- Global Markets Investor

- Posts

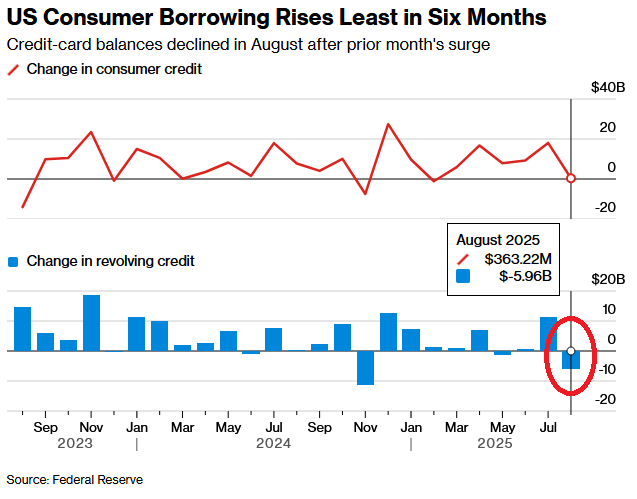

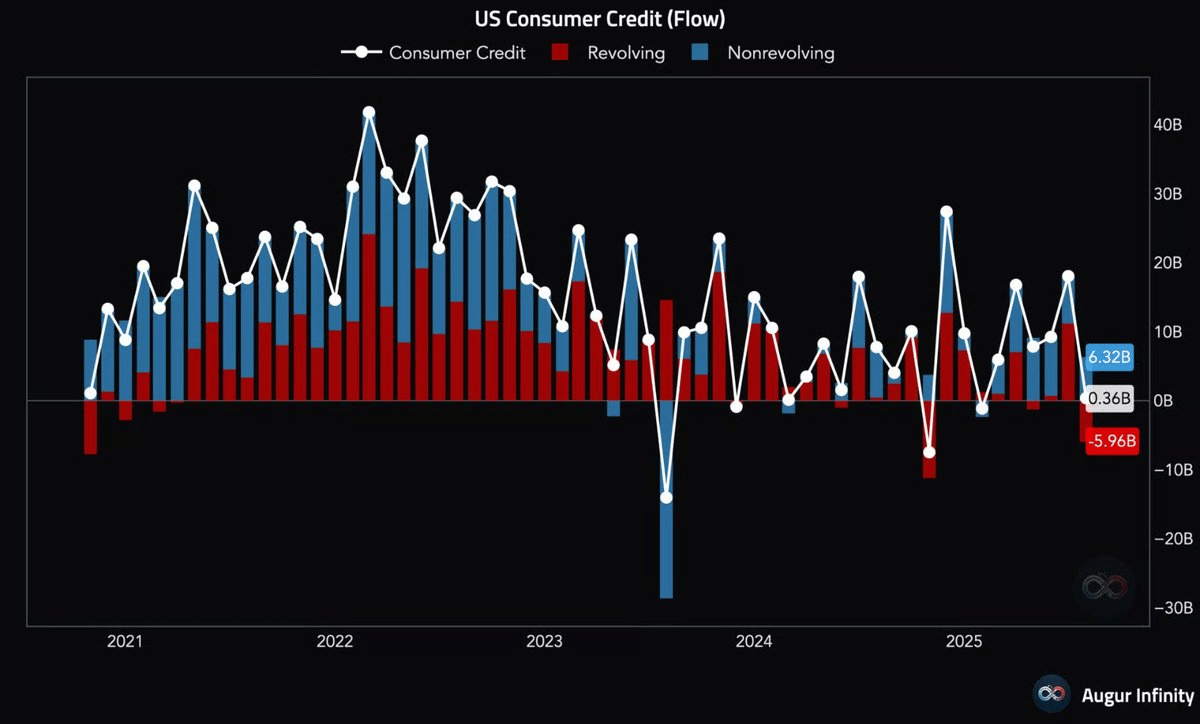

- ⚠️US consumer demand for credit card debt is falling

⚠️US consumer demand for credit card debt is falling

Are Americans tapped out?

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 53% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

US consumer revolving credit, which covers credit cards, dropped by -$6 billion in August — one of the largest monthly drops since the 2020 Crisis.

We don’t do “business as usual”

The world moves fast, but understanding it shouldn’t be hard.

That’s why we created Morning Brew: a free, five-minute daily newsletter that makes business and finance news approachable—and even enjoyable. Whether it’s Wall Street, Silicon Valley, or what’s trending at the water cooler, the Brew serves up the context you need in plain English, with a side of humor to keep things interesting.

There’s a reason over 4 million professionals read the newsletter daily—and you can try it for free by clicking below!

Non-revolving credit, covering auto and student loans, jumped by +$6.3 billion.

As a result, the total consumer credit increased only +$363 million, the slowest pace in 6 months and significantly below expectations of a +$14 billion jump.

This comes as Americans face record-high interest rates and deteriorating job market. According to Fed data, the average interest rate on credit cards rose to 22.8% — the highest in 2025 and near a record high.

More data regarding the issue in the following articles.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: