- Global Markets Investor

- Posts

- 🚨Some cracks are showing up in the US credit market

🚨Some cracks are showing up in the US credit market

Could this translate into a broader market sell-off?

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 60% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

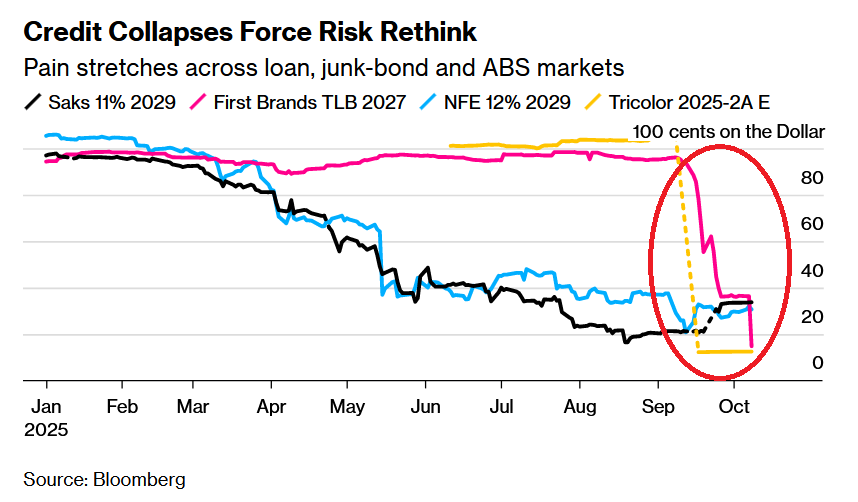

In recent weeks, something troubling has been unfolding in US credit markets, particularly within the leveraged loan space.

A series of bankruptcies has triggered billions of Dollars in losses for asset managers and private equity funds.

This cannot go unnoticed, as the leveraged loan market, now worth an estimated $2 trillion, represents an important segment of the US corporate credit market.

As a result, stocks of several private credit funds (alternative asset managers) have tumbled, highlighting growing concern among investors. The chart below presents Blackstone Secured Lending Fund, Ares Capital Corporation and Blue Owl Capital Inc. versus the S&P 500.

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

What exactly is happening, and why should investors pay attention to these developments? You can find out in the following analysis.

US LEVERAGED LOAN MARKET IS ON TRACK FOR THE BIGGEST LOSS IN YEARS