- Global Markets Investor

- Posts

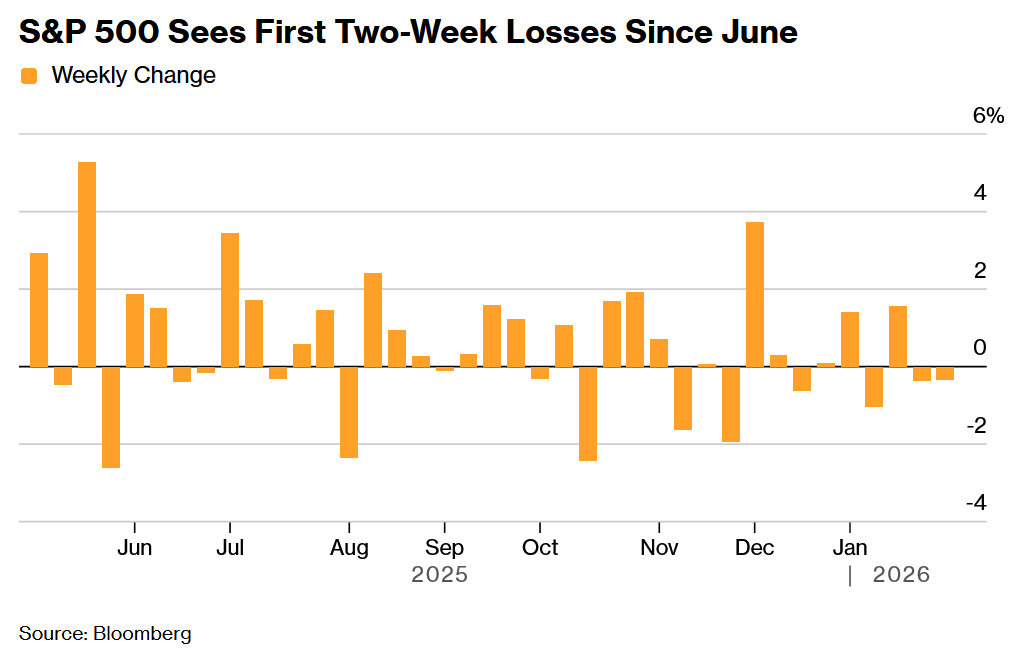

- US stocks fell for the 2nd consecutive week. Weekly market recap, trading week 04/2026

US stocks fell for the 2nd consecutive week. Weekly market recap, trading week 04/2026

Summary of the trading week using the most popular posts from the X platform

🔥GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

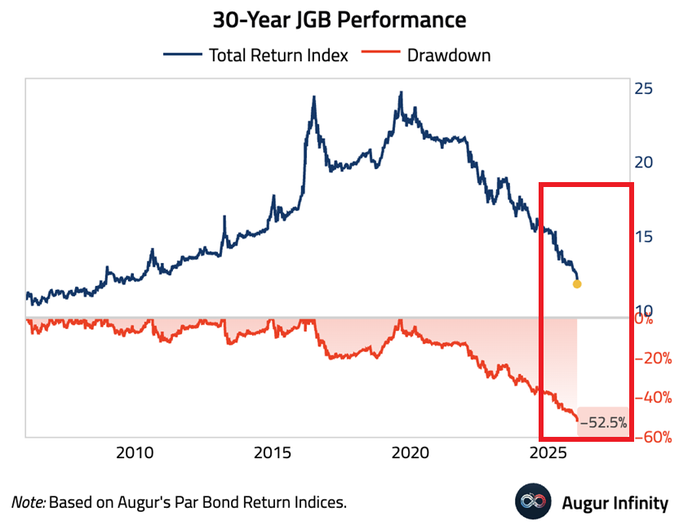

US stocks finished lower for the 2nd consecutive week after a few volatile sessions driven by Japanese bond market chaos, tariff threats, Greenland tensions, New Fed Chair dilemma and others.

Somehow, gold and silver are still rapidly surging with silver hitting an unbelievable $103/OZ.

At the same time, the US Dollar posted the worst week in 9 months.

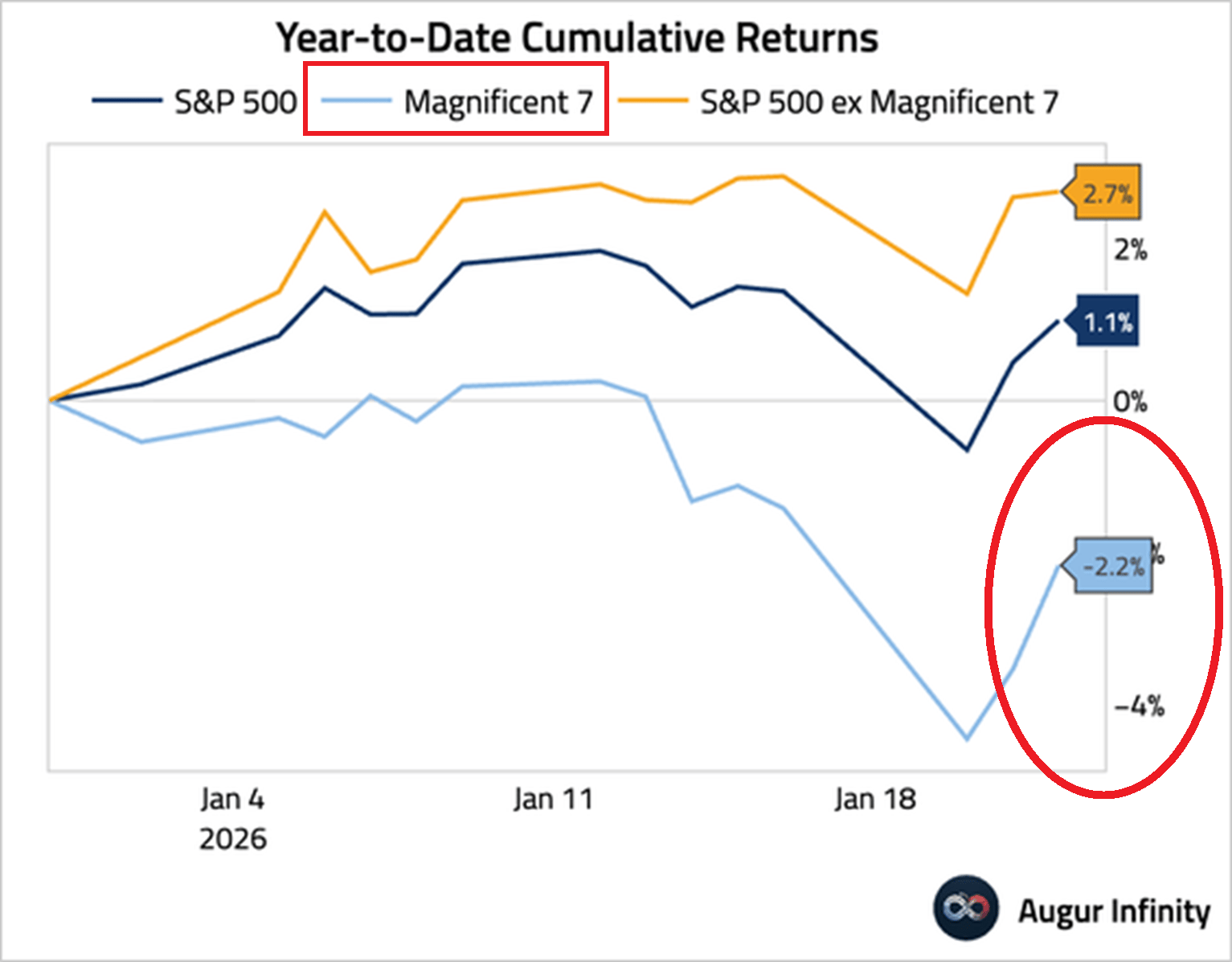

Meanwhile, Magnificent 7 stocks have declined -2.2% year-to-date, underperforming the broader market.

Apple, $AAPL ( ▼ 3.21% ) , alone has dropped -8.8% while Microsoft stock, $MSFT ( ▼ 2.24% ) , has fallen -3.7%.

NVIDIA, $NVDA ( ▼ 4.17% ) , has advanced a mere +0.6%.

Magnificent 7 not so Magnificent anymore? This earnings season is setting up extremely interesting.

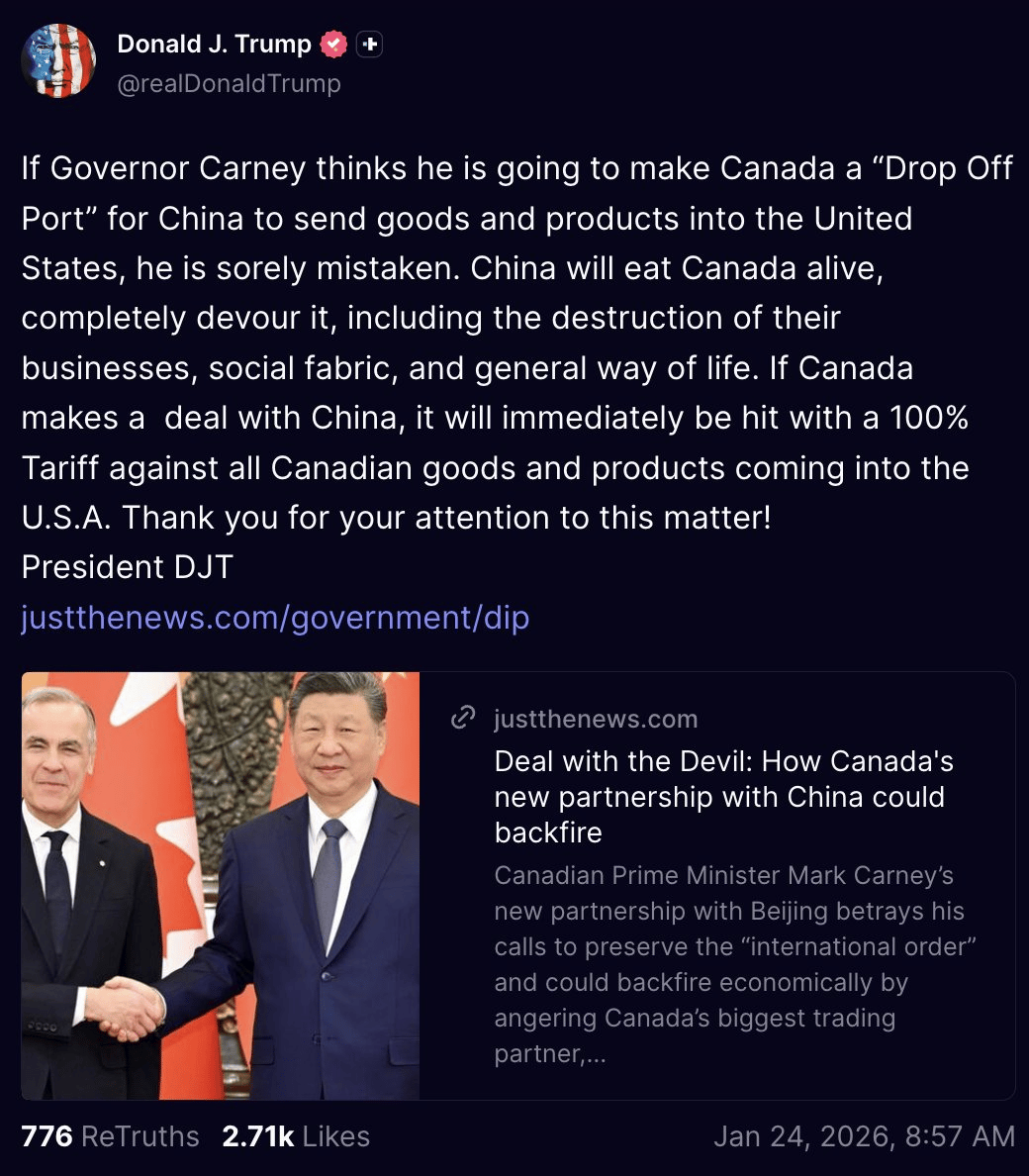

In terms of news flow, President Trump said he will immediately impose a 100% tariff on all Canadian goods and products if Canada strikes a trade deal with China.

If this happens, it would push both countries into a recession, so expect negotiations ahead. Nevertheless, the market should react negatively to this news.

Lastly, there is now a 78% chance of a US government shutdown next week.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 -0.4%

- Nasdaq -0.1%

- Russell 2000 (small caps) -0.4%

- Dow Jones -0.5%

- US 10-year Treasury yield unchanged

- Bank Index -2.1%

- VIX -1%, front month VIX futures -0.2%

- US Dollar index -1.9%

- Gold +8.4%

- Silver +16.1%

- WTI Crude Oil +2.8%

- Bitcoin -6.0%

Go from AI overwhelmed to AI savvy professional

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

For the trading week ending January 30, key events are:

- Fed Interest Rate Decisions including Fed Chair Powell Conference on Wednesday

- US Inflation PPI for December on Friday

- ~33% of S&P 500 companies report earnings including Microsoft, Meta, Tesla and Apple

Massive week ahead. Investors will be watching the Fed, tariff headlines, the Japanese bond market and Magnificent 7 stocks earnings.

2) Retail investors are on a record buying streak of US equities as professional investors dump them.

3) Global equities 'sell signal' was triggered for the 7th month straight. Gold is the most crowded trade.

4) Funding spreads signal more pain ahead for the S&P 500.

5) Some additional posts that include interesting economic and financial markets data.