- Global Markets Investor

- Posts

- US stocks finished higher for the 3rd consecutive week. Weekly market recap, trading week 44/2025

US stocks finished higher for the 3rd consecutive week. Weekly market recap, trading week 44/2025

Summary of the trading week using the most popular posts from the X platform

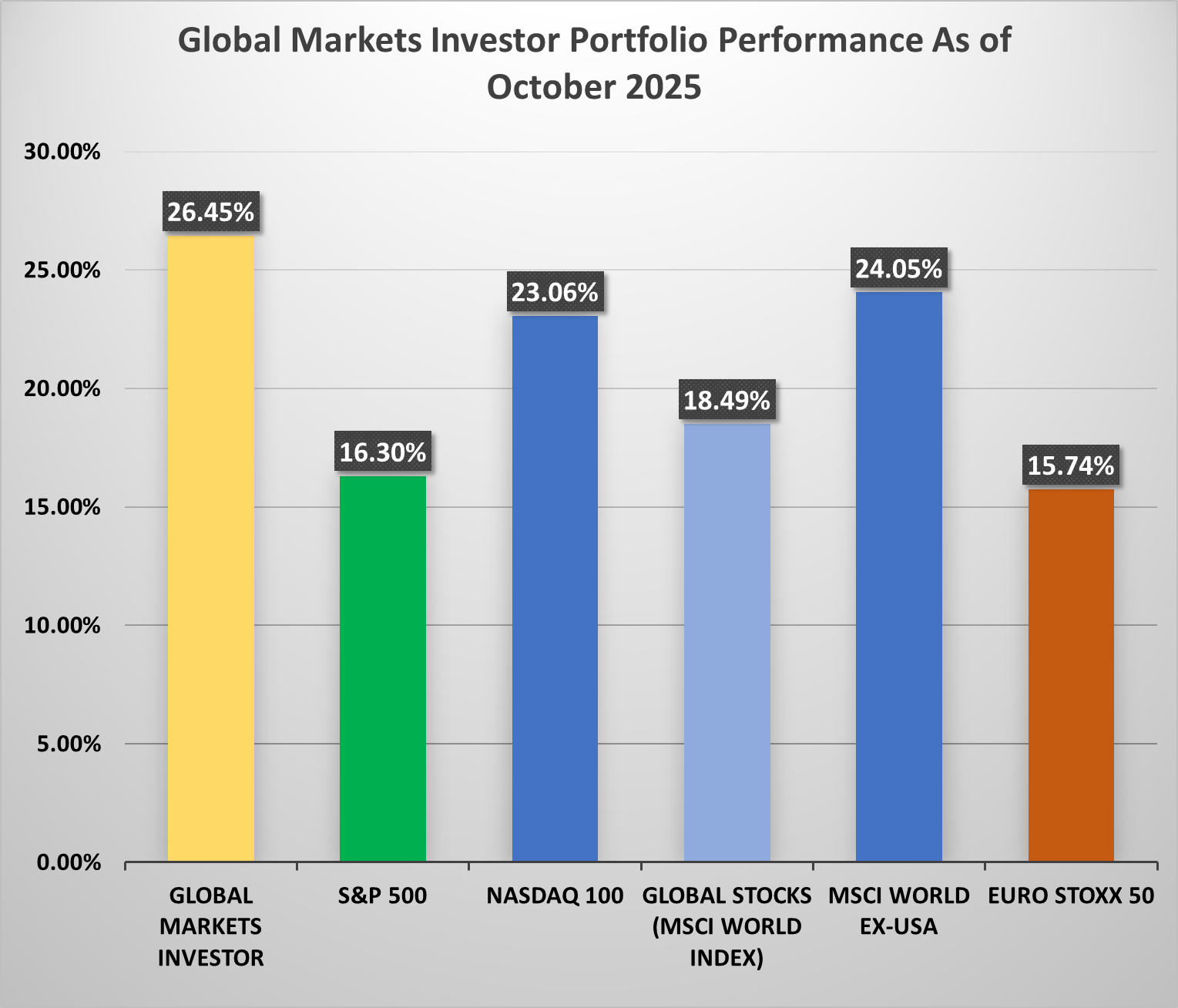

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 56% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

US stocks finished higher following the Fed (hawkish) rate cut and Magnificent 7 mixed earnings results. Nevertheless, the Mag7 drove the majority of stock gains, while the S&P 493 ended the month basically unchanged, resulting in dismal market breadth.

Notably, US credit spreads widened in October, driven by risk-off sentiment in AI-linked bonds, most notably Oracle, $ORCL ( ▼ 5.36% ) .

Meanwhile, the US Dollar posted its second monthly gain of the year while gold and silver continued their decline.

Lastly, the US and China reached a temporary truce on trade tensions, though the risk of escalation remains high.

More specifically, the US agreed to lower tariffs on China by 10%, cutting overall tariffs from around 57% to 47%, primarily by halving fentanyl-related tariffs from 20% to 10%. China committed to resume soybean purchases, suspend rare earths export curbs for 1 year, and work to stop the flow of fentanyl precursor chemicals.

However, China's earlier rare earths restrictions remain in place; only the latest licensing curbs were delayed.

Both leaders agreed to two follow-up visits in 2026, with Trump visiting Beijing in April and Xi visiting the US afterward.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 +0.7%

- Nasdaq +2.2%

- Dow Jones +0.8%

- Russell 2000 (small caps) -1.4%

- US 10-year Treasury yield +8 bps

- VIX +7%, front month VIX futures -1%

- US Dollar index +0.8%

- Silver -0.6%

- Gold -2.8%

- WTI Crude Oil -1.0%

- Bitcoin -1.8%

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

For the trading week ending November 7, key events are:

- US ISM Manufacturing PMI for October on Monday

- US ISM Services PMI for October on Wednesday

- US ADP Employment for October on Wednesday

- US Challenger Job Cuts for October on Thursday

- US Consumer Sentiment for November on Friday

- At least 10 Fed Speeches

- ~10% of S&P 500 firms report earnings results

There is a limited amount of data next week as the US government shutdown continues.

⚠️US stocks finished higher following the Fed (hawkish) rate cut and Magnificent 7 mixed earnings results.

Gold and silver continued their decline.

Performance this week:

S&P 500 +0.7%

Nasdaq +2.2%

Russell 2000 -1.4%

Dow Jones +0.8%

US 10-year Treasury yield +8 bps

Bitcoin— Global Markets Investor (@GlobalMktObserv)

8:44 PM • Oct 31, 2025

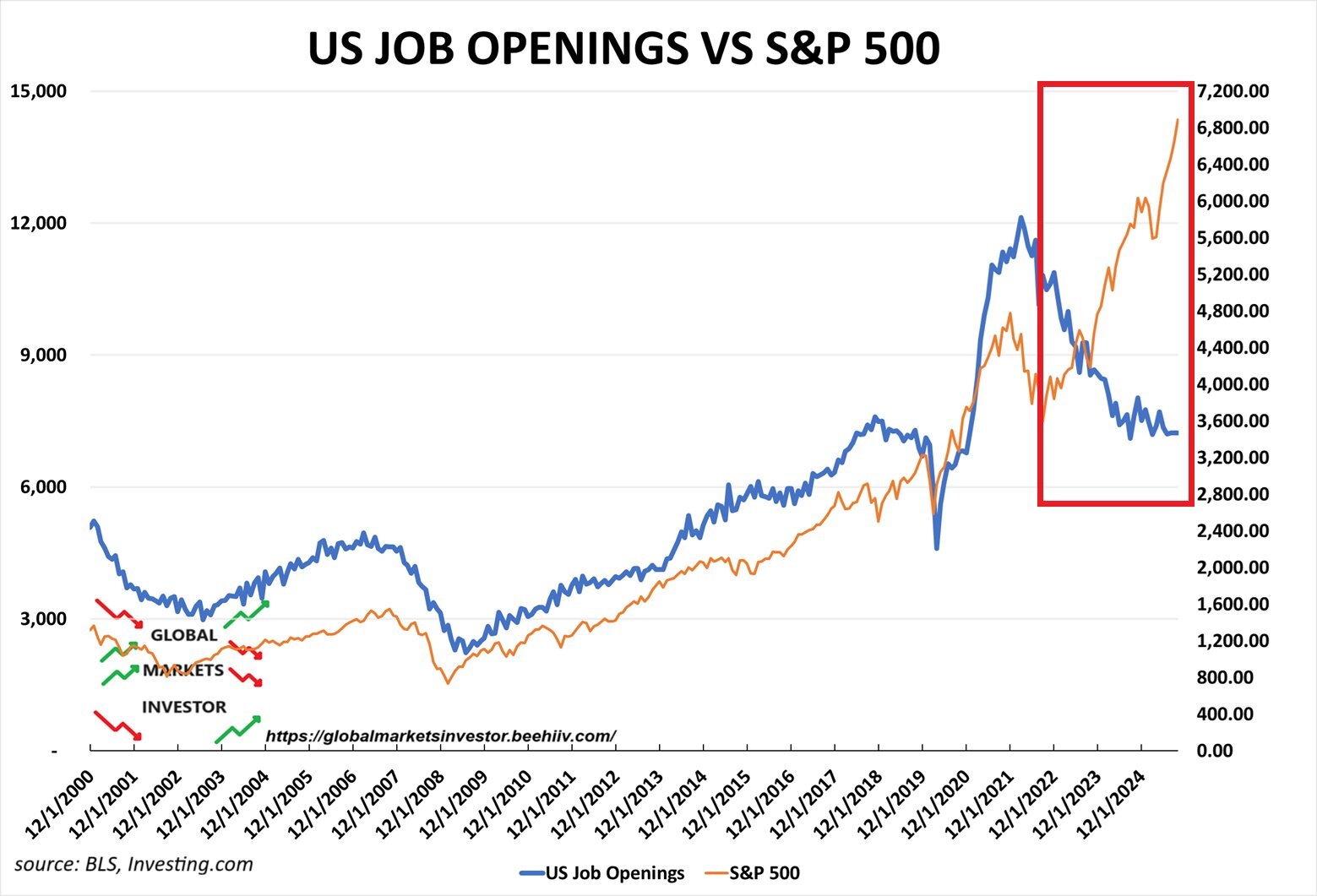

2) Hedge funds are taking more risk than ever, while other professional investors are hedging their positions.