- Global Markets Investor

- Posts

- 🚨US technology stocks capital spending is exploding

🚨US technology stocks capital spending is exploding

Is this sustainable and will it pay off?

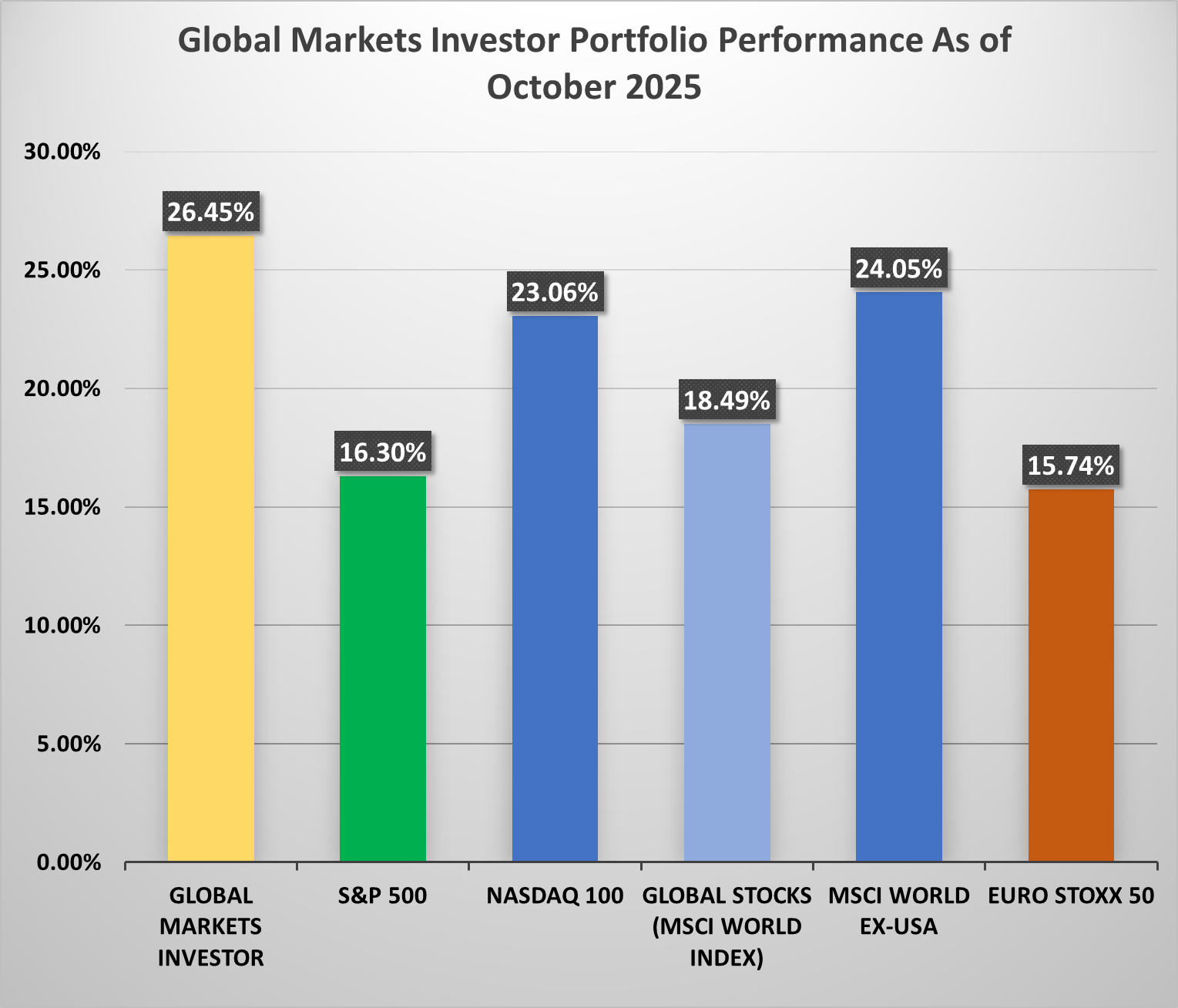

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 56% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Tech capital expenditure has grown more over the last 5 years than during the 2000 dot-com bubble. In fact, this is the fastest tech investment cycle in history.

Choose the Right AI Tools

With thousands of AI tools available, how do you know which ones are worth your money? Subscribe to Mindstream and get our expert guide comparing 40+ popular AI tools. Discover which free options rival paid versions and when upgrading is essential. Stop overspending on tools you don't need and find the perfect AI stack for your workflow.

Back in the early 2000s, telecom firms were valued at huge premiums while wholesale capacity was expanding at extreme rates. Supply far exceeded demand, with less than 5% of total telecom capacity actually in use.

Thousands of miles of expensive fiber-optic networks remained unlit beneath the ground, with some networks expanding by more than 50% per year in 2001 and 2002.

Many companies that had invested heavily in infrastructure eventually sought protection from creditors as the shakeout phase triggered massive consolidation.

Is this AI CapEx cycle sustainable and will it pay off, or is today’s AI CapEx boom setting up the same outcome — massive overinvestment, hidden leverage, and a painful bust?

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: