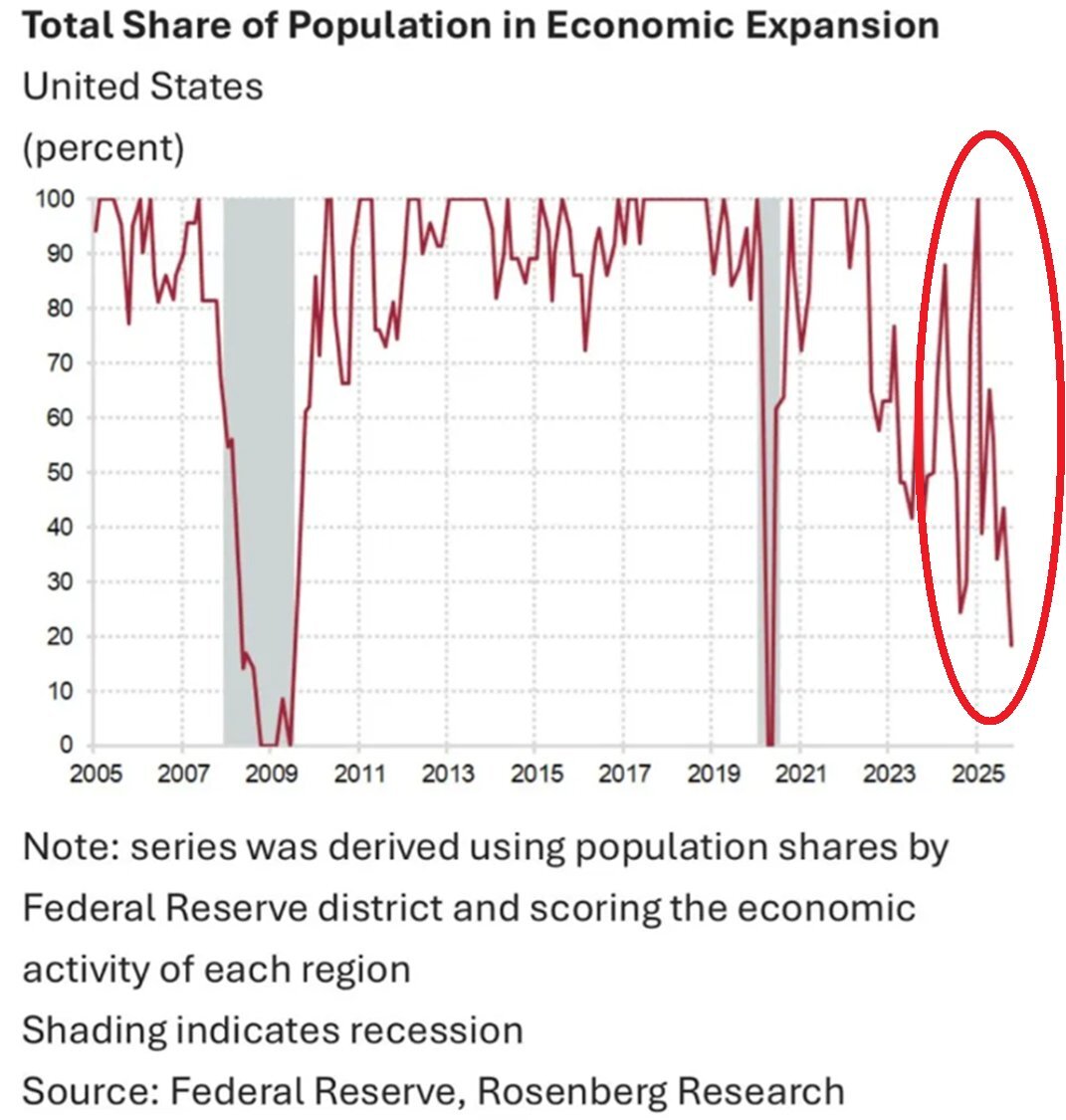

US stocks dropped last week as investor angst over stock valuations and AI hype suddenly rose. A weakening labor market and falling consumer sentiment added to the anxiety.

Gold and silver were roughly flat, while Bitcoin fell materially.

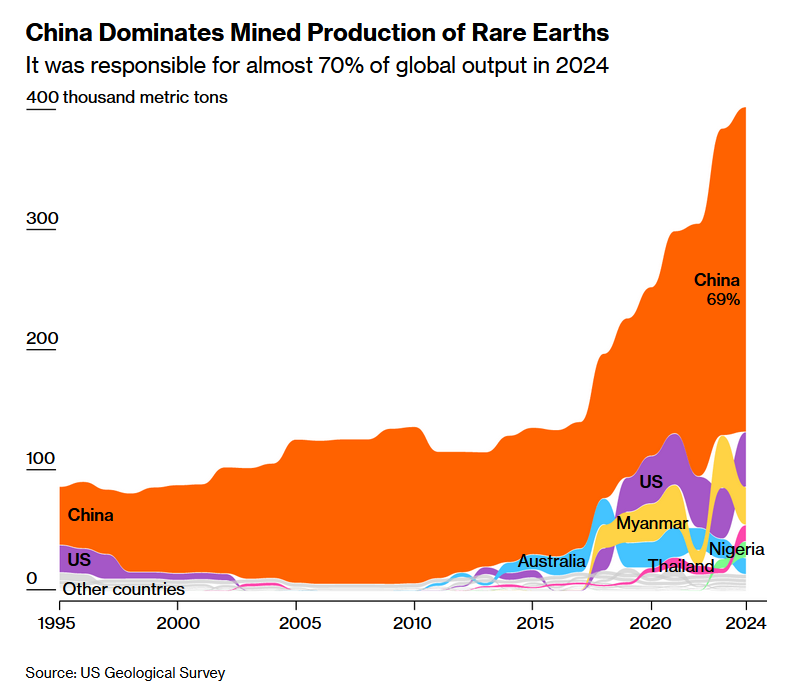

Meanwhile, China has suspended its ban on approving exports of “dual-use items” tied to 3 rare earths (gallium, germanium, antimony), and super-hard materials to the US, the Commerce Ministry said Sunday.

The suspension takes effect immediately and will remain in place until November 27, 2026.

The export ban was originally announced in December 2024. China also paused stricter end-user and end-use checks for dual-use graphite exports to the US, introduced at the same time.

On Friday, Beijing suspended additional export controls imposed on October 9, including expanded curbs on certain rare earth and lithium battery materials.

The move follows an earlier agreement between President Xi Jinping and President Donald Trump to reduce tariffs and pause other trade measures for one year.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 -1.7%

- Nasdaq -3.0%

- Dow Jones -1.2%

- Russell 2000 (small caps) -1.9%

- US 10-year Treasury yield -1 bps

- VIX +10%, front month VIX futures +4%

- US Dollar index -0.2%

- Silver +0.3%

- Gold +0.4%

- WTI Crude Oil -1.9%

- Bitcoin -6.0%

Home insurance rates up by 76% in some states

Over the last 6 years, home insurance rates have increased by up to 76% in some states. Between inflation, costlier repairs, and extreme weather, premiums are climbing fast – but that doesn’t mean you have to overpay. Many homeowners are saving hundreds a year by switching providers. Check out Money’s home insurance tool to compare companies and see if you can save.

For the trading week ending November 14, key events are:

- US NFIB Business Optimism for October on Monday

- US ADP Employment Change Weekly on Tuesday

- At least 10 Fed Speeches

- ~10% of S&P 500 firms report earnings results

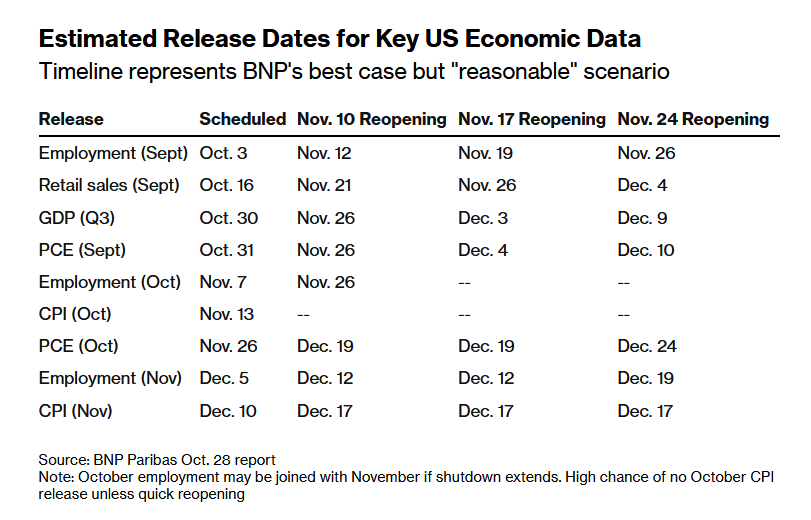

There is still a limited amount of data coming in as the US government shutdown continues. Even if the government reopens, the BLS likely cannot process October and November CPI data before the December Fed meeting.

Estimated release dates for key US economic data are nicely compiled in the following table.

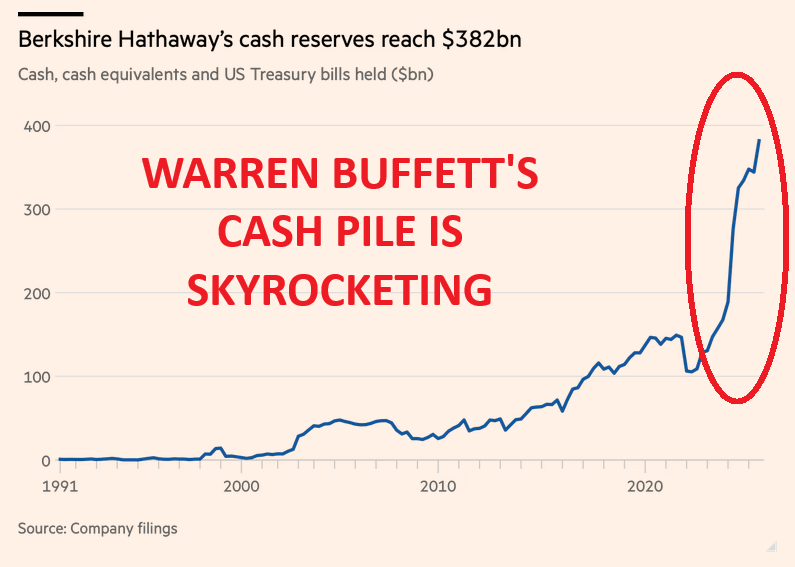

2) Institutional investors dumped a huge amount of stocks.