- Global Markets Investor

- Posts

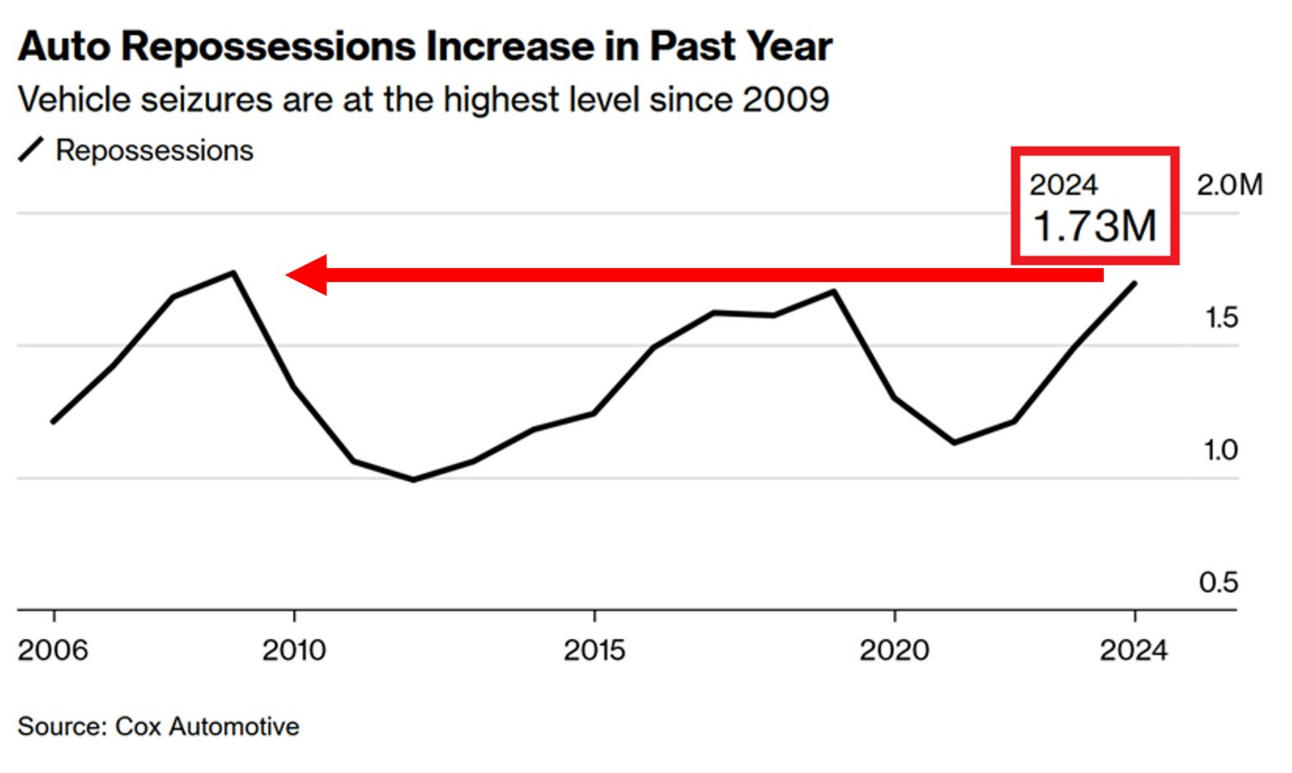

- ⚠️CHART OF THE WEEK: US auto repossessions hit the Great Financial Crisis levels

⚠️CHART OF THE WEEK: US auto repossessions hit the Great Financial Crisis levels

Another evidence that an average US consumer is struggling

THANK YOU FOR READING! PLEASE FIND OUT A 20% DISCOUNT FOR AN ANNUAL SUBSCRIPTION. EXPIRES IN 2 DAYS!👇

US car repossessions rose by 16% and hit 1.73 million in 2024, the highest since 1.77 million in 2009, the last year of the Great Financial Crisis.

Car repossession means a lender legally takes back a vehicle from a borrower who has defaulted on their loan payments.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

To put this differently, Americans are defaulting on their car loans as almost never before.

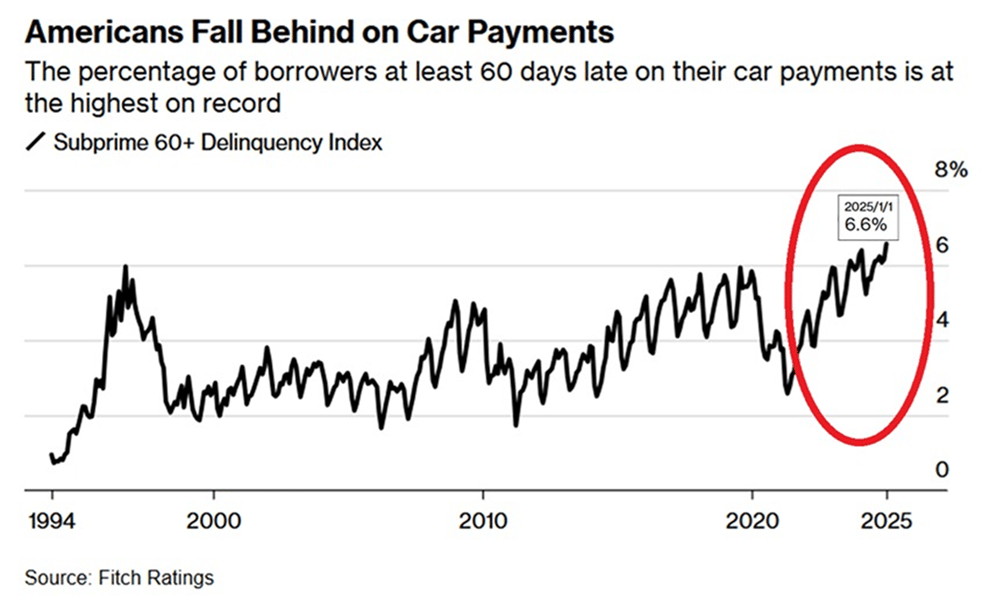

The share of subprime 60+ days delinquencies on auto loans surged to 6.56% in January, the most on record.

Furthermore, auto loans serious (90+ days) delinquency rates hit 3.0% in Q4 2024, the highest level in 14 years.

There are no signs of consumer recovery yet.

If you find it informative and helpful, you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr: