- Global Markets Investor

- Posts

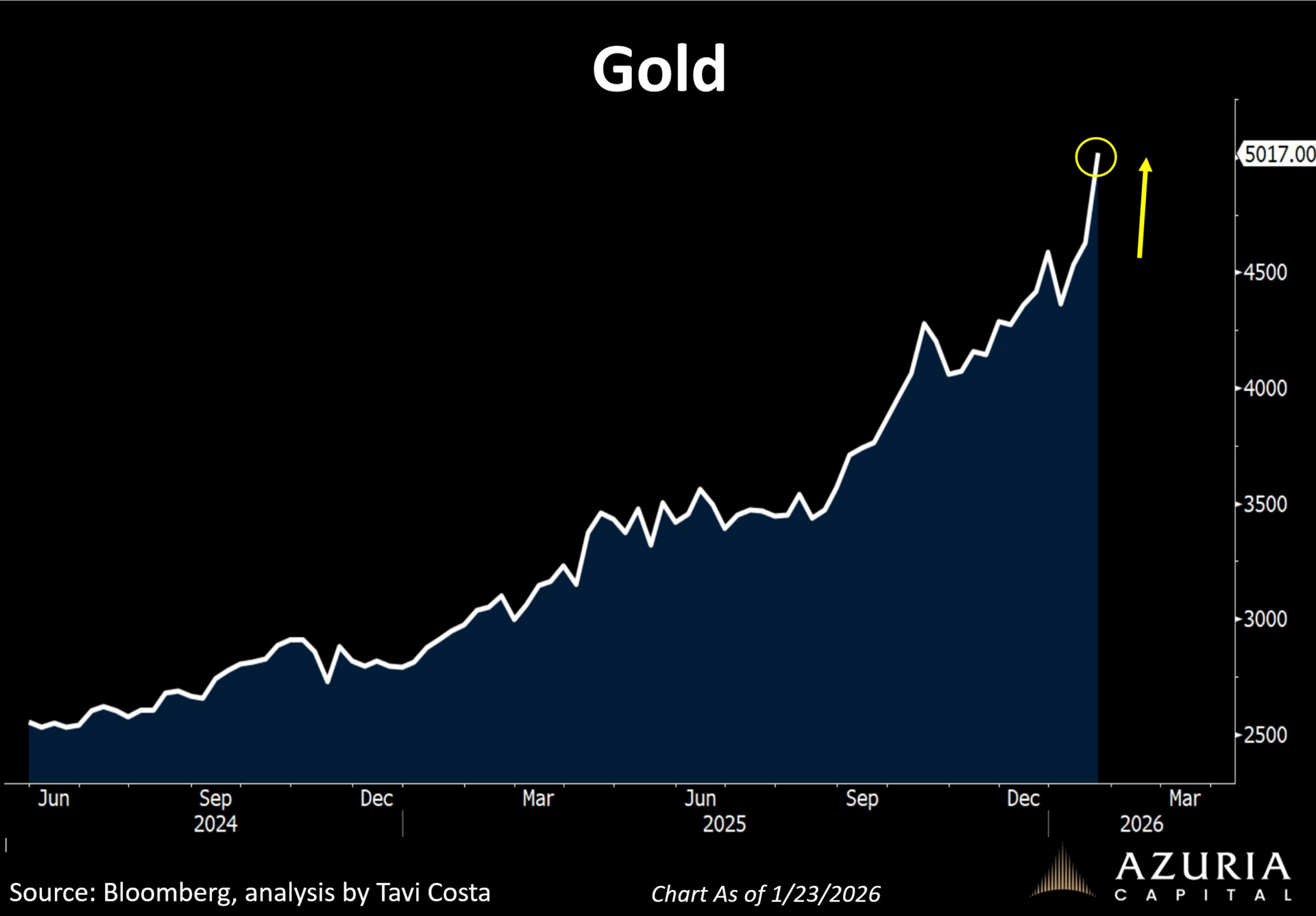

- ⚠️CHART OF THE WEEK: Silver and gold prices hit $100 and $5,000 per ounce for the first time

⚠️CHART OF THE WEEK: Silver and gold prices hit $100 and $5,000 per ounce for the first time

Precious metals are rewriting investing history

🔥GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Silver hit a record $103 per ounce, surpassing $100 for the first time ever.

Prices have skyrocketed +350% over the last 2 years.

Global HR shouldn't require five tools per country

Your company going global shouldn’t mean endless headaches. Deel’s free guide shows you how to unify payroll, onboarding, and compliance across every country you operate in. No more juggling separate systems for the US, Europe, and APAC. No more Slack messages filling gaps. Just one consolidated approach that scales.

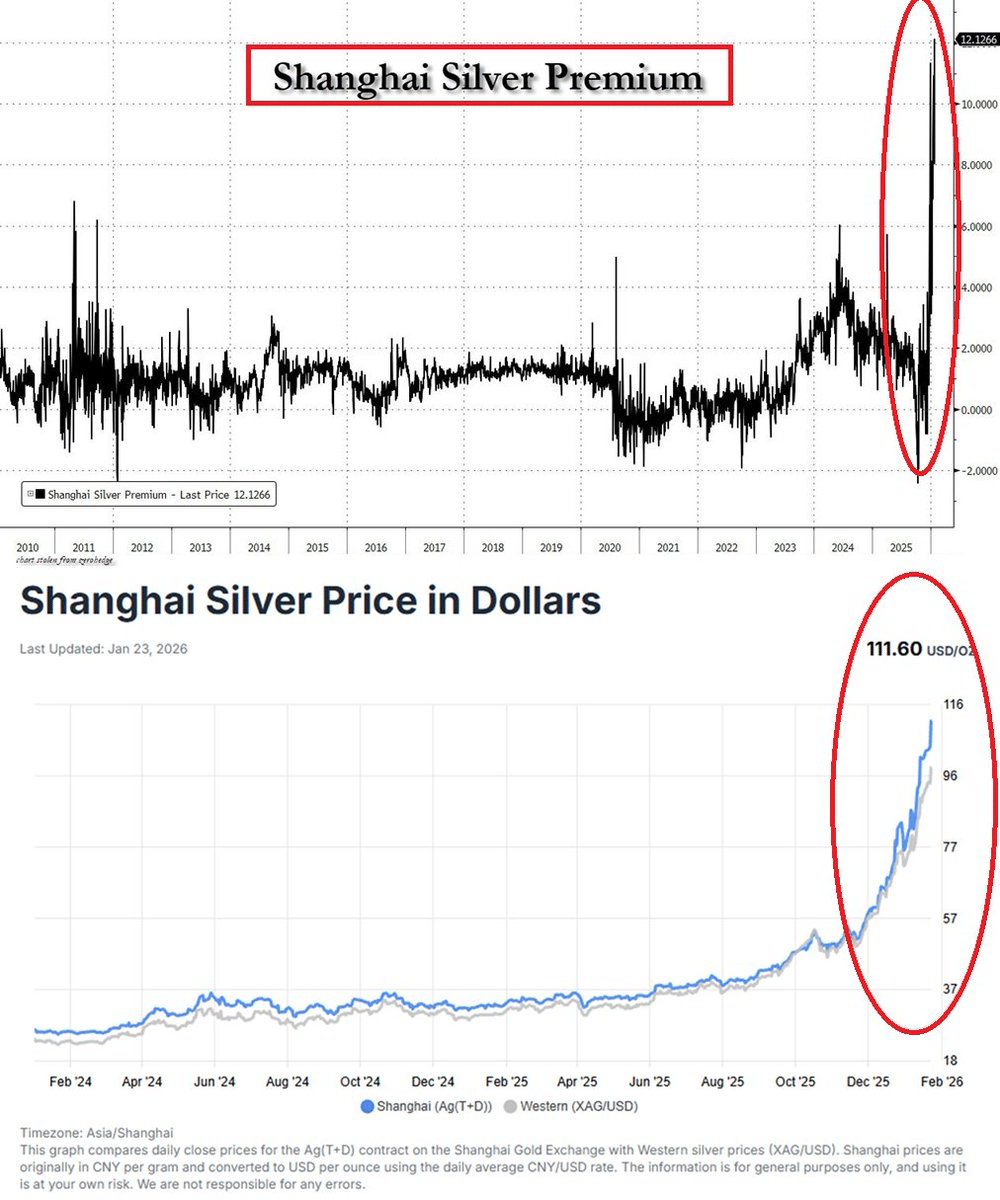

Furthermore, Shanghai silver prices hit a record $112 per ounce, doubling since November.

This means the Shanghai premium is now at a record $10 per ounce.

The premium simply spiked by ~50% overnight.

This signals extreme tightness in China’s silver market, driven by unprecedented demand for physical silver.

Goldman Sachs points out that Chinese and Indian physical demand, partly from retail, has driven the recent leg of the rally. This comes as investors pile into silver as an affordable alternative to gold.

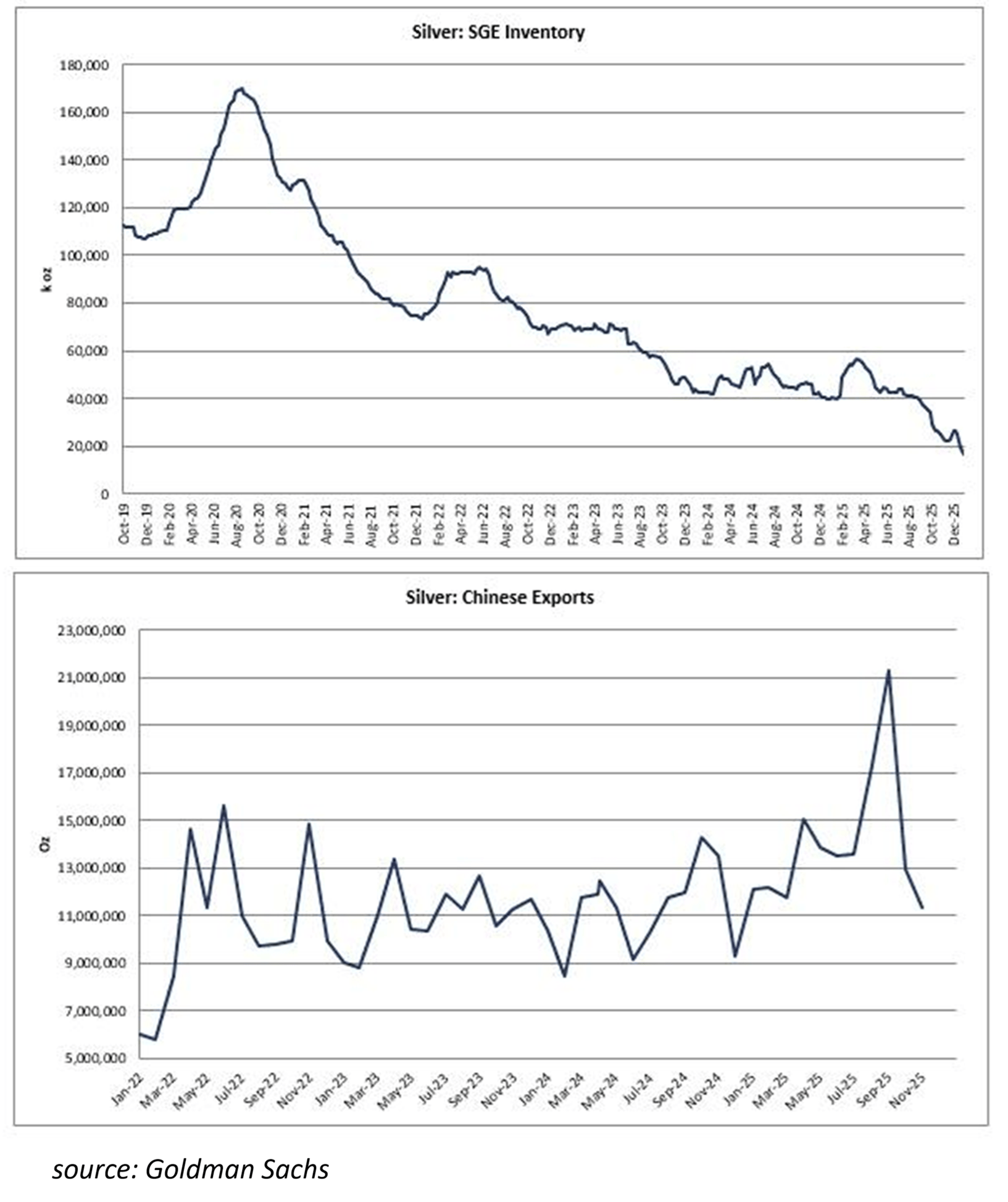

As a result, Shanghai Gold Exchange inventory is down to record lows after 21 million ounces were exported in October, an all-time high.

Interestingly, while physical markets remain extremely tight, futures positioning remains light.

This market has never seen disruptions at this scale.

Will this break industries that rely on silver, such as solar panel manufacturers?

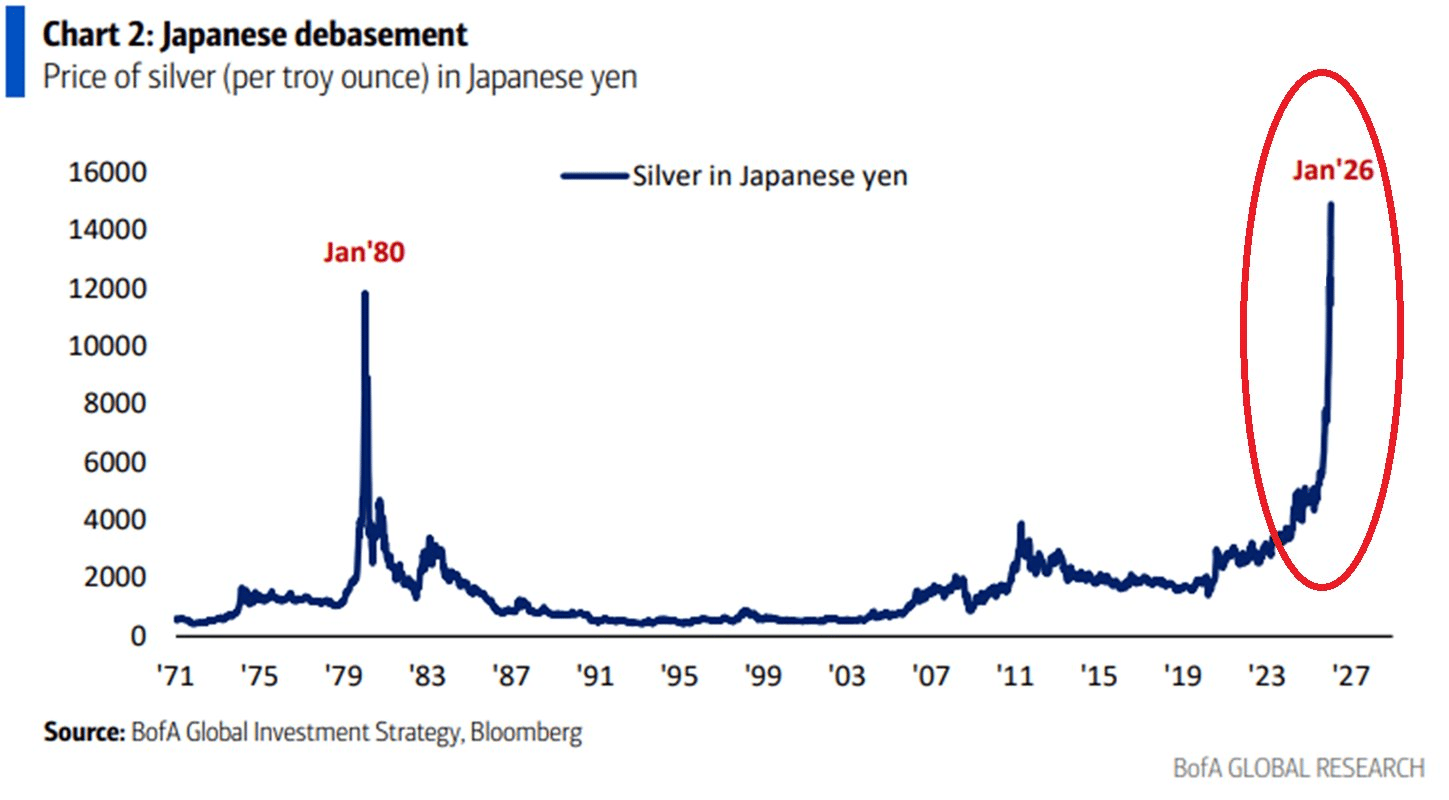

Meanwhile, silver prices in Japanese yen have exceeded ¥16,000 for the first time.

The value of the yen versus silver has halved in less than 2 months.

Since the start of 2024, silver prices in yen have surged an unbelievable +380%.

This is a pure example of currency debasement, a currency collapse.

Put simply, Japanese consumers are losing purchasing power at a historic pace.

If you do not own assets, your savings are losing value at a record rate.

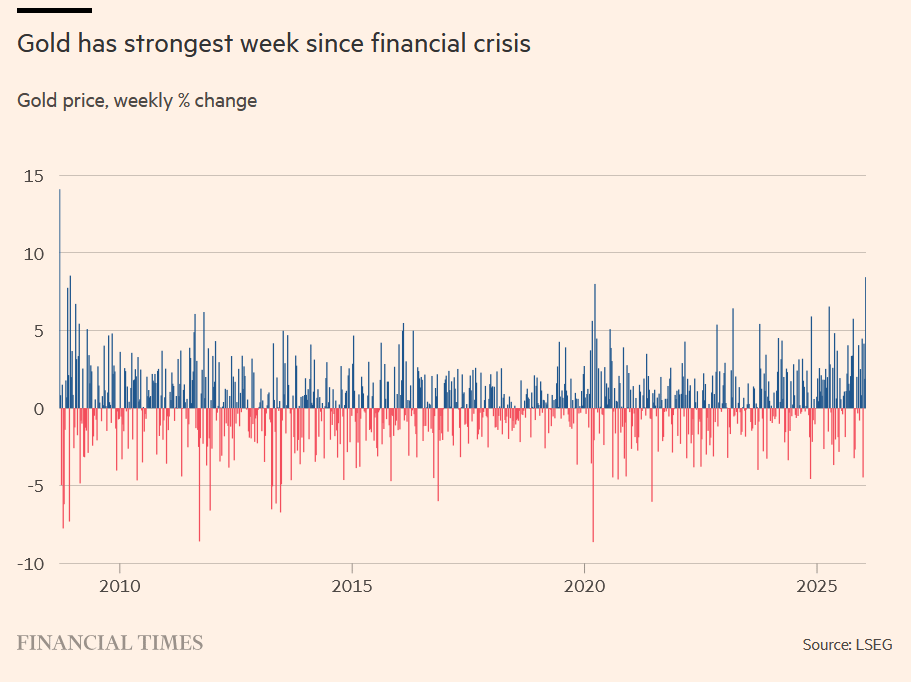

Switching gears to gold, the metal prices rose over 8% this week, the best performance since the Great Financial Crisis, and surpassed $5,000 for the first time.

These are a few drivers of gold and silver prices over the last few weeks, in addition to many others mentioned in previous analyses:

Greenland mini-crisis triggered a flight to safety, as investors reacted to uncertain US policymaking.

Dollar weakness, with the currency suffering its worst week since May, making gold and silver cheaper for foreign buyers.

Heightened geopolitical and political uncertainty, including US tariff threats against European allies.

Concerns over US policy credibility and global stability, including attacks on the Fed.

Safe-haven demand surged, with investors seeking protection from market volatility.

Global diversification away from the US Dollar, as central banks continue buying gold at a record pace.

Broader “Sell America” sentiment, with US stocks, bonds, and the dollar falling together (the S&P 500 fell for 2 weeks straight).

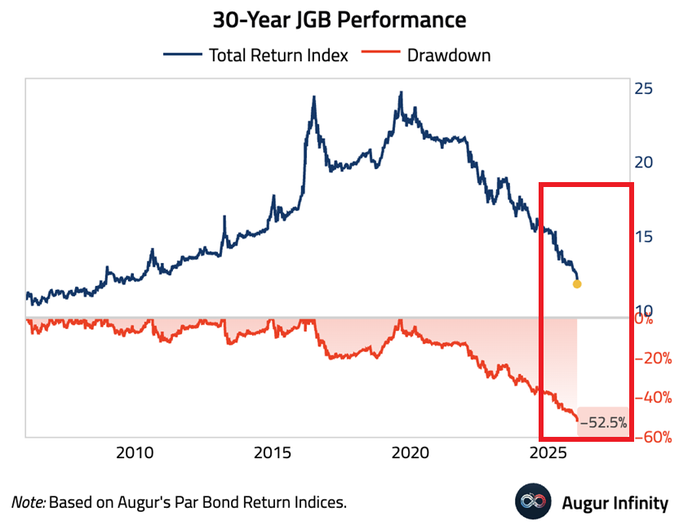

Japan’s bond market turmoil, as it has been described many times in previous articles.

Hedging activity amplified the Dollar sell-off, adding further upward pressure on gold and silver.

I also recommend reading some comments below this post. They add a lot of value.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: