- Global Markets Investor

- Posts

- US stocks had a mixed week amid the Fed’s rate decision. Weekly market recap, trading week 50/2025

US stocks had a mixed week amid the Fed’s rate decision. Weekly market recap, trading week 50/2025

Summary of the trading week using the most popular posts from the X platform

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

US stocks ended mixed after the Fed’s 3rd rate cut of the year and amid growing fears that AI returns may be delayed.

US Treasuries continued to fall along with the US Dollar while gold and silver rallied.

Crypto volatility highlighted last week’s swings as Bitcoin traded between $90,000 and $94,000 before ending slightly up.

Interestingly, small caps and cyclicals outperformed large-cap tech, suggesting investors are betting on a growth re-acceleration supported by government spending and lower Fed rates.

Overall, AI-related stocks have gone nowhere since the beginning of October.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 -0.6%

- Nasdaq -1.6%

- Dow Jones +1.1%

- Russell 2000 (small caps) +1.1%

- US 10-year Treasury yield +5 bps

- VIX +2%, front month VIX futures -4%

- US Dollar index -0.6%

- Gold +2.1%

- Silver +5.2%

- WTI Crude Oil -4.3%

- Bitcoin +1.2%

Tackle your credit card debt by paying 0% intro APR until 2027

Did you know some credit cards can actually help you get out of debt faster? Yes, it sounds crazy. But it’s true.

The secret: Find a card with a “0% intro APR" period for balance transfers or purchases. This could help you fund a large purchase or transfer your debt balance and pay it down as much as possible during the intro period. No interest means you could pay off the debt faster.

For the trading week ending December 19, key events are:

- US Non-farm payrolls for October and November on Tuesday

- US Retail Sales for October on Tuesday

- US S&P Global Services and Manufacturing PMI for December on Tuesday

- US CPI Inflation Data for November on Thursday

- US Consumer Sentiment for December on Friday

- At least 5 Fed Speeches

Upcoming US labor data will confirm whether the employment slowdown is gaining momentum.

2) Hedge funds and retail investors sold equities last week. Is the market liquidity rising again?

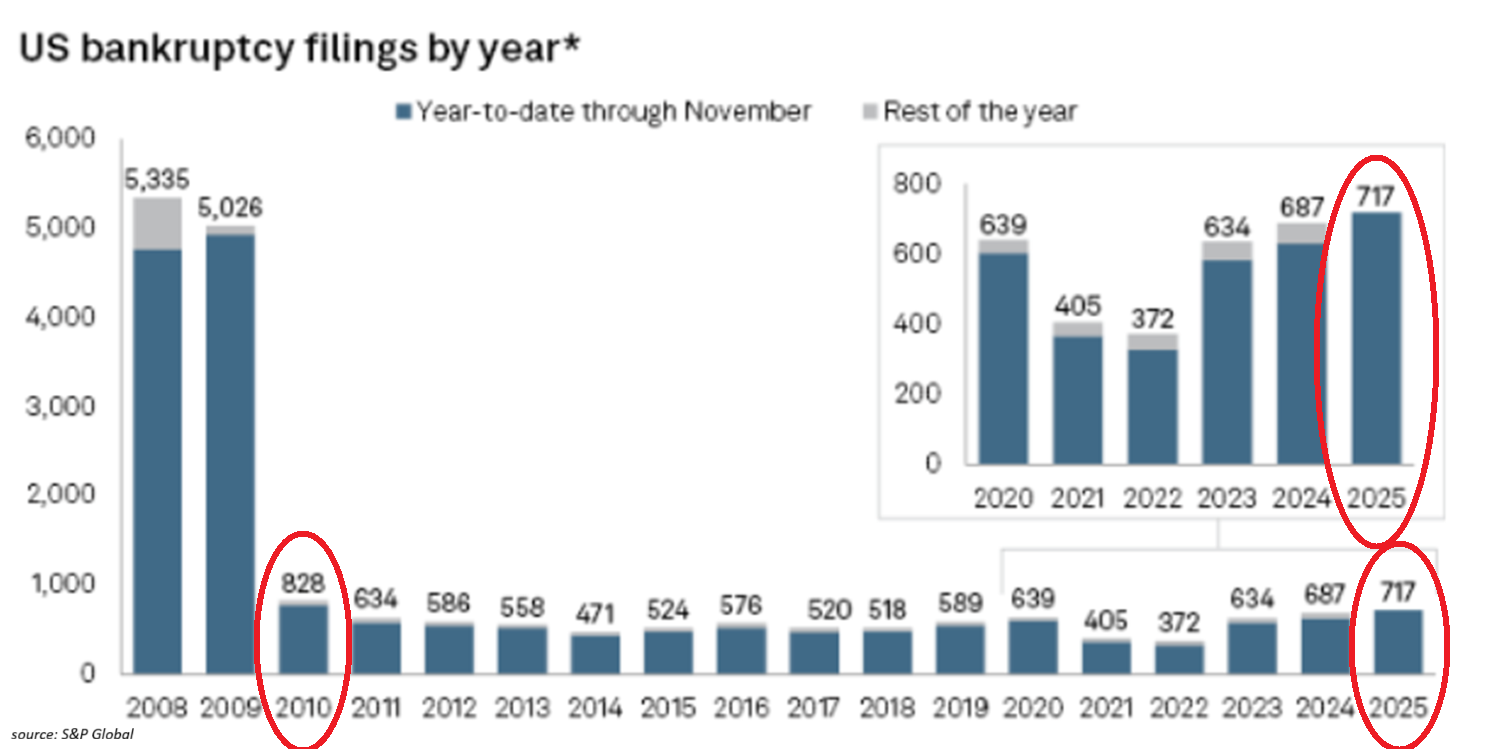

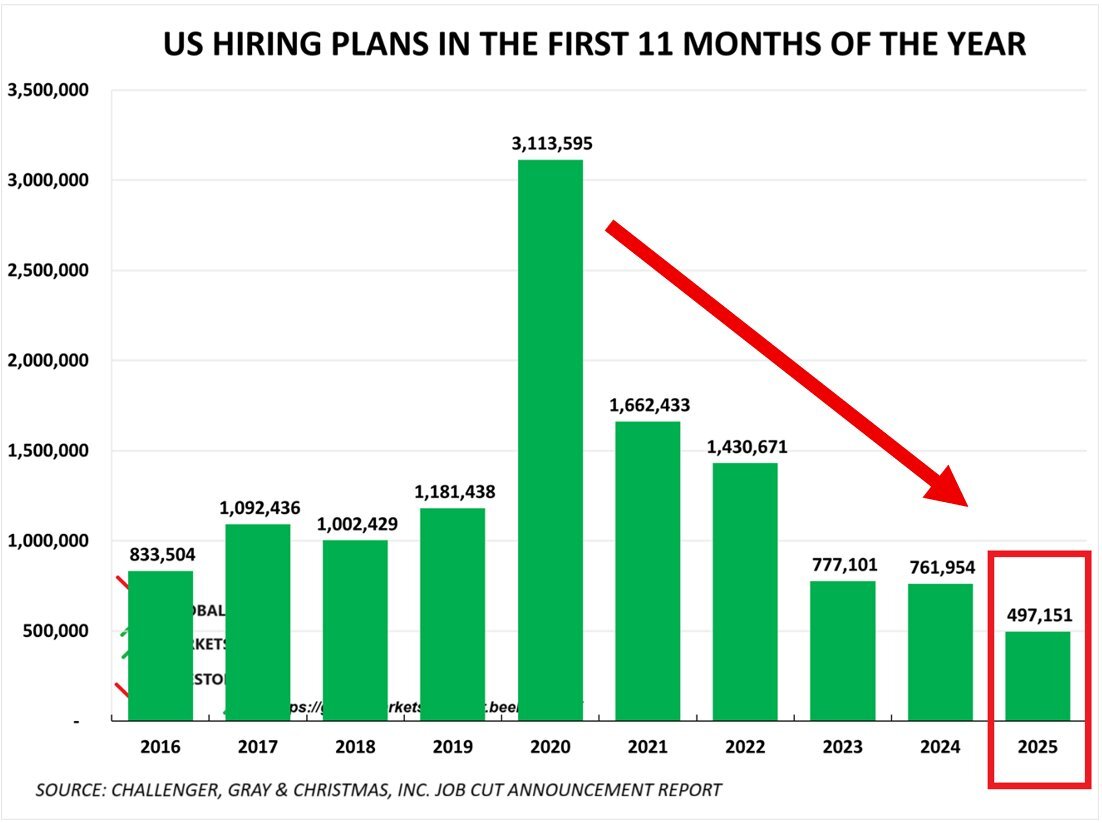

3) Real economy continues to weaken.

4) German bankruptcies and unemployment are surging.

5) Some additional posts that include interesting data.