- Global Markets Investor

- Posts

- 🚨Is the US stock market in a bubble?

🚨Is the US stock market in a bubble?

Is the surge in US technology stock prices sustainable?

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

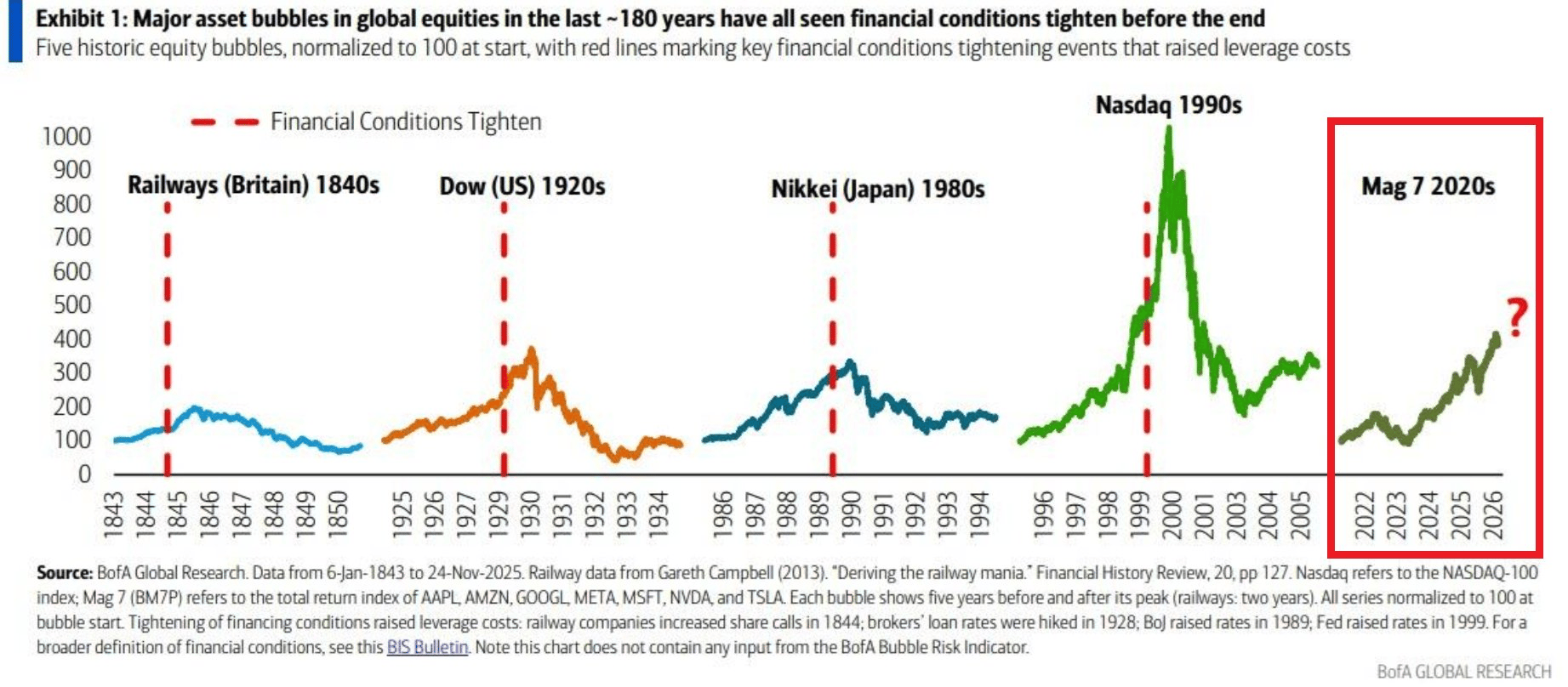

Historically, major technological breakthroughs have repeatedly produced asset bubbles.

The Industrial Revolution fueled railway stock booms in 19th-century Britain.

The Roaring 1920s in the US were driven by automobiles, radios, and early electronics.

The rise of the internet culminated in the late-1990s tech bubble.

Hands Down Some Of The Best 0% Intro APR Credit Cards

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Take a look at this article to find out how you can pay no interest on balance transfers until 2027 with these top cards.

Bubbles tend to form when investors believe a technology will create a transformative future, despite significant uncertainty around its timing and ultimate impact.

These episodes are also characterized by strong retail participation and rising leverage, fueled by easy credit such as margin borrowing, bank lending, and loose monetary conditions.

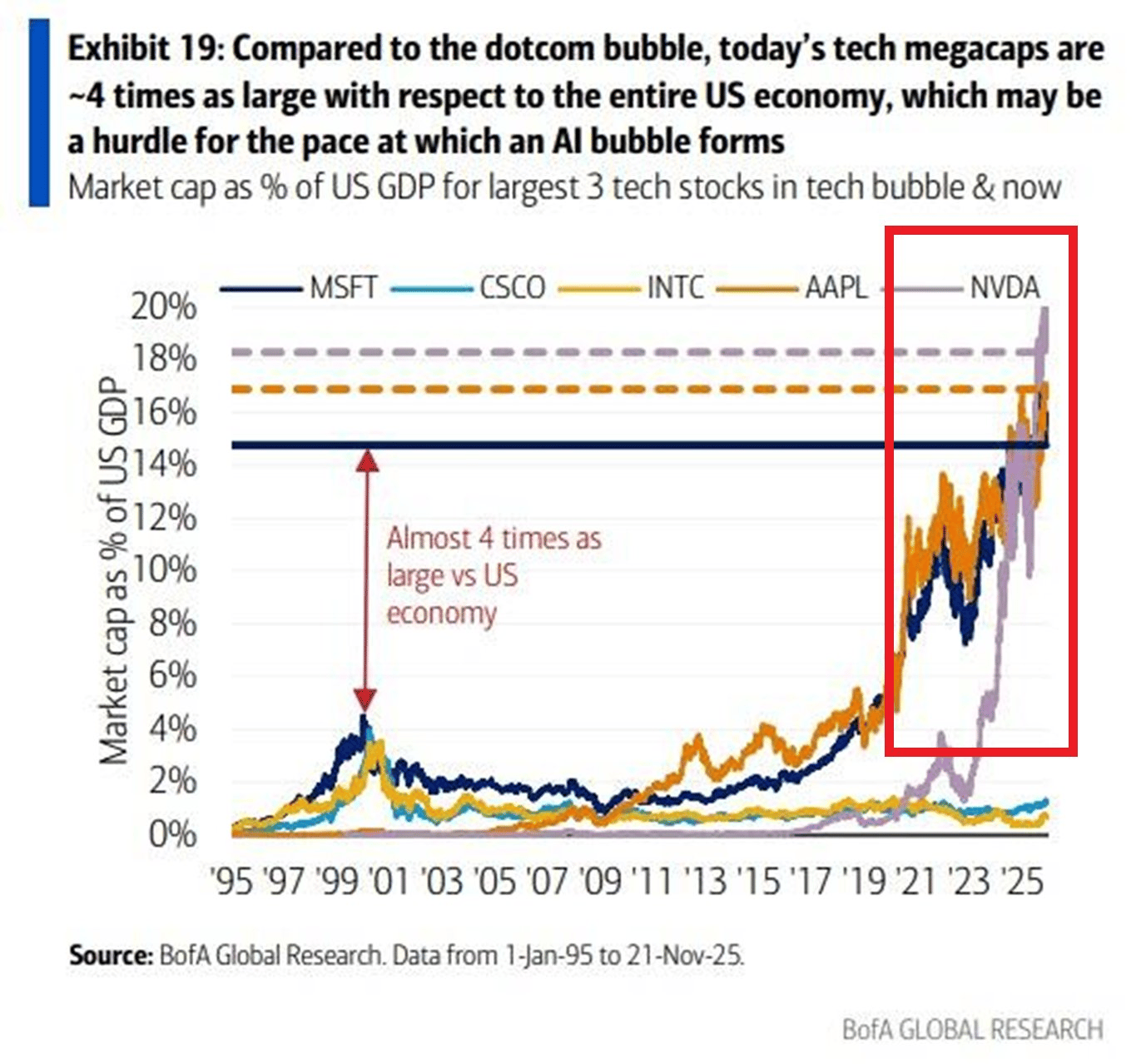

Meanwhile, market cap as a % of US GDP for the top 3 US technology stocks is now 4 times as large as at the Dot-Com peak.

NVIDIA $NVDA ( ▼ 4.91% ) , Apple $AAPL ( ▼ 0.81% ) , and Microsoft $MSFT ( ▼ 0.04% ) have far outpaced overall economic growth.

Top US technology stocks are now significantly larger relative to the economy than the top 3 largest stocks during the 2000 Dot-Com Bubble.

Is this sustainable?

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: