- Global Markets Investor

- Posts

- ⚠️CHART OF THE WEEK: The S&P 500 has reached historically extreme levels

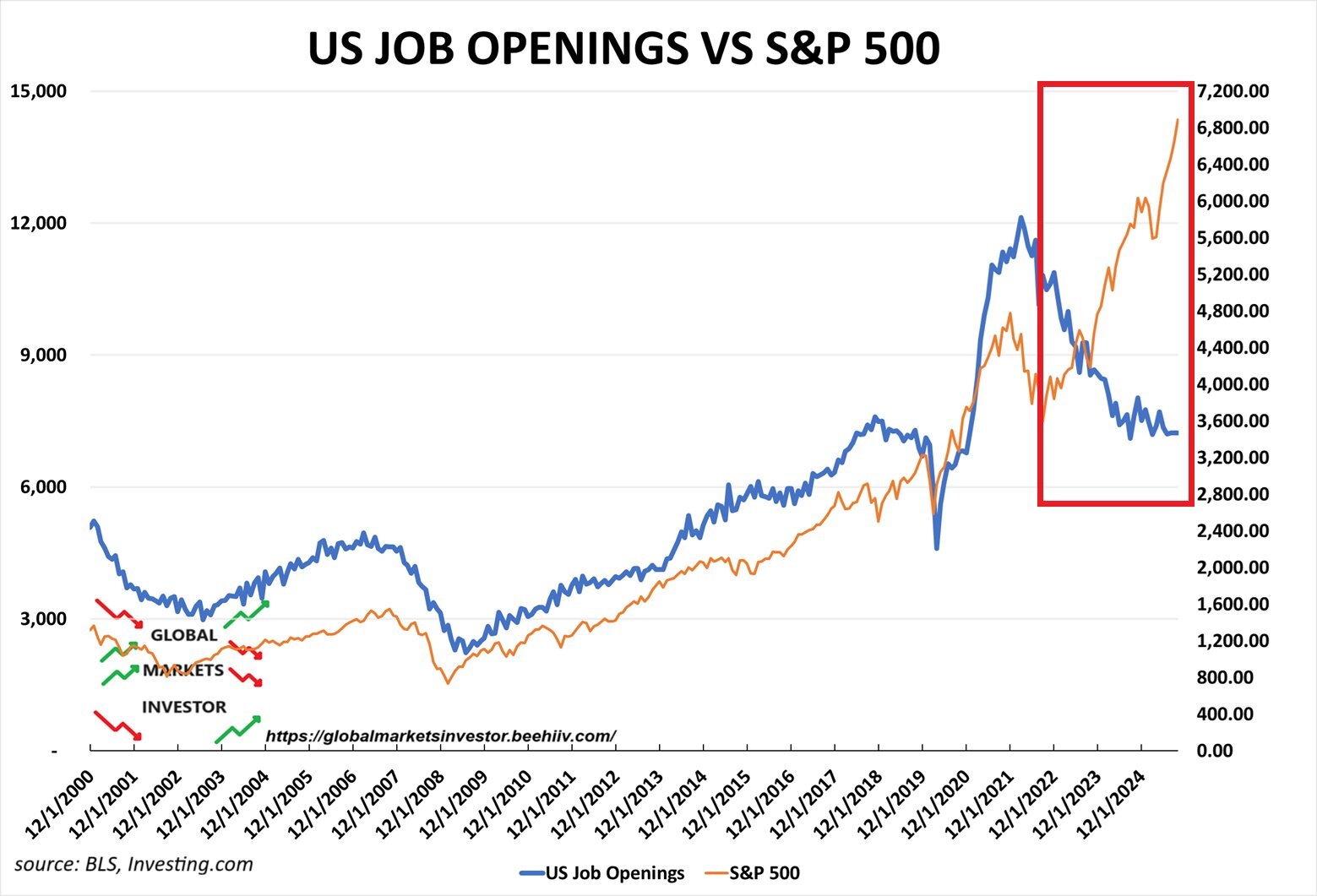

⚠️CHART OF THE WEEK: The S&P 500 has reached historically extreme levels

Over the last 25 years, the market has seen only a few occurrences of such extremes

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 53% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

On Wednesday, the S&P 500 traded 13% above its 200-day moving average, the highest since July 2024, just before the market sold off. On Friday, the index finished at 6,840, or 12% above its 200-day moving average of 6,111 points.

This century, the market has reached such extreme levels only a few times.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

In other words, the technical analysis suggests there is not much further upside, at least in the short term.

This can resolve in only two ways over the next few weeks: either the market will go sideways or we will see a pullback or correction.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: