- Global Markets Investor

- Posts

- The Fed is facing growing internal divide

The Fed is facing growing internal divide

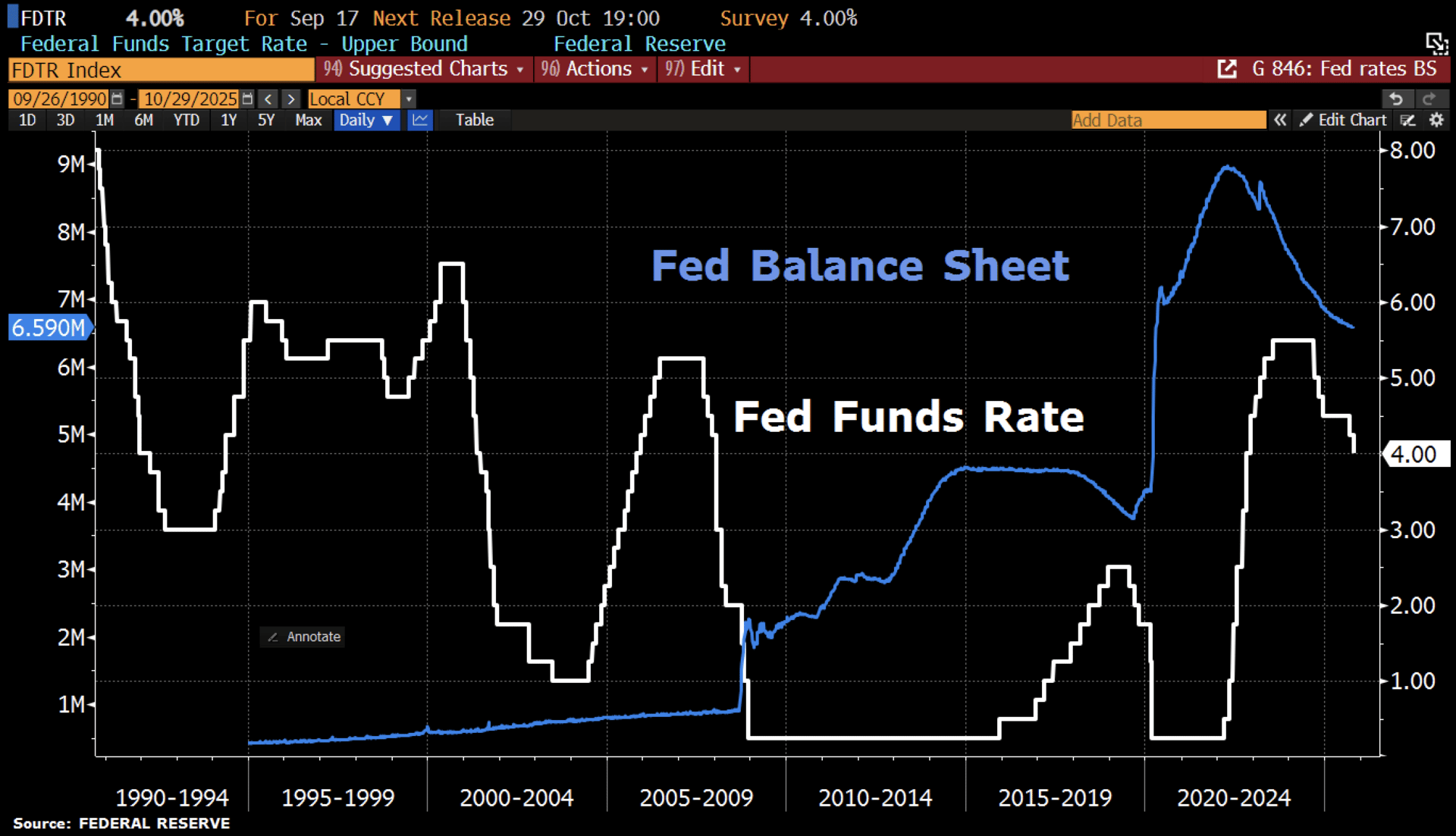

The central bank cut rates by 25 basis points and will end QT on December 1 as expected.

🔥🔥GLOBAL MARKETS INVESTOR PORTFOLIO — UP 60% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

The Federal Reserve cut its target range for the federal funds rate by 25 basis points to 3.75%-4.00% on Wednesday, October 29, marking the 2nd reduction of 2025 after a similar cut in September. This also follows 100 basis points of cuts in 2024.

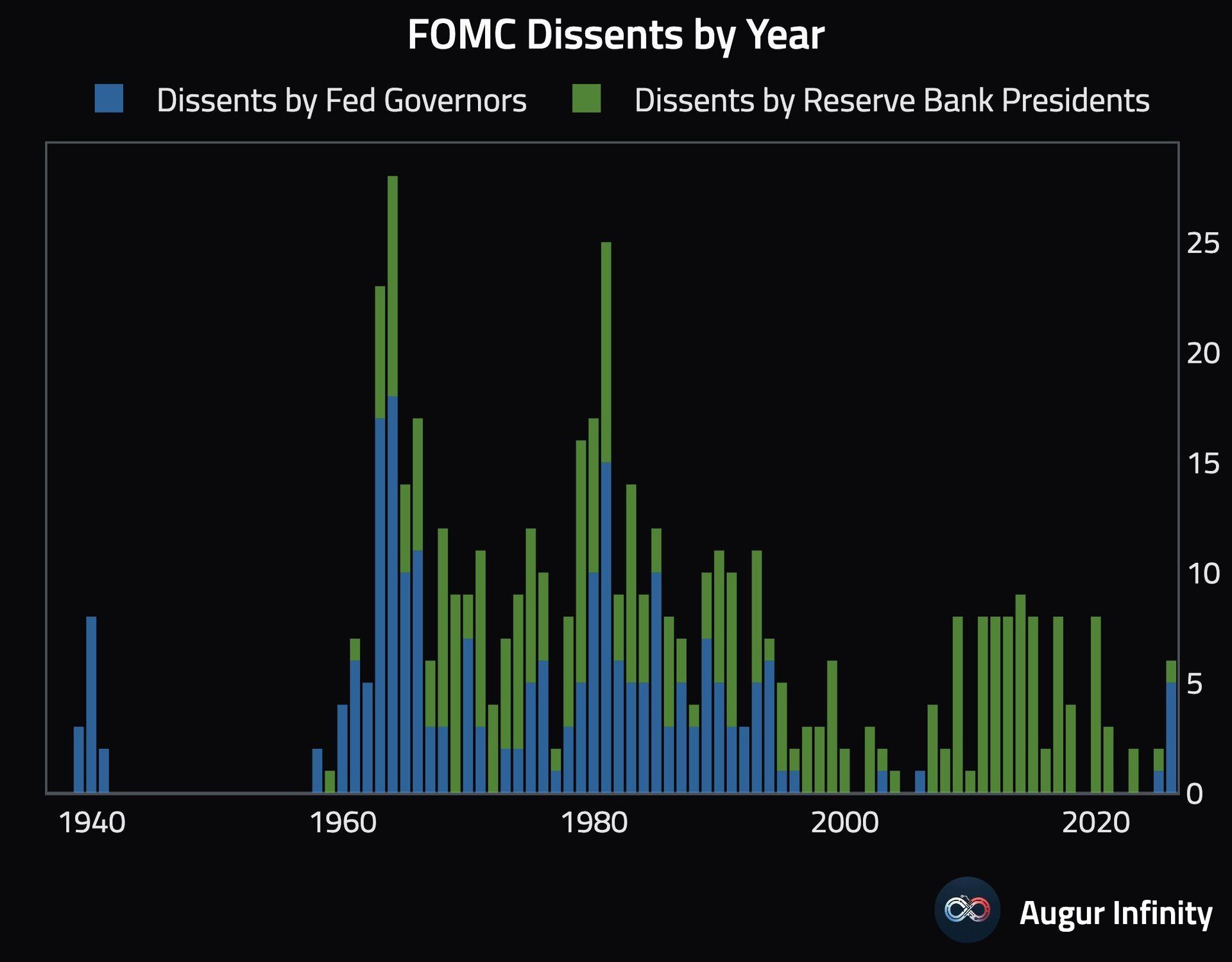

There were two dissents at this meeting, as Governor Stephen Miran supported a 50 bps cut while President Schmid favored holding rates steady. This brings the total number of dissents this year to 6 and marks the 3rd consecutive FOMC meeting with dissenting views among policymakers, the longest streak since 2019.

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

Behind the paywall, you will find a full recap of the meeting, including statement changes and Chair Powell’s remarks and the implications for markets and the economy.

Links to the previous meetings' summaries can be found below.

FED’S STATEMENT, SUMMARY