- Global Markets Investor

- Posts

- The S&P 500 rebounded following Fed Chair Speech. Weekly market recap, trading week 34/2025

The S&P 500 rebounded following Fed Chair Speech. Weekly market recap, trading week 34/2025

Summary of the trading week using the most popular posts from the X platform

IMPORTANT ANNOUNCEMENT: Please find below a 15% discount for the 1st year of an annual subscription and get access to premium content breaking down financial markets and the global economy.🔥🔥🔥

Access exclusive analysis exploiting data from the world’s largest research firms and data providers such as Bank of America, JPMorgan, Goldman Sachs, Morgan Stanley, Nomura, Bloomberg, Financial Times, Refinitiv, WSJ, Barron’s, MarketWatch and others! 2 DAYS LEFT

🔥🔥GLOBAL MARKETS INVESTOR’S INVESTMENT PORTFOLIO - 40% RETURN SINCE JANUARY 2024 - FIND OUT MORE BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

Dovish Fed Chair Powell sparked a market rally on Friday after 4 weak previous days this week. The US Dollar dropped while as stocks, bonds, gold, crypto, and oil all moved higher. Nevertheless, the Magnificent 7 stocks finished the week in the red.

In short, Fed Chair Powell signaled that the balance of risks is shifting, leaving the door open for a potential rate cut on September 17.

He highlighted that while the labor market appears balanced, it is an unusual balance caused by a marked slowdown in both labor supply and demand. Downside risks to employment are rising, and if they materialize, layoffs and unemployment could increase quickly.

Powell confirmed the Fed is abandoning its flexible average inflation targeting framework and cautioned that stable inflation expectations cannot be taken for granted.

Overall, the Fed faces a challenging situation with upside risks to inflation and downside risks to employment, requiring careful adjustment of its policy stance.

August’s job report and inflation data will be key to whether the Fed cuts rates next month.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 rose 0.3%

- Nasdaq index fell 0.6%

- Dow Jones climbed 1.5%

- Russell 2000 (small caps) jumped 3.4%

- US 10-year Treasury yield declined 8 bps

- VIX fell 6%

- US Dollar index declined 0.1%

- WTI Crude Oil rose 1.6%

- Silver jumped 2.4%

- Gold increased 1.0%

- Bitcoin fell 0.4%

For the trading week ending August 29, key events are:

- US CB Consumer Confidence for August on Tuesday

- US Q2 2025 GDP Growth Rate - Second Estimate on Thursday

- US Inflation PCE for July on Friday

- US Consumer Sentiment for August on Friday

- At least 5 Fed speakers

Nvidia’s results and inflation data will be in focus.

⚠️Dovish Fed Chair Powell sparked a market rally on Friday after 4 weak previous days this week.

The US Dollar dropped while as stocks, bonds, gold, crypto, and oil all moved higher.

Nevertheless, the Magnificent 7 stocks finished the week in the red.

Performance this week:

— Global Markets Investor (@GlobalMktObserv)

8:47 PM • Aug 22, 2025

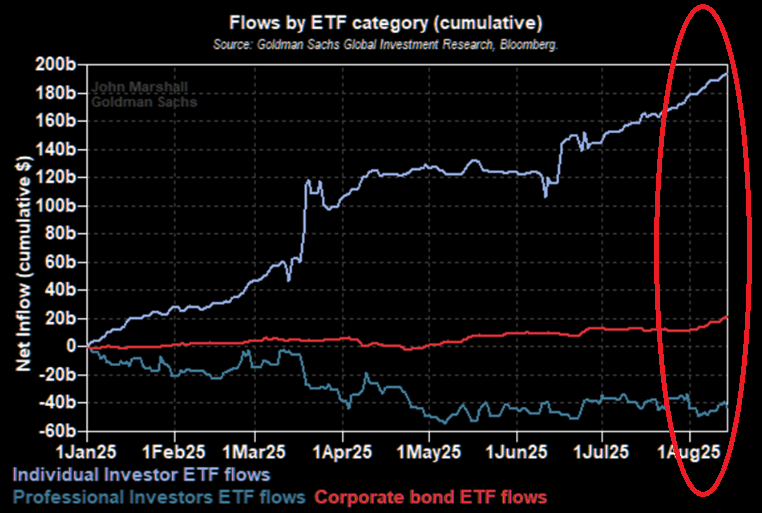

2) Retail investors speculation is skyrocketing.