- Global Markets Investor

- Posts

- 🚨The world's 3rd-largest bond market is breaking

🚨The world's 3rd-largest bond market is breaking

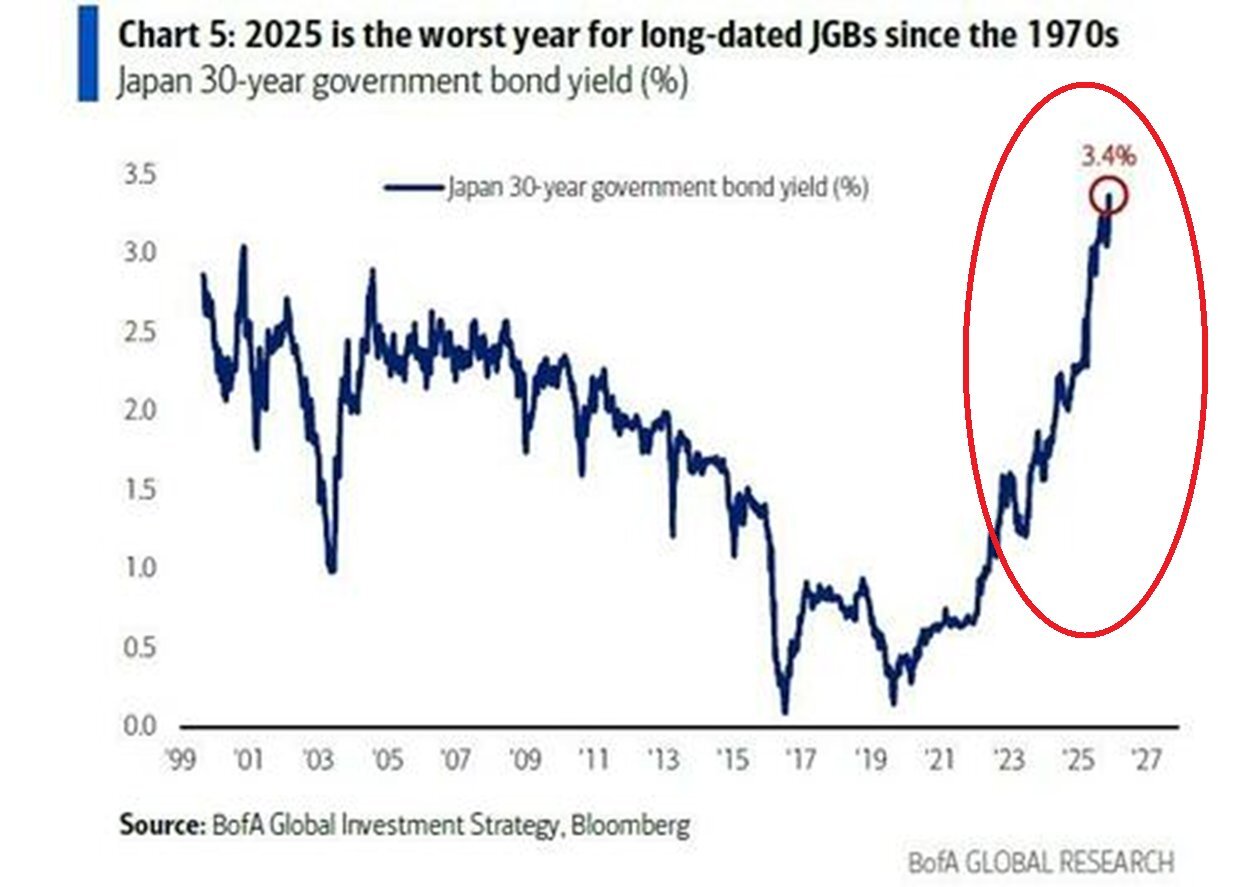

Japanese government bond yields keep on rising

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

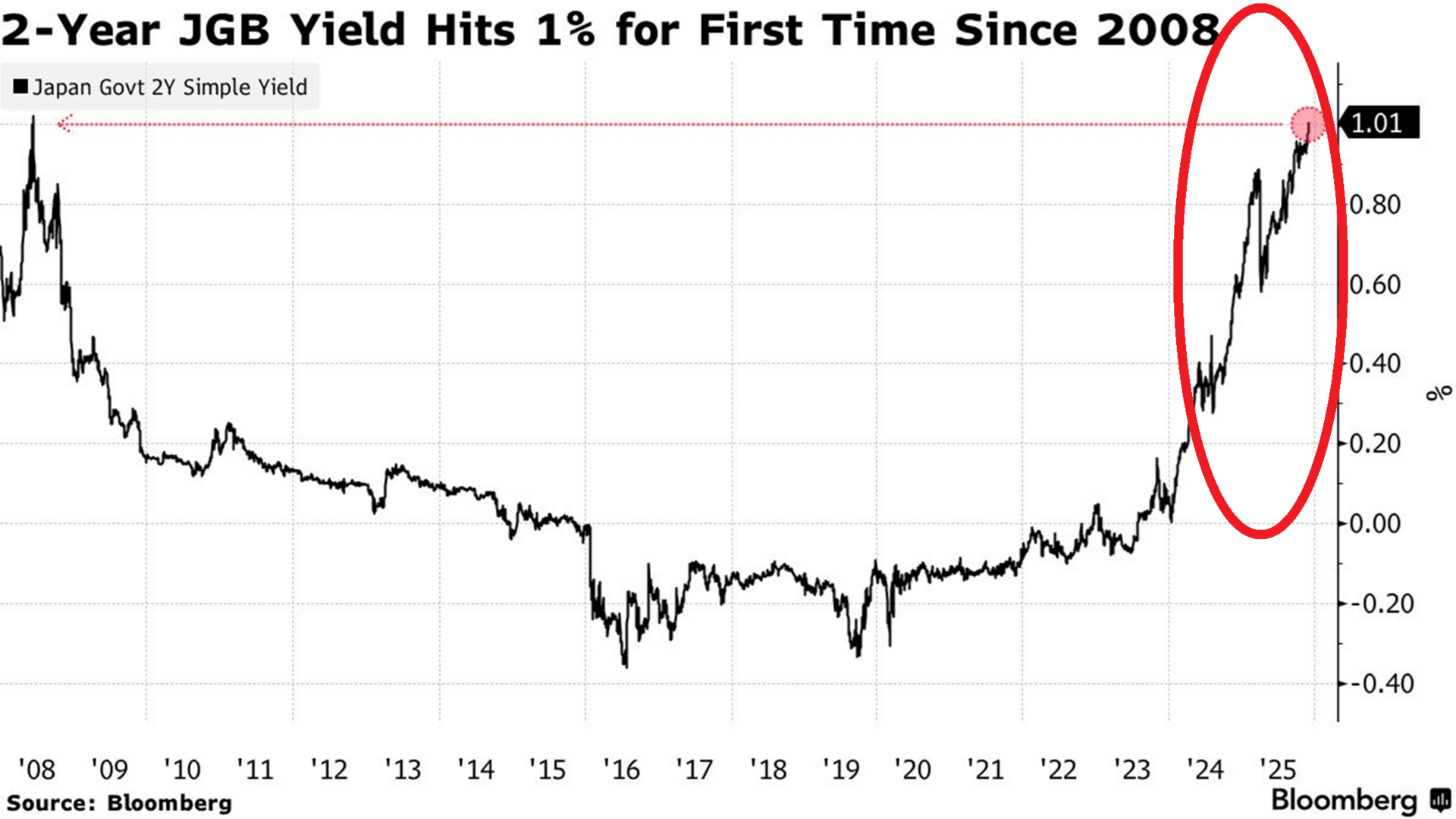

The 2-year Japanese government bond yields have surpassed 1.0% for the 1st time since the Financial Crisis as expectations of another rate hike have risen.

Hands Down Some Of The Best 0% Intro APR Credit Cards

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Take a look at this article to find out how you can pay no interest on balance transfers until 2027 with these top cards.

Investors now expect the Bank of Japan to raise interest rates on December 19 after Governor Kazuo Ueda signaled the bank is actively considering a hike. He said the Bank of Japan will weigh the pros and cons of raising the policy rate and that the outlook is improving enough for a rate increase to be appropriate, adding that a move higher would still mean real rates are at very low levels.

The market is pricing in an over 80% chance of a hike at this month’s meeting. At the same time, odds rise to more than 94% going into the January gathering.

Read more about the consequences of rising government bond yields in Japan in the following piece.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: