- Global Markets Investor

- Posts

- ⚠️Investors are dumping US financial stocks

⚠️Investors are dumping US financial stocks

The pace of selling is well above the long-term average

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 60% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Investors sold $0.8 billion of financial stocks last week, marking the 8th week of selling in the last 9.

The 4-week average of selling hit $0.8 billion, more than 2 standard deviations below the average over the last 17 years.

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

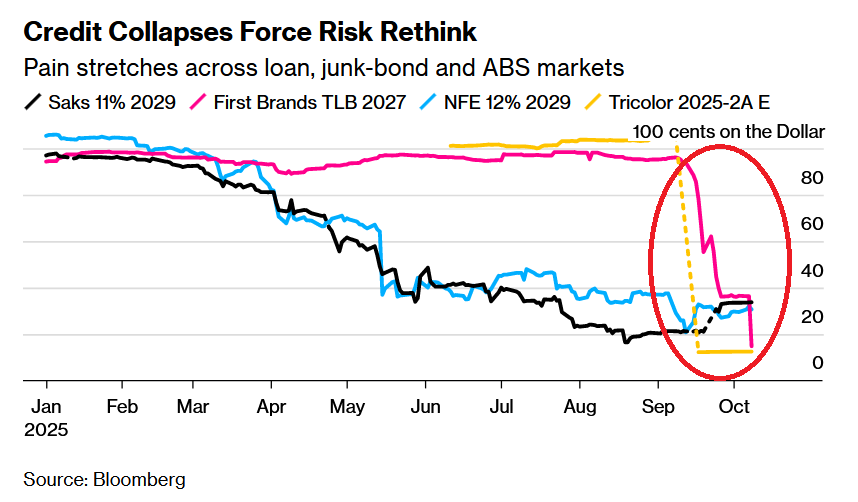

The most recent selling has been driven by rising concerns over regional banks and issues in the private credit market. More on those in the following pieces.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: