- Global Markets Investor

- Posts

- ⚠️CHART OF THE WEEK: The level of leverage in the ETF market is at extreme levels

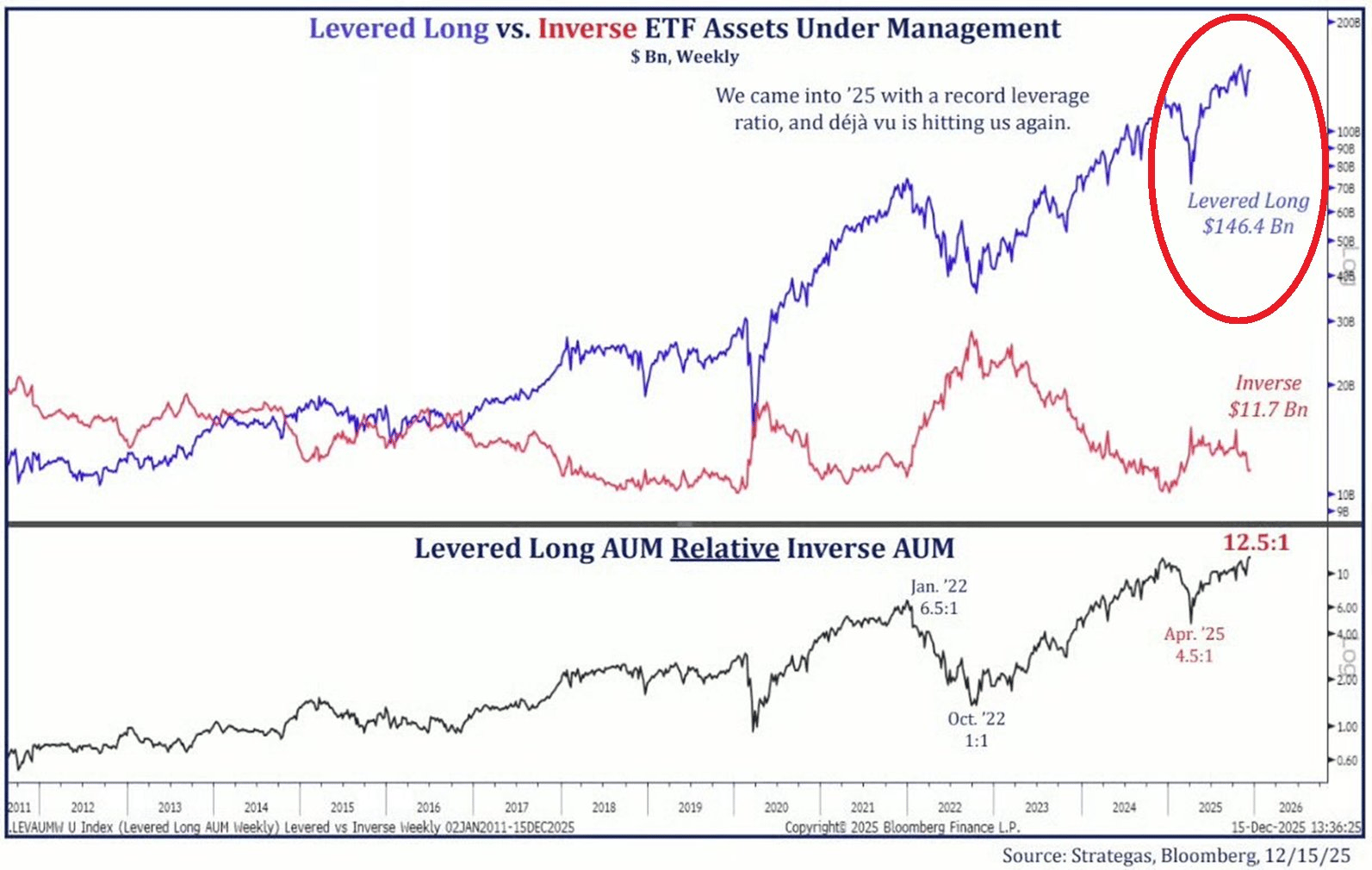

⚠️CHART OF THE WEEK: The level of leverage in the ETF market is at extreme levels

Traders are piling into long-leveraged ETFs at a record pace

🎄 IMPORTANT ANNOUNCEMENT 🎄

20% OFF an Annual Premium Subscription, Christmas Discount 🔥

Get access to exclusive, data-driven market analysis powered by insights from the world’s leading research firms and data providers, including Bank of America, JPMorgan, Goldman Sachs, Morgan Stanley, Nomura, Bloomberg, Financial Times, Refinitiv, WSJ, Barron’s, MarketWatch, and more.

This offer expires at midnight on 28 December.

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 64% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

Total assets in US leveraged long ETFs now outweigh short ETFs by 12.5x, the most extreme imbalance on record and nearly 3x higher than in April.

Nearly a record ~$146 billion is now parked in leveraged bullish funds, versus just $12 billion in inverse ETFs.

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

By comparison, the ratio stood near 1 to 1 during the 2022 bear market and the 2020 crisis.

This level of leverage would significantly amplify the downside move in any correction.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: