- Global Markets Investor

- Posts

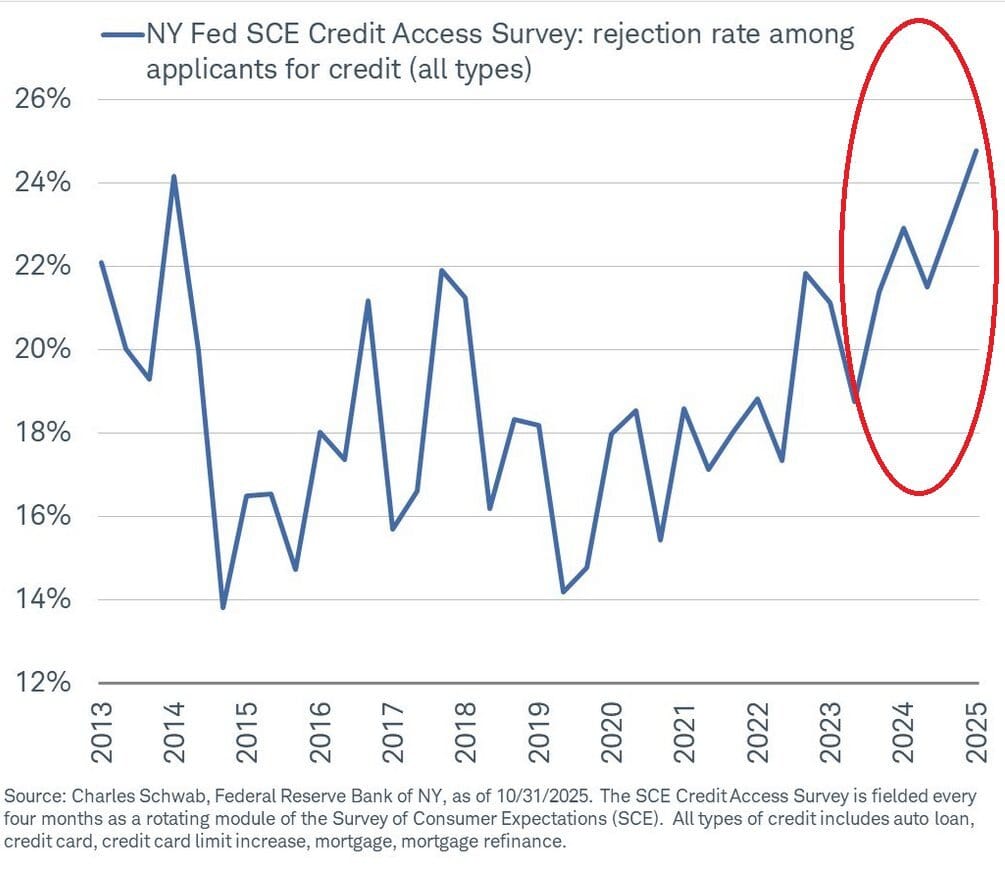

- 🚨US credit rejection rates are surging at a concerning pace

🚨US credit rejection rates are surging at a concerning pace

Access to credit in the world's largest economy is still getting worse

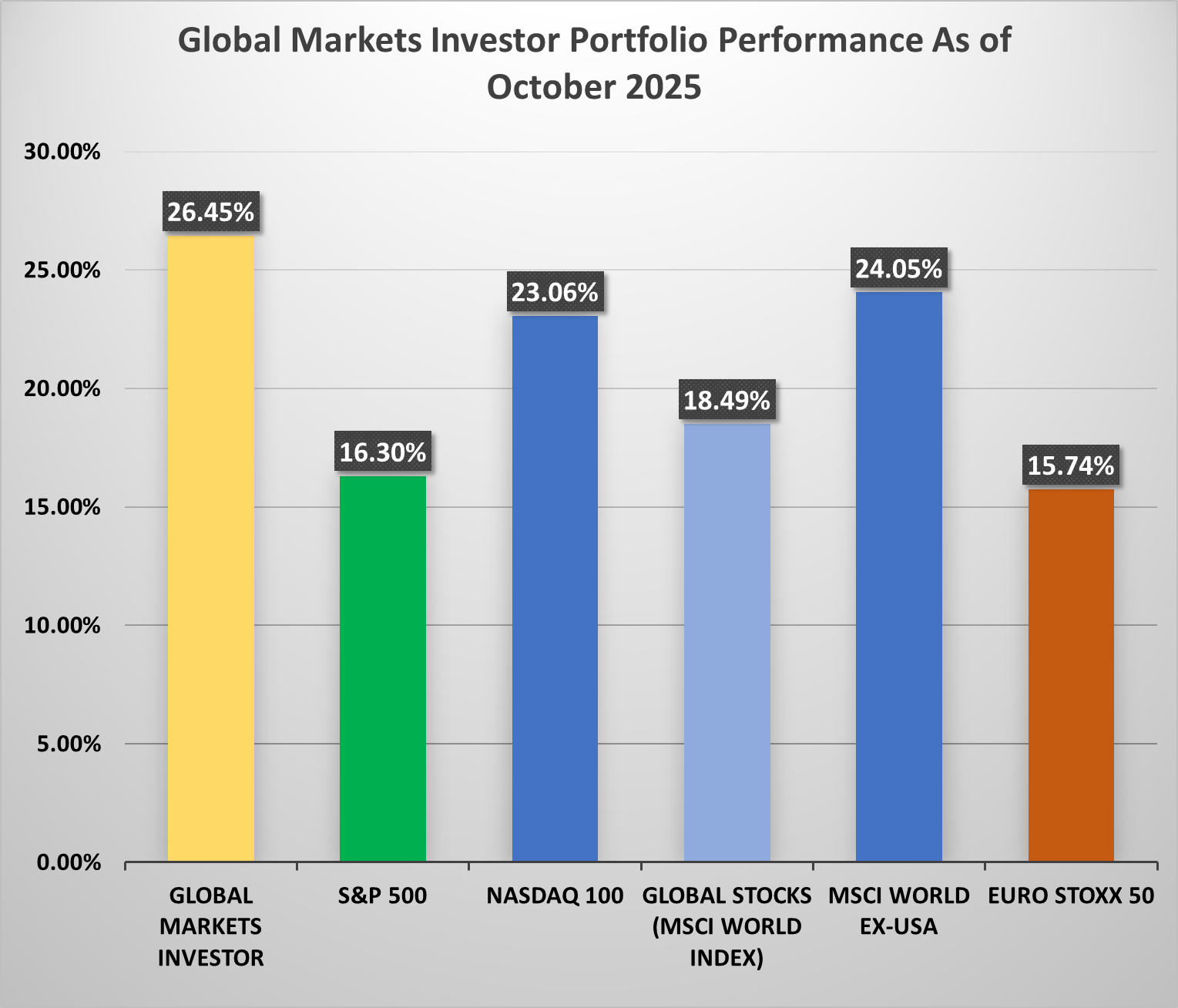

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

US consumer rejection rates for credit cards, credit card limit increases, mortgages, auto loans, and other loans jumped to 25% over the last 12 months, the highest since the NY Fed data began in 2013..

The rate has surged +11 percentage points since 2019.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

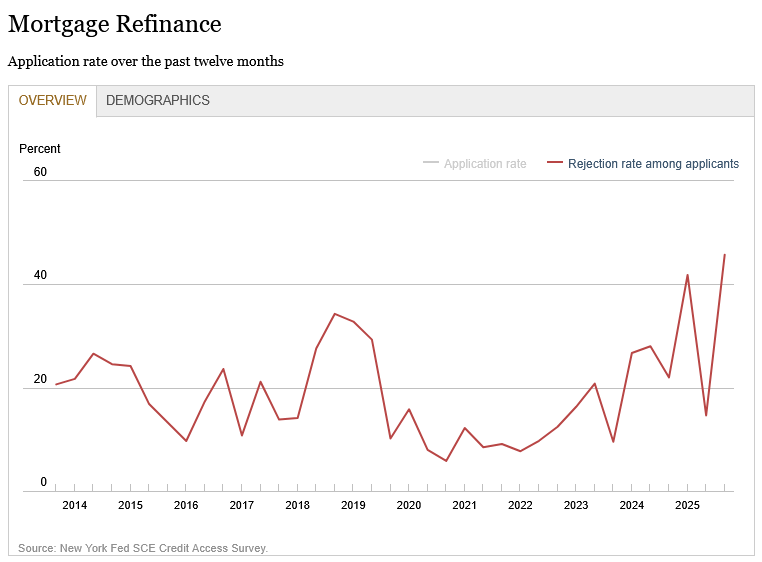

This comes as the rejection rate for mortgage refinance spiked to 45.7%, an all-time high, while mortgage rejection rates hit 23.0%, the largest since 2015.

The rejection rate for auto loans reached 15.2%, the 2nd-highest on record. Meanwhile, credit card rejection rates held steady at 21.2%, below the 26.3% peak seen in February 2021.

It has rarely been this tough to access credit in the US.

As a reminder, rising rejection rates often signal less debt and slower consumer spending, especially for bottom 50% income households and the middle class.

More on the financial shape of US consumers in the following piece.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: