- Global Markets Investor

- Posts

- ⚠️ The US Treasury is running the largest buyback program in its history

⚠️ The US Treasury is running the largest buyback program in its history

The goal is to boost liquidity and improve cash management

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 40% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

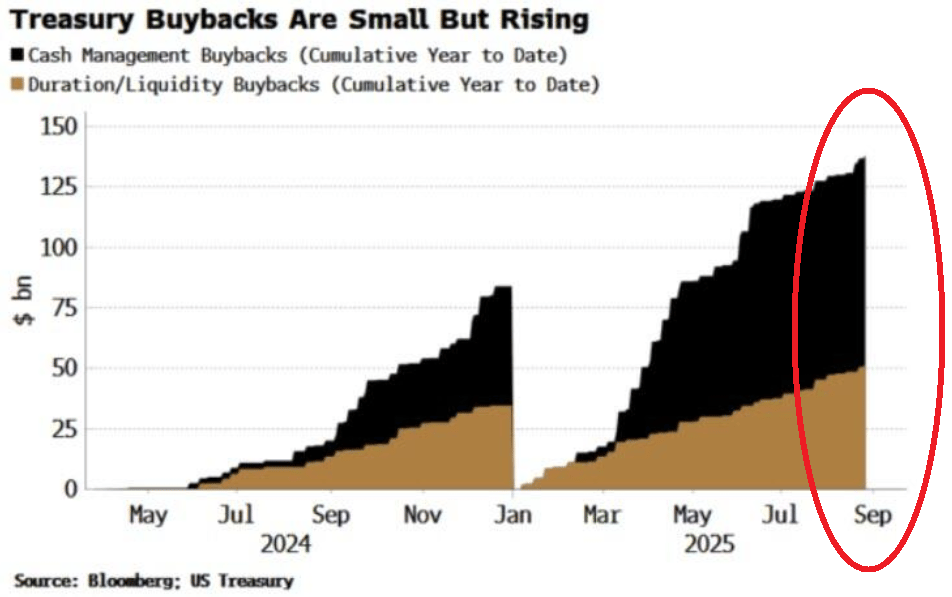

US Treasury has bought back ~$138 billion in government bonds, far exceeding the $79 billion repurchased in all of 2024.

Swap, Bridge, and Track Tokens Across 14+ Chains

The Uniswap web app lets you seamlessly trade tokens across 14+ chains with transparent pricing.

Built on audited smart contracts and protected by real-time token warnings, Uniswap helps you avoid scams and stay in control of your assets.

Whether you're discovering new tokens, bridging between chains, or monitoring your portfolio, do it all in one place — fast, secure, and onchain.

The stated goal of the Treasury’s buyback program is to boost liquidity and manage cash—making sure the government has the right amount of money to pay bills and run smoothly—but the effects go far beyond that.

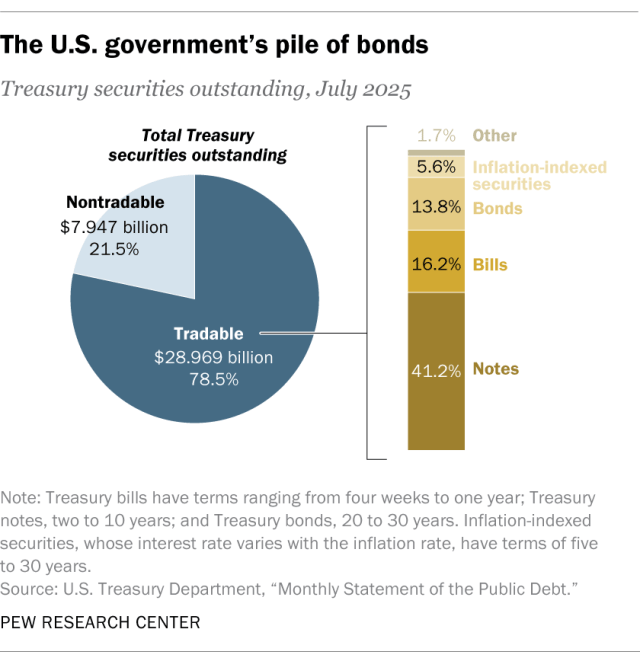

Overall the program works like this. The Treasury is buying back older, less-traded bonds and replacing them with newer, more popular ones. This makes it easier for investors to trade bonds and keeps the market running smoothly. Before this, dealers—the banks and firms that help people buy and sell Treasuries—were stuck holding bonds nobody wanted, which made the market less liquid. The buybacks give these bonds a buyer and encourage more trading, which helps prevent sudden spikes in volatility.

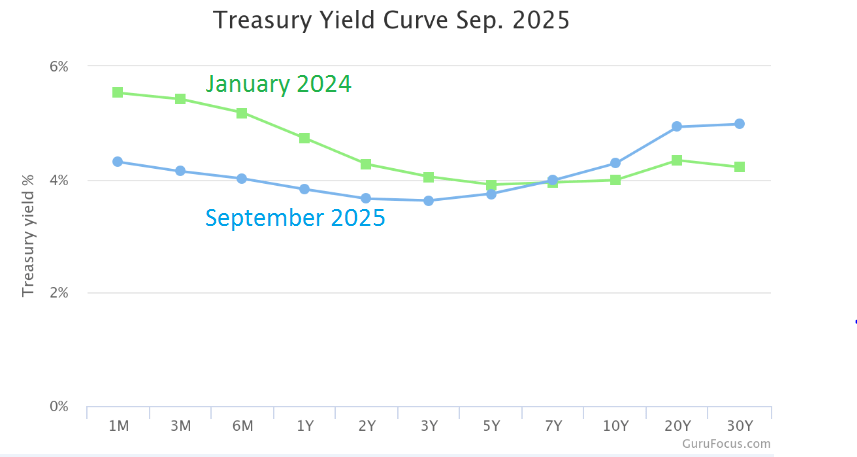

At the same time, the Treasury is avoiding borrowing heavily at the long end of the curve (like 10-, 20-, or 30-year Treasuries), favoring short-term bills. This policy is meant to keep yields down and reduce volatility, but it has side effects: shorter debt maturity combined with rising bill supply can steepen the yield curve. A steeper curve usually brings higher bond volatility, as long-term yields become more sensitive to changes in expectations. In other words, when the yield curve is steep, long-term bond prices can jump up or down more easily because investors react strongly to news or changes in interest rate expectations.

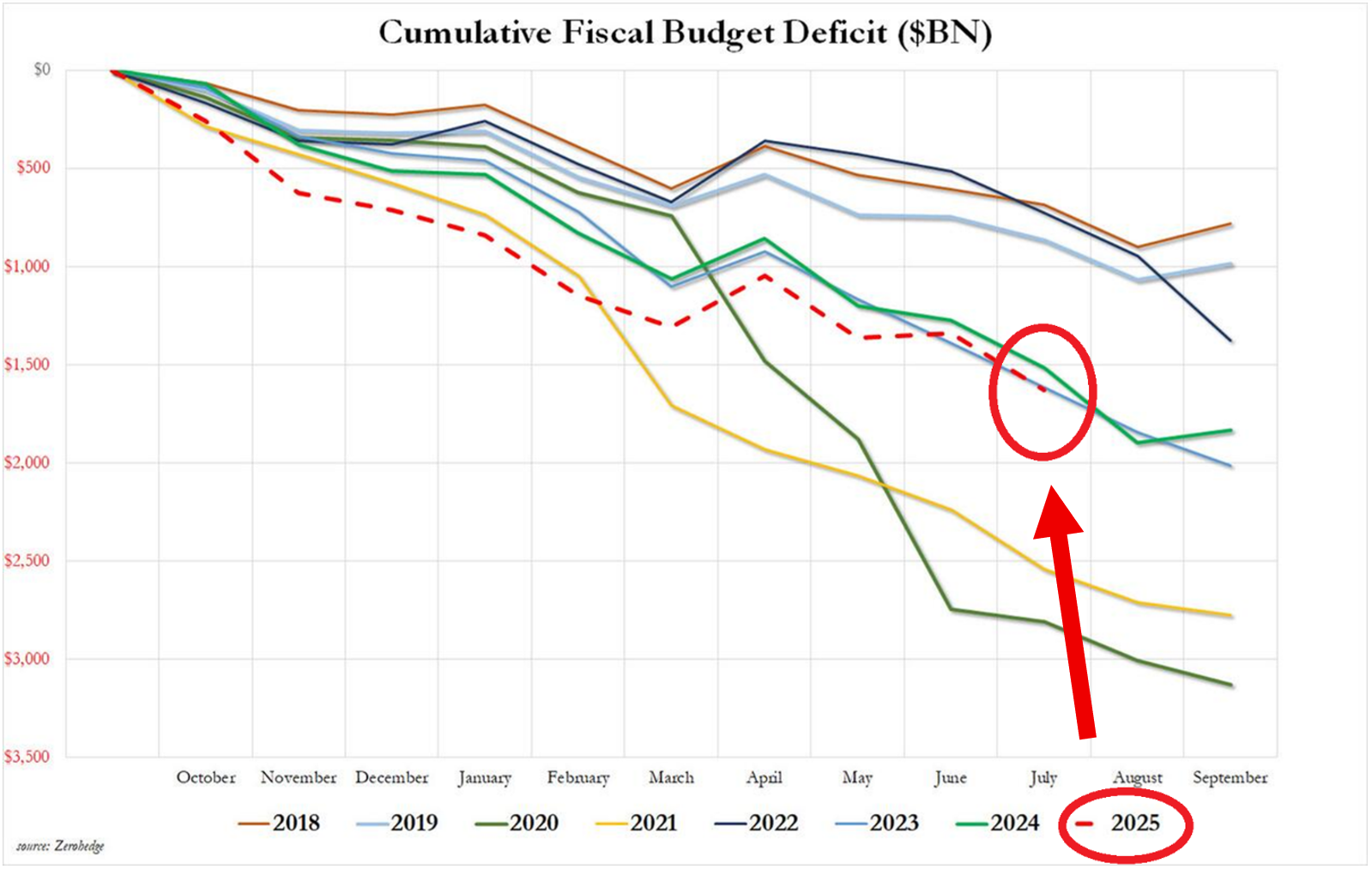

In other words, the Treasury is trying to “put out small fires” in the bond market, but by repressing normal volatility, it may be setting the stage for a bigger, more abrupt move in government bond yields. Low volatility today can mask fragility, and if yields rise suddenly, liquidity could tighten quickly, causing sharp moves across the $29 trillion US Treasury market—the largest and most important bond market in the world.

The net effect: the Treasury’s buybacks and short-term borrowing are helping in the short term, but they may unintentionally increase long-term risks such as steeper curves, higher yields, and a more volatile market. Stability is appearing today, but the underlying structure is more fragile, making abrupt shocks more likely in the future.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: