- Global Markets Investor

- Posts

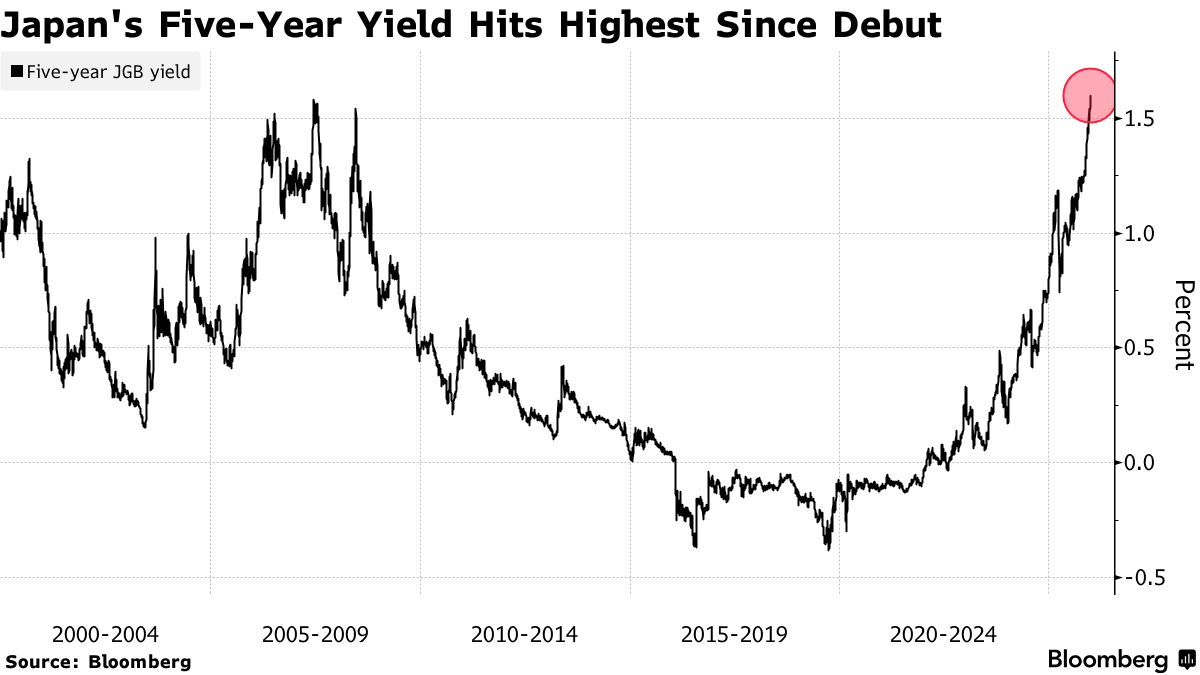

- ⚠️Japanese government bonds are crashing

⚠️Japanese government bonds are crashing

Something is going to really break soon

🔥GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Japan's 30-year government bond yield spiked 30 basis points in one session, to 3.90%, the highest in HISTORY.

40-year yield surged 28 basis points, to 4.22%, the highest EVER.

40-year yields have soared ~80 basis points since the new Prime Minister Sanae Takaichi took over in October, 20.

10-year yield jumped 12 basis points, to 2.37%, the highest since the 1990s.

Hiring in 8 countries shouldn't require 8 different processes

This guide from Deel breaks down how to build one global hiring system. You’ll learn about assessment frameworks that scale, how to do headcount planning across regions, and even intake processes that work everywhere. As HR pros know, hiring in one country is hard enough. So let this free global hiring guide give you the tools you need to avoid global hiring headaches.

This comes as investors worry that the tax-cut promises ahead of the February elections mean the government will bring in less money, take on more debt, and put even more strain on Japan’s already extremely weak finances.

Meanwhile, demand collapsed at a 20-year government bond auction, sending buyers to the sidelines.

Thin demand opened the floodgates, pushing yields into levels Japan has never seen.

History shows that rapid yield spikes often trigger market crises:

1) April 2024 - US administration eased tariff policy as rising Treasury yields threatened financial stability.

2) In early 2023, several US regional banks failed in March after US Treasury yields spiked and their bond portfolios collapsed in value. As a response, the Fed stepped in to the rescue.

3) In September 2022, UK yields surged after the Liz Truss budget announcement, forcing a policy reversal. As a result, the BoE launched an emergency bond-buying program to stop a financial meltdown.

4) In 2010–2012, European sovereign yields for Greece, Italy, Spain, Portugal, and Ireland surged to unsustainable levels. Subsequently, the ECB massively intervened to prevent defaults and preserve the euro.

Japan has clearly lost the control of its bond market.

Gold and silver are skyrocketing as a response.

What breaks this time?

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: