- Global Markets Investor

- Posts

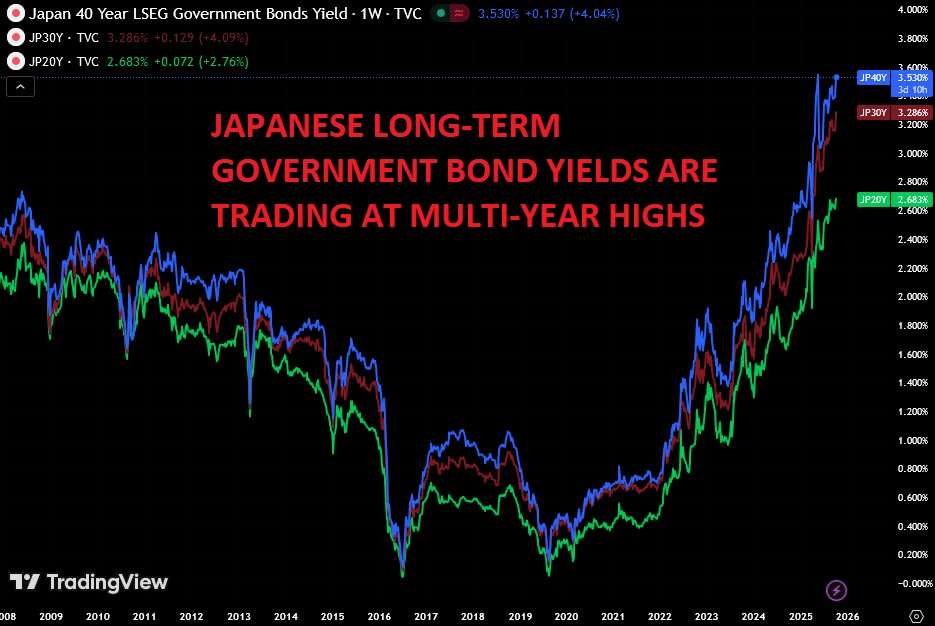

- 🔴Japanese long-term government bond yields are trading at multi-year highs

🔴Japanese long-term government bond yields are trading at multi-year highs

Japanese government bonds are selling-off again

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 53% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Japan's 20-year government bond yield hit its highest since 1999.

The 30-year JGB yield reached its highest since debuting in 1999.

The 40-year JGB yield is near its highest since debuting in 2007.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

Bond yields in Japan have risen because investors are worried about fiscal deterioration and rising government debt following Sanae Takaichi’s surprise election victory.

Takaichi is seen as pro-stimulus and pro-spending, raising fears of larger budget deficits and potential credit downgrades.

These concerns have led investors to demand higher yields to compensate for increased fiscal risk, especially on longer-term bonds like the 30-year and 40-year JGB.

Recent weak bond auctions and uncertainty about the Bank of Japan’s next policy move have also added pressure, pushing yields toward record highs.

More on the rise in global bond yields over the past few years in the article below.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: