- Global Markets Investor

- Posts

- US stocks dropped amid intensyfiying US-China trade tensions. Weekly market recap, trading week 41/2025

US stocks dropped amid intensyfiying US-China trade tensions. Weekly market recap, trading week 41/2025

Summary of the trading week using the most popular posts from the X platform

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 53% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

US stocks fell this week after President Trump threatened a “massive increase” in tariffs on China and said there was “no reason” to meet with Chinese President Xi Jinping.

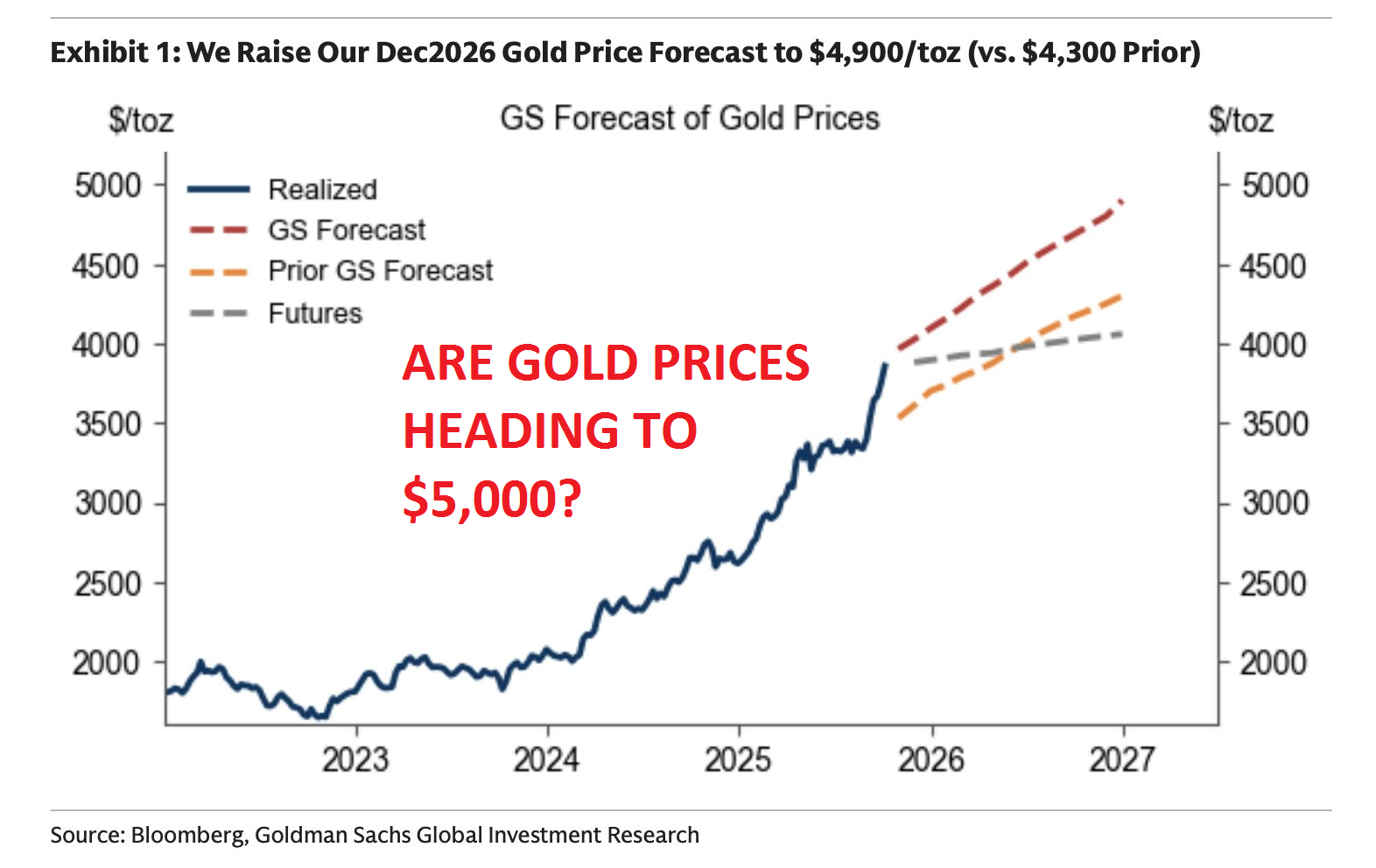

On Friday, the S&P 500 fell -2.7%, the biggest decline since April 10. Investors rushed into US Treasuries and gold, instead while the US Dollar recorded the best week in 2025.

This came after China unveiled sweeping new restrictions on rare earth and critical material exports, requiring foreign exporters using Chinese-sourced rare earths to obtain an export license, citing national security concerns.

China also sent a letter to President Trump, effective November 1, 2025, imposing large-scale export controls on virtually all Chinese-made products.

More about China’s restrictions in the following posts.

🇨🇳 China just weaponized rare earths - again, but this time globally.

Beijing’s new MOFCOM Notice No. 61 (2025) goes far beyond past export bans. It now forces foreign companies to seek Chinese approval before re-exporting any product that contains even 0.1% China-origin rare

— Velina Tchakarova (@vtchakarova)

11:13 PM • Oct 9, 2025

BREAKING:

🇨🇳 China has announced further export control measures of rare earth minerals.

China imposes export control on graphite and lithium batteries.

Beijing also just added more rare earth elements to its export control list, including holmium, erbium, and a few others

— Megatron (@Megatron_ron)

3:43 PM • Oct 9, 2025

This really isn't getting enough attention. China has truly gone all in on export controls today, in a major way.

Not only did they announce the unprecedented rare earths restrictions that I posted about earlier 👇 (targeted, among others, at the advanced semiconductors sector)

— Arnaud Bertrand (@RnaudBertrand)

1:14 PM • Oct 9, 2025

Subsequently, S&P 500 futures extended drop to -3.3% after President Trump unveiled a 100% tariff on Chinese imports effective November 1 and imposed export controls on critical software. Trump’s new tariffs would lift total import taxes on many Chinese goods to 130% starting next month, just below the 145% peak reached earlier this year before both sides eased duties in a temporary truce.

Trump said he could roll back the tariff hike if China withdraws its rare earth restrictions and added that he has not canceled his meeting with President Xi, saying he “might still” hold it. This suggests there will be some negotiations between both parties until the end of the month.

The chart below presents full Friday’s price action of the Nasdaq 100 ETF, $QQQ ( ▲ 0.13% ) .

As a reminder, China dominates the global rare earths supply chain:

Meanwhile, China’s Commerce Ministry said on Sunday its countermeasures are “necessary defensive actions” and urged the US to return to dialogue.

It clarified that rare earth export controls are not a full export ban and that eligible applications will continue to receive licenses.

Beijing said the impact on global supply chains will be “minimal” and reaffirmed it is “not afraid” of a trade war.

Is this de-escalation?

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 -2.4%

- Nasdaq -2.5%

- Dow Jones -2.7%

- Russell 2000 (small caps) -3.3%

- US 10-year Treasury yield -9 bps

- VIX +32%, front month VIX futures +19%

- US Dollar index +1.3%

- Silver -1.9%

- Gold +3.2%

- WTI Crude Oil -4.2%

- Bitcoin -9.3%

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

For the trading week ending October 17, key events are:

- Fed Chair Powell Speech on Tuesday

- US Retail Sales for September on Thursday

- US PPI Inflation for September on Thursday

- US Industrial Production for September on Friday

- At least 10 Fed Speeches

Notably, the US Labor Department will release the September CPI report on October 24, even if the government shutdown continues. It will come just 5 days before the October Fed meeting.

⚠️US stocks dropped this week following President Trump threats of a “massive increase” in China tariffs, and said there was “no reason” to meet with Chinese President Xi Jingping.

On Friday, the S&P 500 fell -2.7%, the biggest decline since April 10. Investors rushed into US

— Global Markets Investor (@GlobalMktObserv)

5:17 PM • Oct 11, 2025

2) Institutional investors are still dumping US equities.