- Global Markets Investor

- Posts

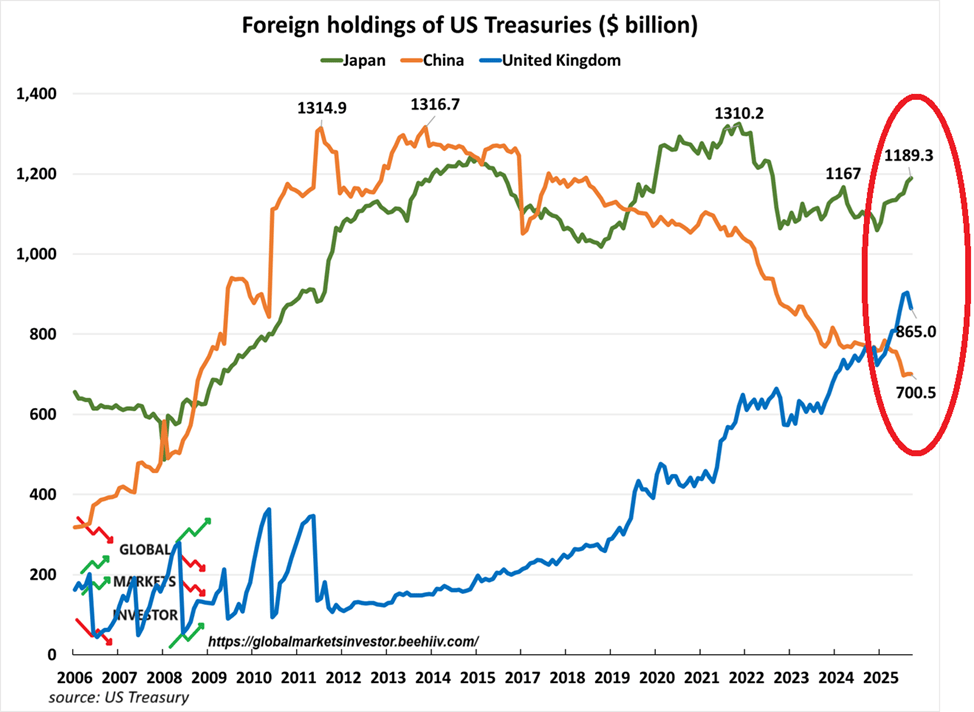

- ⚠️CHART OF THE WEEK: China's Treasury holdings are still declining

⚠️CHART OF THE WEEK: China's Treasury holdings are still declining

China is diversifying out of the US Dollar

🔥25% OFF AN ANNUAL SUBSCRIPTION, BLACK FRIDAY AND THANKSGIVING PROMO

Click below to redeem, expires Friday 28 November before midnight.

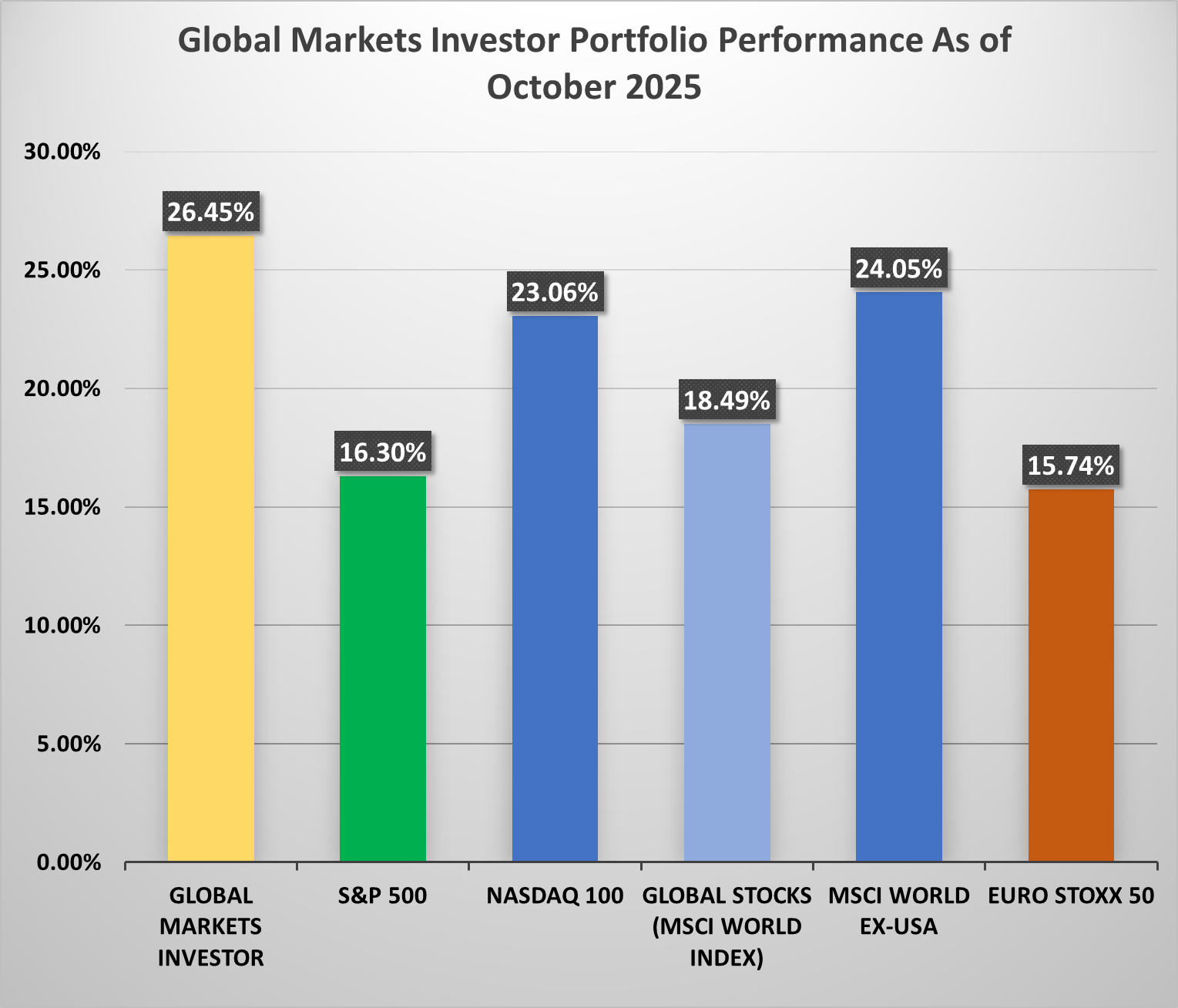

🔥🔥 GLOBAL MARKETS INVESTOR PORTFOLIO — UP 53% SINCE JANUARY 2024 DURING THE MARCH-APRIL 2025 MARKET TURMOIL, MAJOR US INDEXES FELL NEARLY 20%, WHILE THE GMI PORTFOLIO GAINED OVER 5%, FIND OUT HOW BELOW:

China has sold $32 billion of US government bonds over the last 3 months, bringing its total to $700.5 billion, the lowest in 17 years.

China’s total holdings have now declined by over $600 billion since 2013.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Meanwhile, Japan, the biggest foreign holder of Treasuries, saw an $8.9 billion rise in its holdings in September, to $1.19 trillion, the highest since August 2022, while the UK's holdings fell by $39.3 billion, to $865 billion.

At the same time, Belgium, which likely also includes Chinese custodial accounts (15%-30%), increased its Treasuries by $12.5 billion, to $466.8 billion.

Overall, foreign holdings of Treasuries declined slightly, by $10 billion, to $9.25 trillion.

If you find it informative and helpful, consider a paid subscription or become a Founding Member, and follow me on Twitter or Nostr: