- Global Markets Investor

- Posts

- The US stock market has never been this expensive

The US stock market has never been this expensive

Valuations have even exceeded the 2000 Dot-Com Bubble levels

🎄 IMPORTANT ANNOUNCEMENT 🎄

20% OFF an Annual Premium Subscription, Christmas Discount 🔥

Get access to exclusive, data-driven market analysis powered by insights from the world’s leading research firms and data providers, including Bank of America, JPMorgan, Goldman Sachs, Morgan Stanley, Nomura, Bloomberg, Financial Times, Refinitiv, WSJ, Barron’s, MarketWatch, and more.

This offer expires at midnight on 28 December.

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

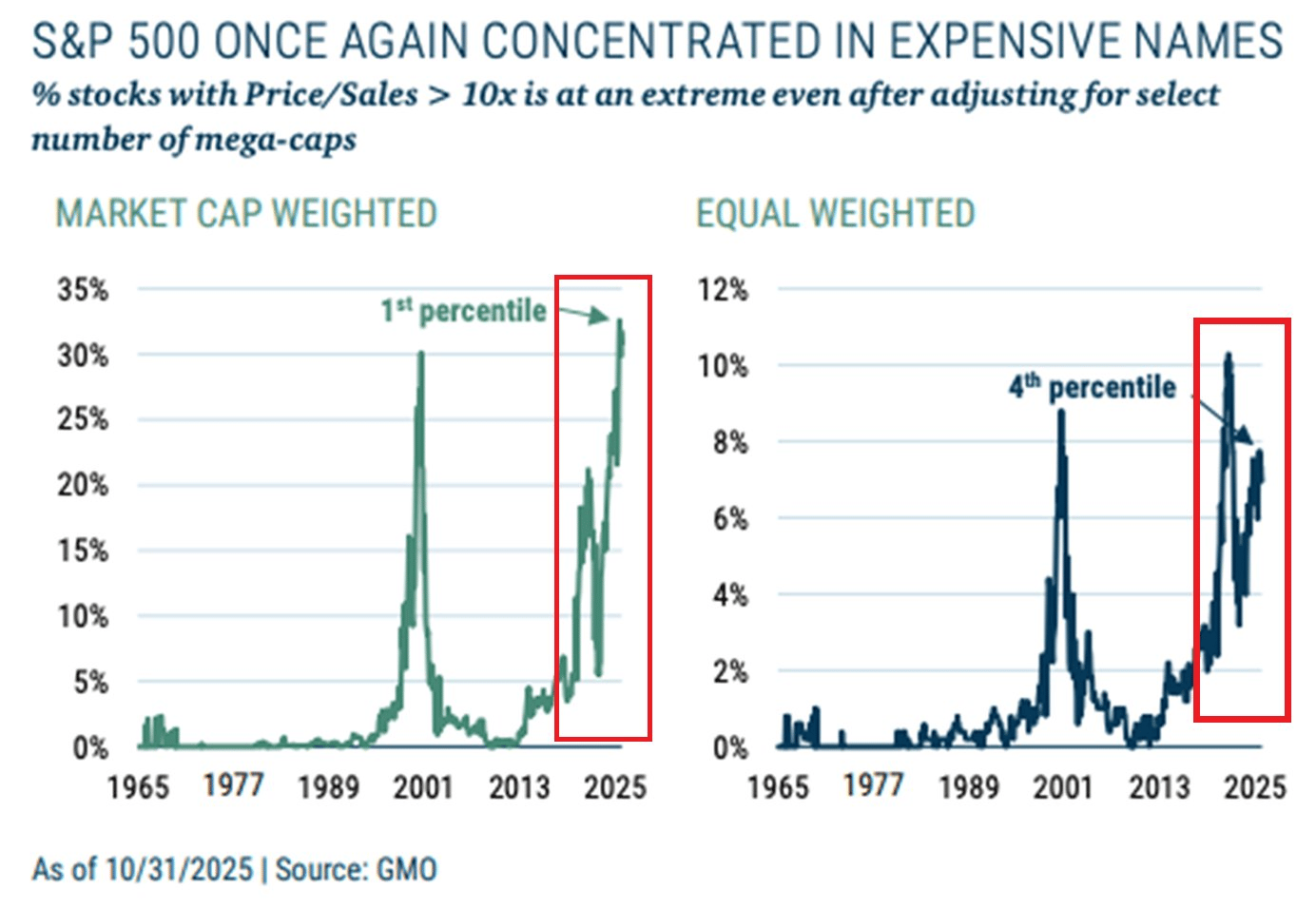

Currently, a record ~33% of S&P 500 stocks are trading at Price-to-Sales ratios above 10x on a market-cap weighted basis.

This exceeds the 2000 Dot-Com Bubble peak of 30%.

On an equal-weighted basis, ~8% of stocks trade above 10x P/S, the 3rd-highest percentage on record.

Invest right from your couch

Have you always been kind of interested in investing but found it too intimidating (or just plain boring)? Yeah, we get it. Luckily, today’s brokers are a little less Wall Street and much more accessible. Online stockbrokers provide a much more user-friendly experience to buy and sell stocks—right from your couch. Money.com put together a list of the Best Online Stock Brokers to help you open your first account. Check it out!

This confirms investors are paying unusually high premiums, especially for mega-cap stocks.

Valuations at these levels leave little room for more than average long-term future returns.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: