- Global Markets Investor

- Posts

- ⚠️Gold and silver markets are a little calmer this week

⚠️Gold and silver markets are a little calmer this week

Trading volumes stabilize versus last week, retail demand still strong

GLOBAL MARKETS INVESTOR’S PORTFOLIO IS 🔥UP +93%🔥SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

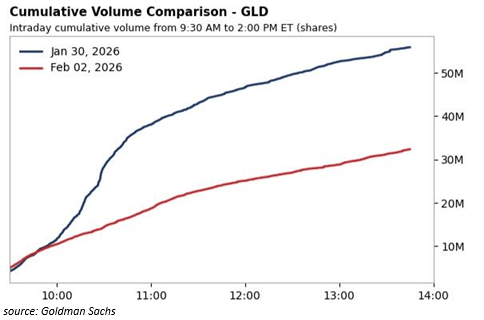

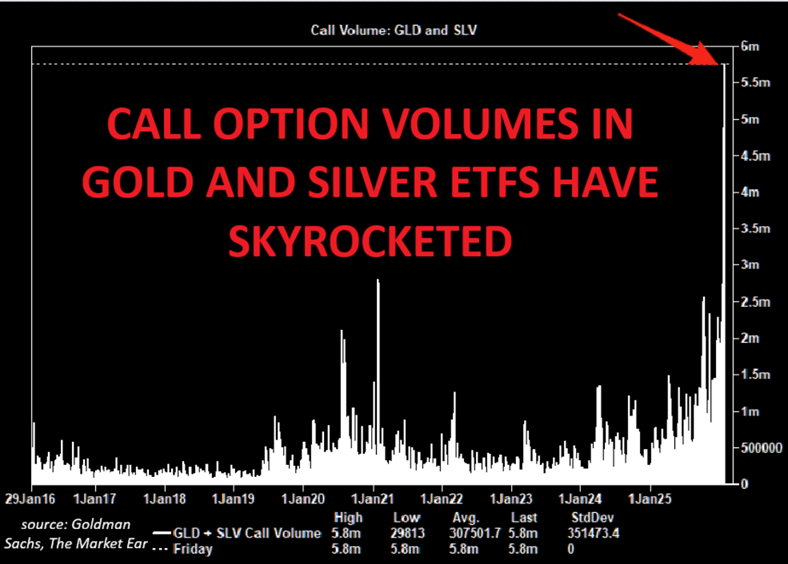

The largest physical gold-backed ETF $GLD ( ▼ 4.01% ) trading volume was down ~50% from Friday’s record, according to Goldman Sachs data.

Similarly, for the largest physical silver-backed ETF $SLV ( ▼ 3.98% ) .

Wake up to better business news

Some business news reads like a lullaby.

Morning Brew is the opposite.

A free daily newsletter that breaks down what’s happening in business and culture — clearly, quickly, and with enough personality to keep things interesting.

Each morning brings a sharp, easy-to-read rundown of what matters, why it matters, and what it means to you. Plus, there’s daily brain games everyone’s playing.

Business news, minus the snooze. Read by over 4 million people every morning.

As we know, last week they were one of the most traded assets on the planet.

Interestingly, despite Friday’s crash, Silver and gold were still one of the best performing major assets in the world in January.

Meanwhile, it looks like retail demand for gold remain incredibly strong.

On Monday, retail investors crowded United Overseas Bank Ltd., Singapore’s only bank offering physical gold, even as bullion prices plummeted, according to Bloomberg. Demand was so intense that customers without pre-orders were turned away.

Many were buying the dip, betting that gold’s main drivers remain intact.

The scene highlights extraordinary retail demand, showing that even sharp declines aren’t deterring individual investors from adding physical gold to their portfolios.

The frenzy apparently was not limited to Singapore. In central Sydney, lines stretched into the street outside ABC Bullion near Martin Place, where individual investors showed up after Friday’s losses, determined to reload.

Thailand saw the same pattern. Local investors are holding onto their gold rather than selling into weakness, according to Globlex Securities CEO Thanapisal Koohapremkit. “It’s still a buying market in Thailand,” he said. “People are sticking with their existing holdings and looking for opportunities.”

Lastly, in China, the pullback ahead of the Chinese Lunar New Year, a major seasonal buying period, is also drawing fresh demand. Retail investors who missed the rally are treating the sell-off as an entry point. In Shuibei, China’s major precious-metals trading hub, silver tightness eased slightly over the weekend as supply increased, but there was no panic selling, and local silver prices still held premiums over exchange benchmarks.

“Gold has shown real strength,” said Liu Shunmin of Shenzhen Guoxing Precious Metal Co. “Dip buyers have been out in force over the past two days, picking up jewelry and bars ahead of Lunar New Year. Silver, on the other hand, is seeing more hesitation.”

Detailed explanation of what happened to gold and silver markets on Friday can be found in the latest market recap.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: