- Global Markets Investor

- Posts

- US stocks saw a mixed week, silver and gold prices collapsed. Weekly market recap, trading week 05/2026

US stocks saw a mixed week, silver and gold prices collapsed. Weekly market recap, trading week 05/2026

Summary of the trading week using the most popular posts from the X platform

GLOBAL MARKETS INVESTOR’S PORTFOLIO IS 🔥UP +93%🔥 SINCE JANUARY 2024

DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly, so I thought it could provide some value to your analysis, and investment process. These posts are surrounded by extra charts, commentary and explanations of complicated topics.

What a volatile week it has been.

US stocks were mixed following big Tech earnings including Microsoft, Meta, Tesla and Apple.

Gold plunged more than 12% intraday on Friday, dropping below $5,000 an ounce in its steepest single-day fall since the early 1980s, wiping out $5 trillion in market cap in just 2 days.

Silver plunged over 36% at some point, marking the largest intraday drawdown ever recorded.

The US Dollar posted its sharpest rally since May on Friday, which intensified the metals crash.

This was partially (not the main reason for gold and silver) driven by President Trump nominating Kevin Warsh for Fed Chair, a candidate viewed as more hawkish than other contenders.

Interestingly, Kevin Warsh was the youngest Fed Governor during the Great Financial Crisis and has been critical of recent Fed policies, saying rates were raised too late in 2022 and post-2020 Crisis stimulus hurt Fed credibility. He argues QE fuels asset bubbles and inequality. Warsh also favors a smaller balance sheet and supports a rules-based Fed focused on price stability.

In case you missed it, other posts from this week are listed below.

1) Weekly performance. In the first post attached, you can see last week’s performance of the major US indexes, the VIX volatility index, 10-year Treasury yield, the US Dollar, gold, silver, WTI Crude oil and Bitcoin.

- S&P 500 +0.3%

- Nasdaq -0.2%

- Russell 2000 (small caps) -2.0%

- Dow Jones -0.4%

- US 10-year Treasury yield unchanged

- Bank Index +2.1%

- VIX +8%, front month VIX futures +4%

- US Dollar index -0.4

- Gold -2.1%

- Silver -17%

- WTI Crude Oil +7.7%

- Bitcoin -5.6%

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

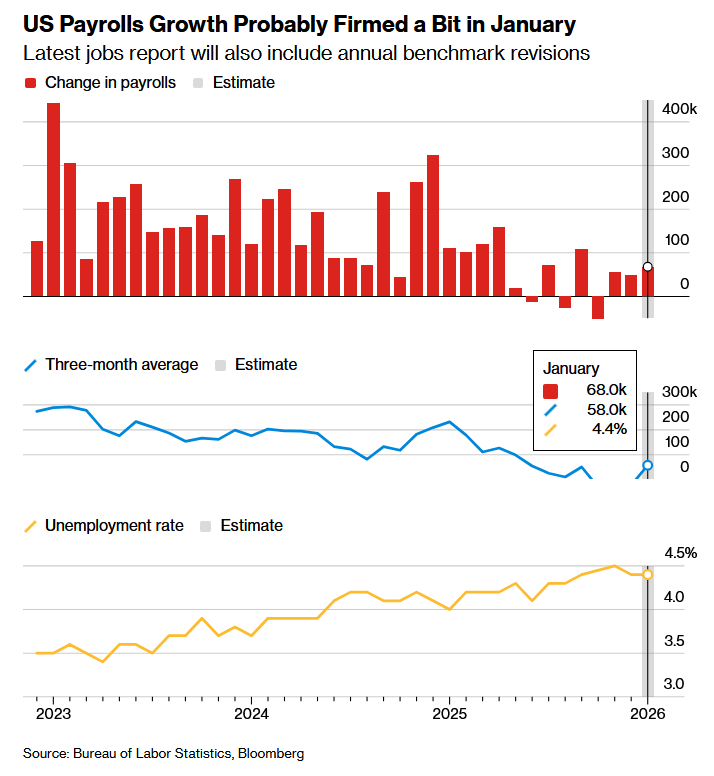

For the trading week ending February 5, key events are:

- US ISM Manufacturing PMI for January on Monday

- US job openings for December on Tuesday

- US ISM Services PMI for January on Wednesday

- US Challenger job cut announcements for January on Thursday

- US Non-Farm Payrolls for January on Friday

- US Consumer Sentiment for February on Friday

- At least 5 Fed Speakers

- ~12% of S&P 500 companies report earnings including Alphabet and Amazon

Another busy week ahead. Investors will be focused on US job market data and the S&P 500 earnings.

2) What really hit silver and gold prices?

3) Will Bitcoin prices get as low as $60,000?

4) Is the AI boom already over?

5) Some additional posts that include interesting economic and financial markets data (such as the first US bank failure of 2026).