- Global Markets Investor

- Posts

- S&P 500 advanced for the 2nd consecutive week. Weekly market recap, trading week 16/2025

S&P 500 advanced for the 2nd consecutive week. Weekly market recap, trading week 16/2025

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are also surrounded by commentary and explanations of complicated topics.

US stocks' performance was mixed last week, with gold continuing its rally. On the one hand, equities were supported by reports that China laid out a set of preconditions for resuming trade talks with the US and it is open for talks if Trump shows ‘respect’ and names a point person, according to Bloomberg.

On the other hand, Fed Chair Powell provided some sobering comments that the Fed will not intervene if the market plummets. Powell also said that if needed, the central bank can provide liquidity dollars.

Moreover, WSJ reported US plans to use negotiations with more than 70 countries to ask them to disallow China to ship goods through their countries, which will make it difficult to avoid US tariffs.

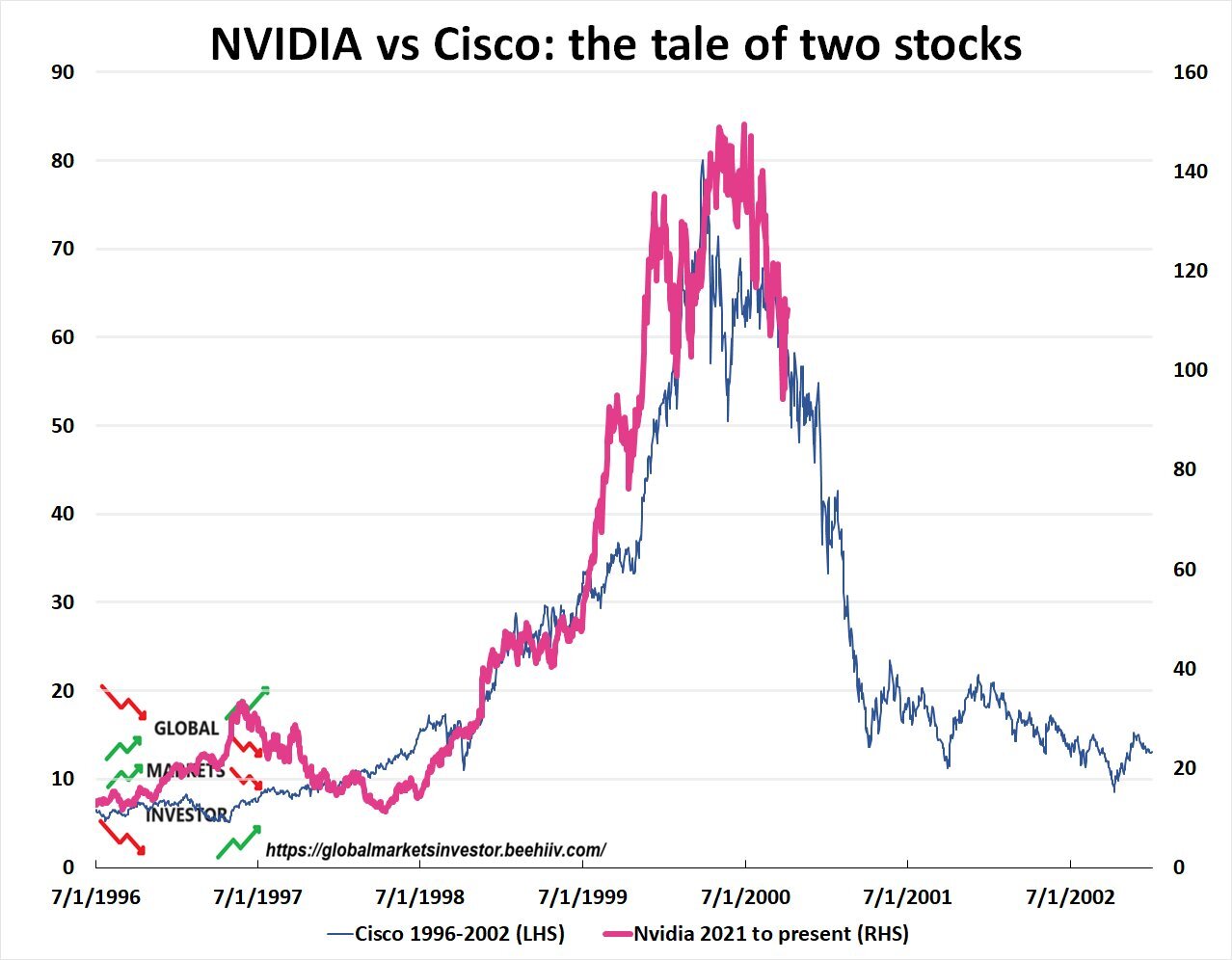

NVIDIA, $NVDA ( ▲ 1.12% ) , was a big laggard after the company said the US banned it from selling H20 chips to China.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 rose 0.3%

- Nasdaq index decreased 0.6%

- Dow Jones declined 1.1%

- Russell 2000 (small caps) increased 2.7%

- US 10-year Treasury yield dropped 17 bps

- VIX fell 27%

- US Dollar index fell 0.7%

- WTI Crude Oil jumped 4.7%

- Silver rose 2.0%

- Gold surged 3.0%

- Bitcoin fell 0.3%

For the trading week ending April 25, key events are:

- US S&P Global Manufacturing and Services PMIs for April on Wednesday

- US New Home Sales for March on Wednesday

- US Existing Home Sales for March on Thursday

- US Durable Goods Orders for March on Thursday

- US Consumer Sentiment for April on Friday

- At least 8 Fed Officials Speeches

- ~31% of S&P 500 companies reporting Q1 2025 earnings

Pretty big week for earnings with Tesla, $TSLA, and Google, $GOOGL, in focus. Tariff headlines will also be closely watched.

⚠️Mixed US stocks performance this week following sobering Fed Chair Powell's comments.

Historic economic and trade uncertainty persist.

Gold continued its outstanding performance.

Performance this week:

S&P 500 +0.3%

Nasdaq -0.6%

Russell 2000 +2.7%

Dow Jones -1.1%

US 10-year— Global Markets Investor (@GlobalMktObserv)

8:54 PM • Apr 17, 2025

2) Global fund managers’ pessimism over US stocks and the global economy is skyrocketing.