- Global Markets Investor

- Posts

- US stocks finished the week higher driven by small caps. Weekly market recap, trading week 02/2026

US stocks finished the week higher driven by small caps. Weekly market recap, trading week 02/2026

Summary of the trading week using the most popular posts from the X platform

🔥🔥IMPORTANT ANNOUNCEMENT: Get lifetime access to premium analysis for $100 per year - a 50% discount. 3 DAYS LEFT🔥🔥

🔥GLOBAL MARKETS INVESTOR’S PORTFOLIO IS UP +72% SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

US stocks finished the week higher despite mixed economic data, with small caps leading the gains.

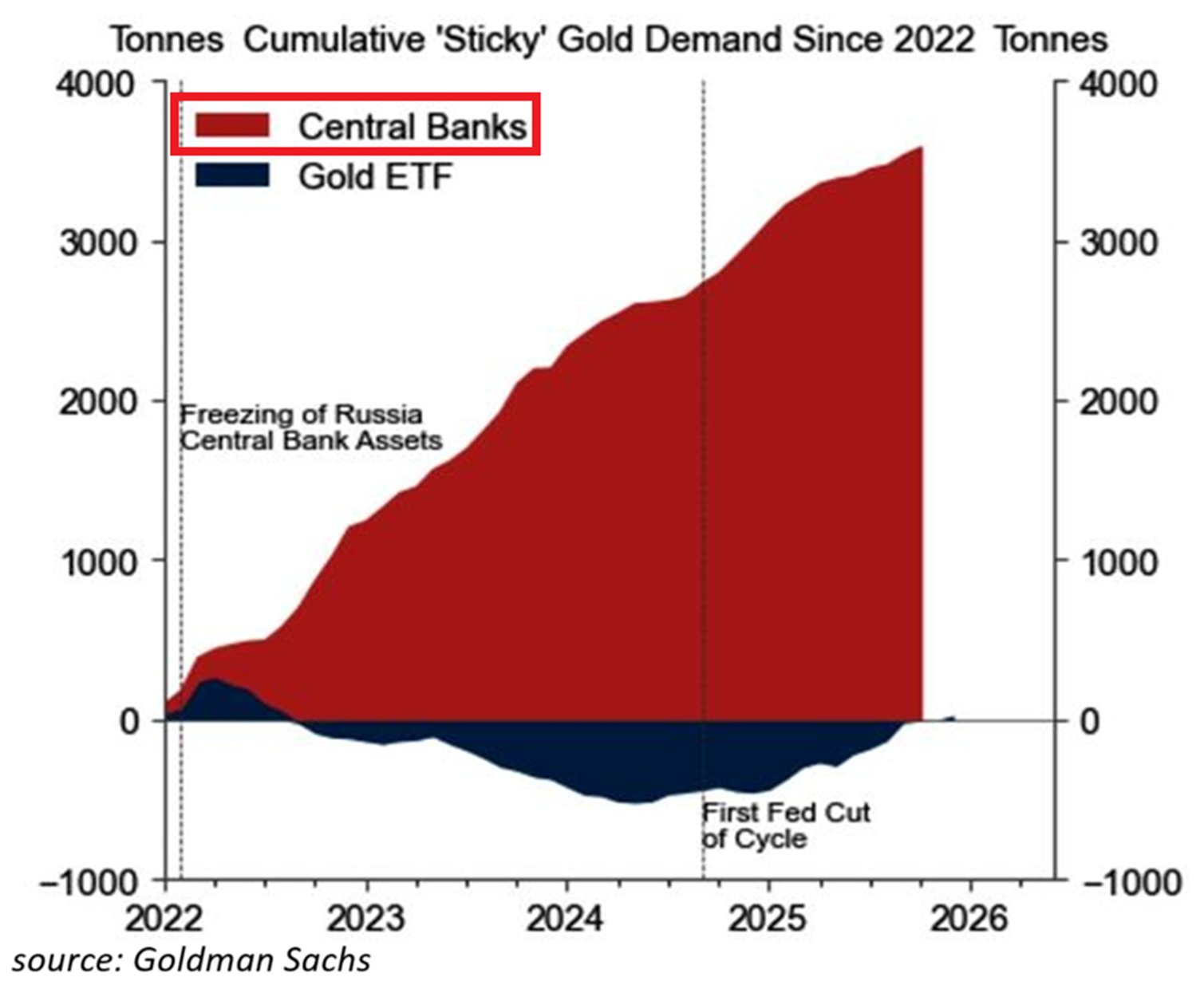

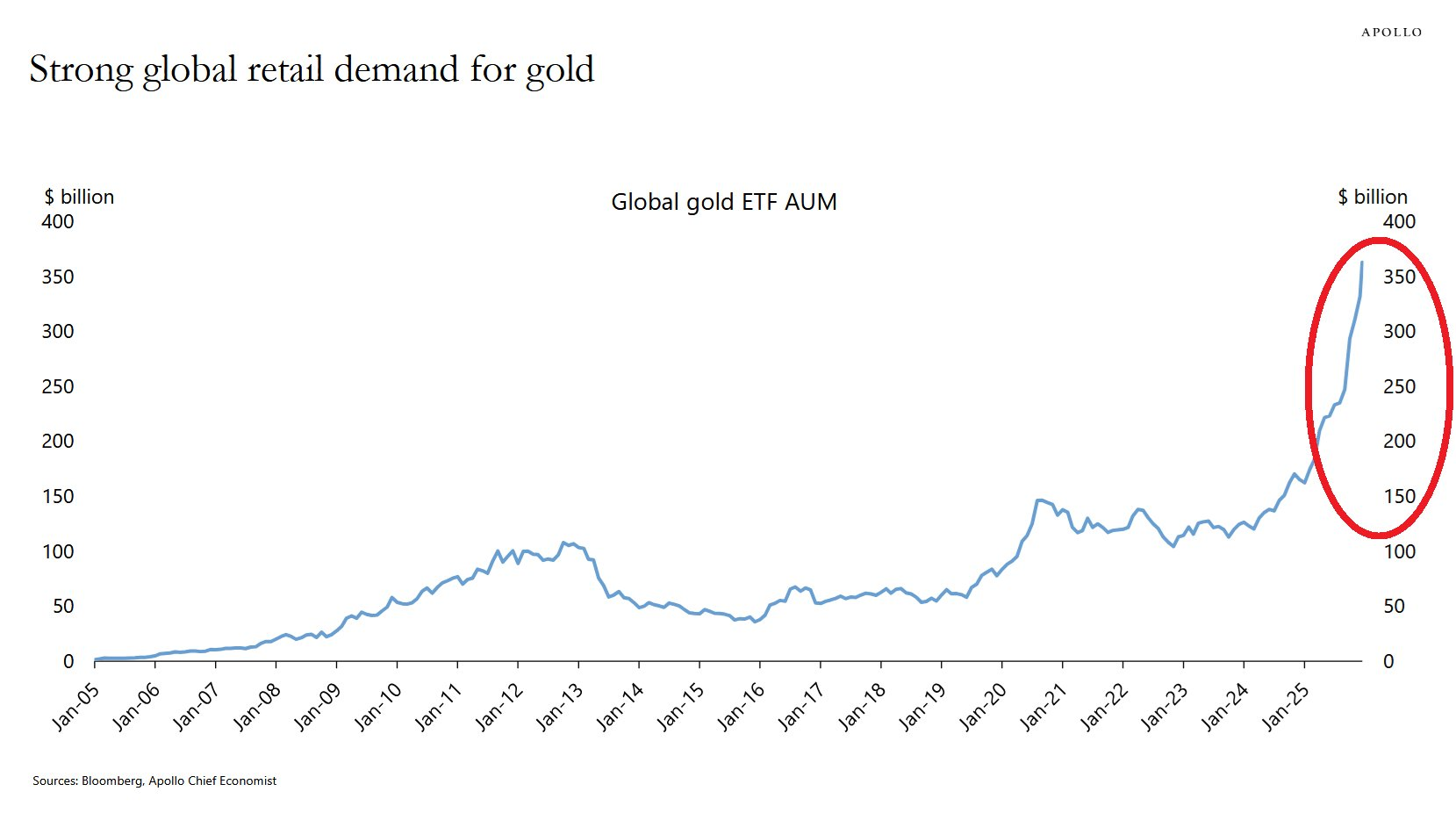

Gold and silver somehow continued their run.

Meanwhile, volatility stayed subdued with option markets showing little fear.

This comes asset managers have aggressively increased their VIX futures shorts, to the highest level since July 2024.

In other words, funds are betting heavily on continued low stock market volatility.

Such extreme short VIX positioning often leaves markets vulnerable to sharp volatility spikes if sentiment turns.

A similar setup occurred in July-August 2024, when a sudden shift in risk appetite drove a nearly -10% market drop.

Is the volatility set to spike over the next few weeks?

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 +1.6%

- Nasdaq +1.9%

- Dow Jones +2.3%

- Russell 2000 (small caps) +4.6%

- US 10-year Treasury yield -2 bps

- VIX -0.1%, front month VIX futures +0.1%

- US Dollar index +0.8%

- Gold +3.2%

- Silver +1.8%

- WTI Crude Oil +3.1%

- Bitcoin +0.1%

Trusted by millions. Actually enjoyed by them too.

Morning Brew makes business news something you’ll actually look forward to — which is why over 4 million people read it every day.

Sure, the Brew’s take on the news is witty and sharp. But the games? Addictive. You might come for the crosswords and quizzes, but you’ll leave knowing the stories shaping your career and life.

Try Morning Brew’s newsletter for free — and join millions who keep up with the news because they want to, not because they have to.

For the trading week ending January 16, key events are:

- US CPI Inflation for December on Tuesday

- US PPI Inflation for November and October on Wednesday

- US Retail Sales for November on Wednesday

- US Industrial Production for December on Friday

- At least 17 Fed speakers

US inflation data will be in focus, along with plenty of Federal Reserve speakers.

2) The Fed's balance sheet is officially surging again after over 3.5 years of declining. Why is this happening? Is this QE? How does it affect the financial system and overall liquidity conditions?

3) Japan's bond market is facing its toughest year in over a decade.

4) US manufacturing is experiencing its worst period since the Financial Crisis.

5) Bank of America’s data shows investors dumped US equities throughout 2025.

6) Some additional posts that include interesting data.